When is Aussie Retail Sales and how might the data affect AUD/USD?

Australia's Retail Sales for February is a key data event today that is scheduled for the top of the hour. It is expected to post a relatively strong gain in February, with Queensland and New South Wales flooding risks the only bumps along the road.

The data should come in strong as households run down their sizeable savings, analysts at TD Securities argued. ''Thus, we see sales revisiting the record high in Nov'21 soon. The outsized gains in ANZ job vacancies (+8.4% MoM) in February could be a preview of the likely strength in the official job vacancies data.''

AUD/USD outlook on Retail Sales

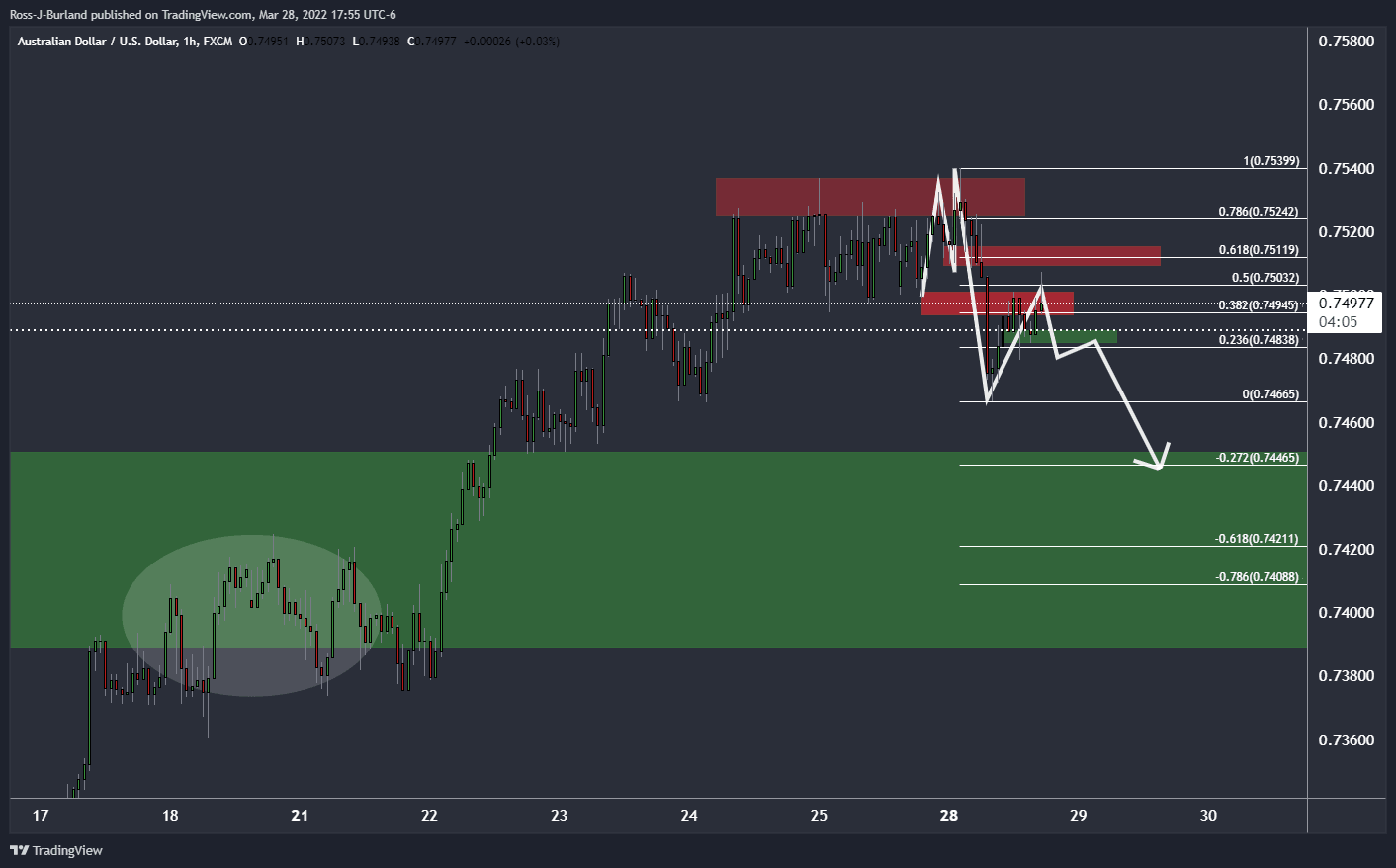

As illustrated on the hourly chart above, the price is under pressure and could be on the verge of a test of the demand area in and below the 0.7400/50 areas for the coming sessions. Zooming on in the hourly time frame ...

... an M-formation is present and the price has already reverted towards the neckline in a 50% mean reversion of the prior bearish impulse. Should this resistance area hold and the data not impress, then there is the possibility that the pair will start to melt in the direction of the said targetted areas.

If, on the other hand, the data surprise positively in any significant way, then the bears will have to play a waiting game as the price firms back into the consolidation areas in the 0.75's for a while longer, presuming that a deeper correction on the daily chart will play out before there is enough fuel for a continuation higher:

About Retail Sales

The primary gauge of Australia’s consumer spending, the Retail Sales, is released by the Australian Bureau of Statistics (ABS) about 35 days after the month ends. It accounts for approximately 80% of total retail turnover in the country and, therefore, has a significant bearing on inflation and GDP.

This leading indicator has a direct correlation with inflation and the growth prospects, impacting the Reserve Bank of Australia’s (RBA) interest rates decision and AUD valuation. The stats bureau uses the forward factor method, ensuring that the seasonal factors are not distorted by COVID-19 impacts.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.