Top Crypto Losers: Monero extends losses below $370 as Aster and Bonk risk record lows

- Monero trades below $370 after recording a nearly 8% drop on Sunday and breaking under the 50-day EMA.

- Aster is back under $1 after four consecutive days of losses, risking a crucial support level.

- Bonk extends consolidation below its $0.00001000 psychological resistance, with bears eyeing the $0.00000884 support level.

Altcoins, including Monero (XMR), Aster (ASTER), and Bonk (BONK), are at risk of extending their losses as the broader cryptocurrency market stalls amid the dragging peace talks between Ukraine and Russia.

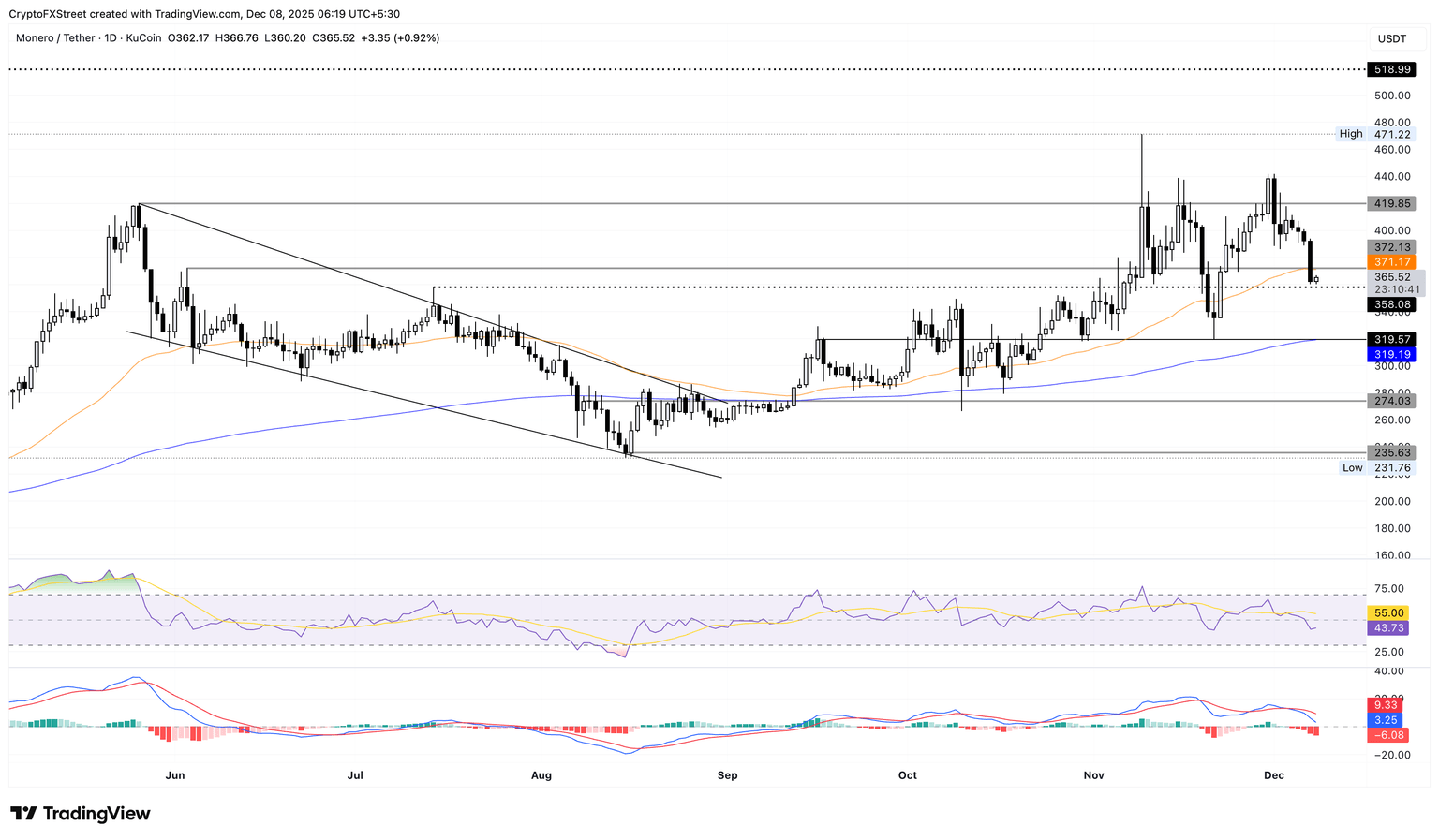

Monero under pressure risks testing the 200-day EMA

Monero trades below its 50-day Exponential Moving Average (EMA) at $371 following the 8% decline on Sunday, which marked the fourth straight bearish candle on the daily chart. At the time of writing, XMR holds steady with a 1% rise on Monday as bulls defend the $350 mark.

A potential slip below this level could extend the downward trend to the 200-day EMA at $319.

The momentum indicators on the daily chart evidence the tightening bearish grip. The Relative Strength Index (RSI) is at 43, slipping below the midline, indicating relatively stronger selling pressure.

At the same time, the Moving Average Convergence Divergence (MACD) approaches its zero line, maintaining the sell signal generated by a crossover on Wednesday.

If XMR resurfaces above the 50-day EMA at $371, it could extend its recovery to the $400 round figure.

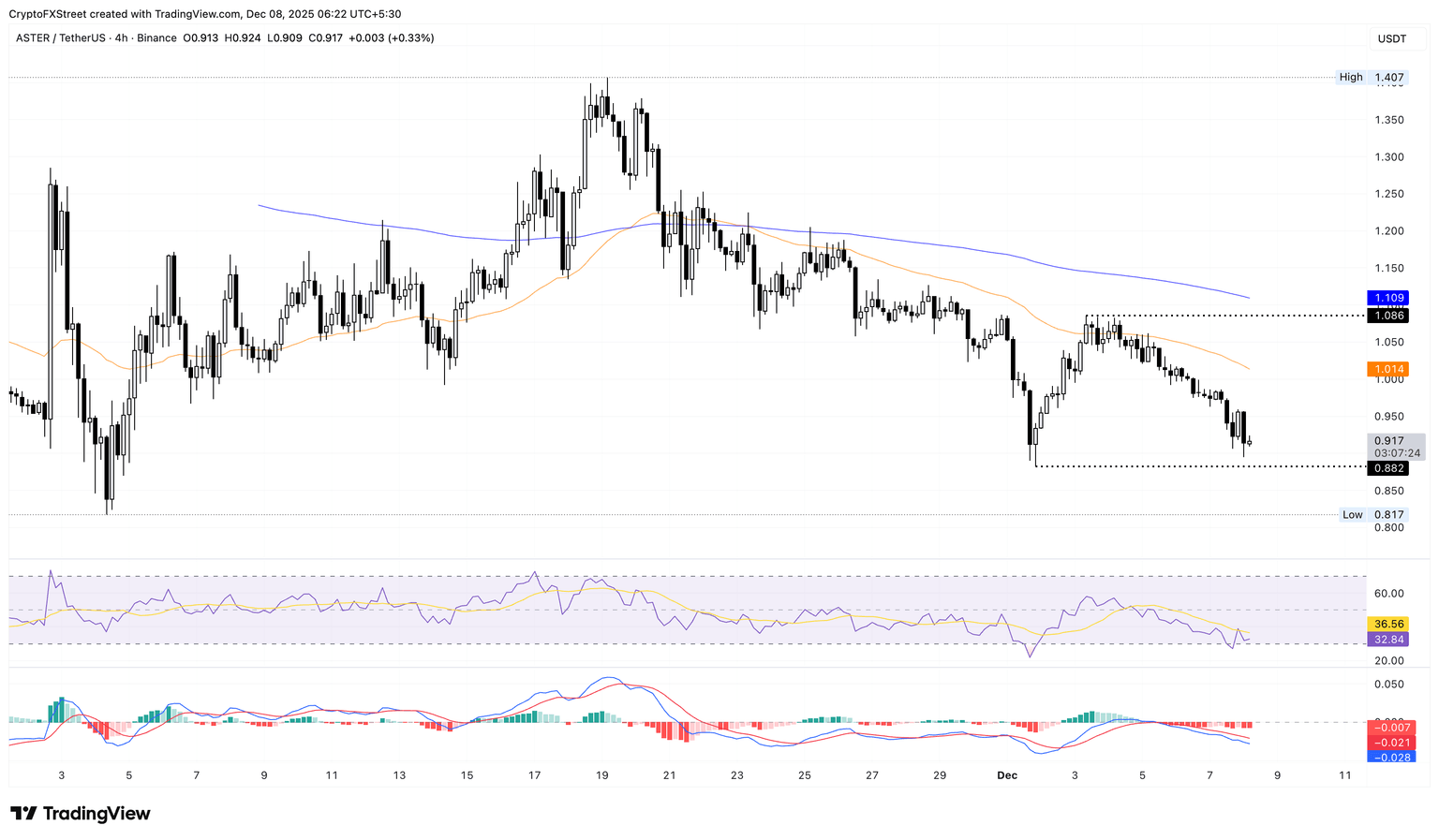

Aster’s downfall gains traction, risks a new record low

Aster trades above $0.900 at press time on Monday, after losing 6% the previous day. The perpetuals focused exchange token risks losing the $0.882 level, aligning with last week’s low.

If ASTER marks a successful close below this level, it risks testing the all-time low of $0.817 from November 4. Below this, the exchange token could enter a price discovery mode for a new record low.

The momentum indicators on the 4-hour chart indicate intense overhead pressure. The RSI at 32 hovers near the oversold zone while the MACD and signal lines extend a declining trend.

However, a potential rebound in Aster from $0.882 above the $1.000 psychological level could reinstate recovery towards the $1.086 high.

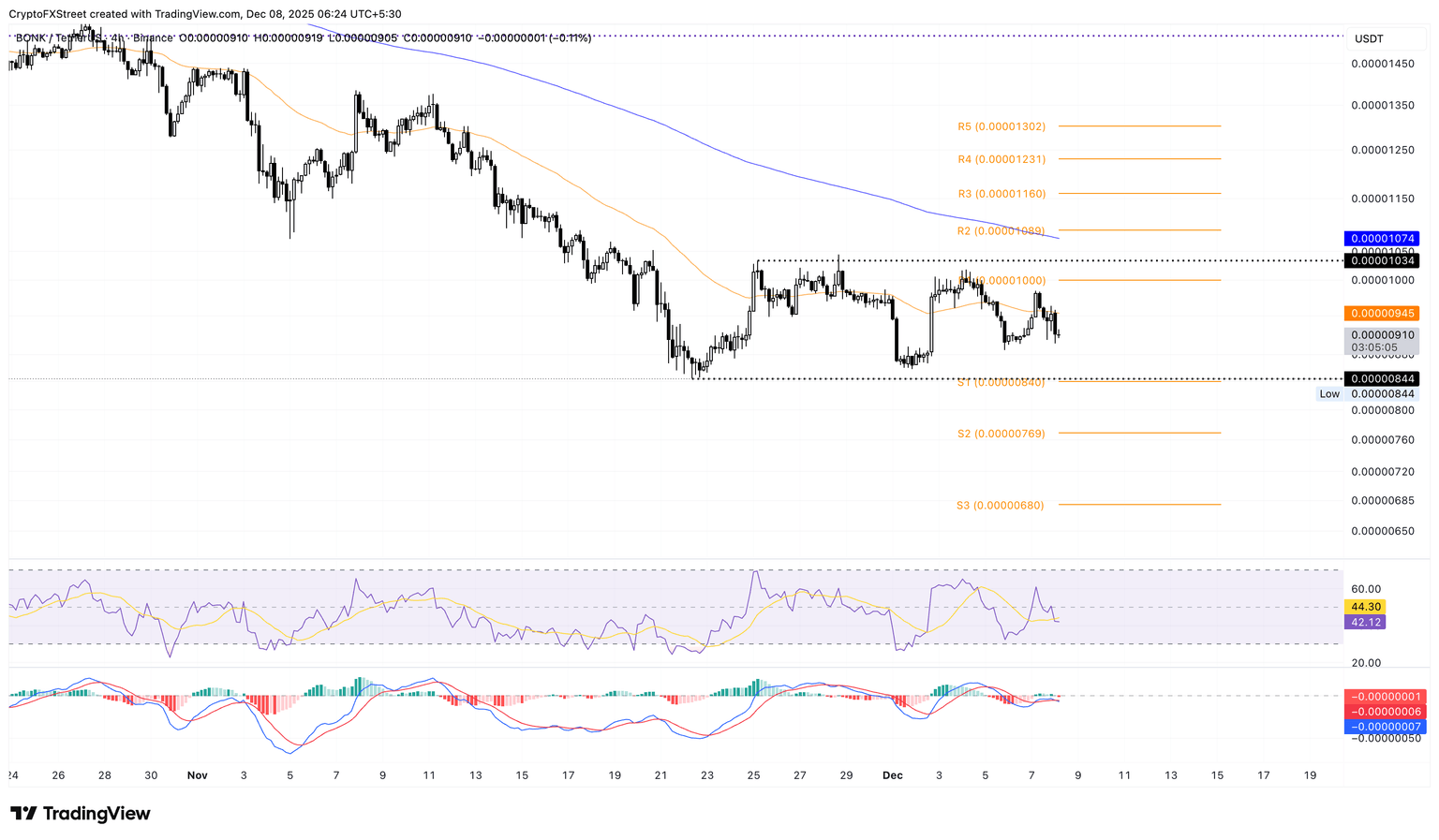

Bonk’s path of least resistance points to further losses

Bonk remains under pressure below $0.00001000 by press time on Monday, trading within a consolidation range on the 4-hour chart, with support at the November 22 low of $0.00000844 and resistance at $0.00001034.

The path of least resistance for the meme coin points to $0.00000844, as the RSI is at 42 on the 4-hour chart, with room to the downside before oversold levels. Meanwhile, the MACD and signal lines move flat below the zero line, flashing mixed signals.

In case of a bullish breakout of the range, BONK could aim for the 200-period EMA at $0.00001074, followed by the R3 Pivot Point at $0.00001160.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.