Revlon stock: REV soars roughly 35% on talks of potential buyout offer

- Revlon has had to file for Chapter 11 bankruptcy protection.

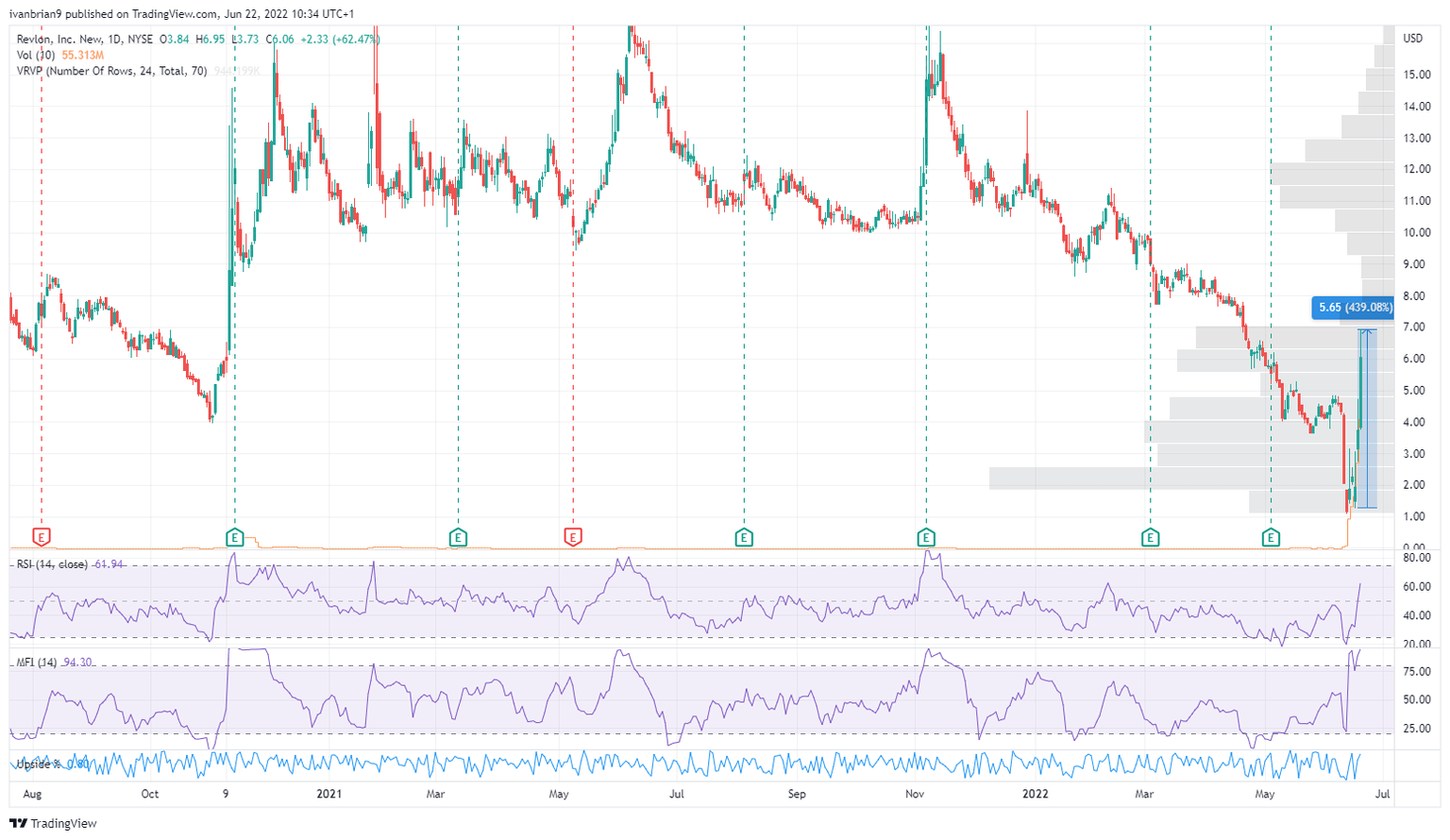

- Despite this, REV stock has moved from $1.25 to over $8.

- REV gains over 650% from record lows as the company gets another loan.

Update: The epic short squeeze in REV stock lost traction on Wednesday, as bulls turned cautious amid looming recession and inflation fears. The overall dour mood on Wall Street, as Fed Chair Jerome Powell remained non-committal on the size of the rate hikes in the coming meetings, citing higher rates could potentially lead to recession. Despite the sharp pullback from three-month highs of $9.89, the meme stock soared 34.32% on expectations that Revlon may emerge from its current bankruptcy process as a stronger company. The bankrupt cosmetics giant rallied as much as 650% from a record low amid soaring trading volume and speculations of a potential buyout offer.

Revlon stock (REV) is top of the leaderboard of the favorite short squeeze mentions across social media this week as the stock stages an epic squeeze.

A quick recap on the story so far in case you missed it. Revlon is a consumer cosmetics brand well known globally but an old legacy business that has struggled to adapt to changing tastes and new more upstart brands. REV has suffered as a result with balance sheet problems and consequently an enormous debt pile. As we have been banging on across the meme stock sector this year, this is not the environment to be heavily indebted. Widening credit spreads, rising interest rates and souring investor sentiment mean that debt burdens are rising just when revenues are falling. Refinancing debt has all of a sudden dried up with bond issuance collapsing especially across the junk or high-yield space. Fitch reported in May that Q1 high yield issuance has fallen 75% versus a year ago. This has done serious damage for Revlon and last week it filed for Chapter 11. Its long-term debt has trebled over the past 10 years.

Also read: Walmart Deep Dive Analysis: Hold WMT to play defense vs upcoming US recession

Revlon stock news: More debt, please

If the debt is the problem, then it is somewhat ironic that extra debt is part of the reason for this massive sudden spike in REV stock. On last Friday, a bankruptcy court approved an additional $375 million loan for Revlon so it could struggle along and actually sell some stuff to generate some income. It's a bit of an odd one but basically, the company had virtually no cash left meaning it would shortly cease all operations unless the loan was approved. The hope is the loan will allow it to struggle along to the end of the year and potentially restructure and keep some form of the business afloat. That may allow the company to restructure, be acquired, or just prolong the failure.

One other caveat to add is that this was a slow-train crash, meaning shorts had ample opportunity to jump on board at higher prices. The dogs on the street could see this heading for Chapter 11 and so it was well shorted. Many shorts will not want to wait for a time-consuming outcome and merely decided to take their profits and move on. So the rally is a bit of short-covering rather than a short squeeze, in my opinion.

REV stock forecast

Where is REV stock going from here? Well, certainly stating the obvious this is not a stock you really want to hold. Some short-term opportunities perhaps, but all are high risk, involving selling options to capitalize on the high volatility. I am not going to recommend any strategies here because option wiring exposes unlimited losses and is only for highly experienced professional options traders who know how to manage the delta and gamma changes.

Revlon shares will likely struggle along with an inevitable massive debt restructuring, which will likely wipe out many debt and equity holders. The temptation is obviously to short such a massive move but if you do please use stops as volatility is huge.

REV stock chart, daily

Update: REV stock maintained the positive stance on Wednesday, finishing the day up 34.32% at $8.14 per share. Revlon stock ignored the generally poor performance of Wall Street, as major indexes ended the day with modest losses after spending the day battling to advance. The Dow Jones Industrial Average lost 47 points, while the S&P 500 ended the day pretty much unchanged, down 0.02%. The Nasdaq Composite settled at 11,053, down 0.15% or 16 points.

The focus was on US Federal Reserve Chairman Jerome Powell, who testified on monetary policy before Congress. Powell noted that higher interest rates may lift the chances of a recession, although he considers that the risk of such happening is not too high at the time being. He also repeated that the current pace of rate hikes remains appropriate, reaffirming a 75 bps hike for July. He also noted that he would not dismiss a larger rate hike if data supports so.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.