Wake Up Wall Street (SPY) (QQQ): Stock market recovery continues despite yield escalation

Here is what you need to know on Friday, April 8:

Equity markets continued to make small gains on Thursday and again on Friday with futures markets indicating a higher open. European benchmarks are also tracking higher, but nervousness remains close at hand with a series of Fed hawkish comments spooking bond markets and hitting risker stocks. Thursday saw a modest stabilization and this may continue next week with the first week of earnings season.

First up are the financials who normally should stand to benefit from higher yields and rates. Outlooks and commentary will be key here. Thursday saw energy and consumer staples lead the recovery while tech and real estate sectors were weak.

Oil prices remained volatile on global demand fears and increasing reserve releases. China going into lockdown has also hit oil prices and this will be something to keep a close eye on in the upcoming earnings season.

The dollar meanwhile is targetting 100 for the dollar index on those hawkish comments. Oil is at $96.50 and gold price is $1,933. Bitcoin price is at $43,200.

European markets are higher with the Dax leading the way at +1.4%, the FTSE is +0.2% and Eurostoxx is +0.7%.

US futures are also higher: Dow Jones futures leading the way here at +0.4% while Nasdaq futures are +0.3% and the S&P also +0.3%.

Wall Street top news (SPY) (QQQ)

Money markets now predict a 65 bps rate hike in Europe by end of 2022.

Kremlins says special operation in Ukraine could end soon if goals are met and a peace deal is completed.

Germany to provide €100 billion in credits to firms hit by energy prices.

System1 (SST) rallies another 13% premarket after results and upgrades earlier this week. Heavy retail interest.

Sunshine Biopharma (SBFM) also rallying on retail interest following cancer treatment news earlier this week.

Tesla (TSLA) to make cyber truck next year according to Elon Musk at the opening of Giga Texas.

WD40 (WDFC) is higher on strong earnings.

Robinhood (HOOD) downgraded by Goldman Sachs.

Paysafe (PSFE) reaffirms guidance for 2022.

Spirit Airlines (SAVE) to begin talk with JetBlue (JBLU) on a takeover proposal.

Designer Brands (DBI) raises forecasts for full year.

Kroger (KR) Bank of America upgrades.

Crowdstrike (CRWD) gets authorization to protect assets with Dept of Defense.

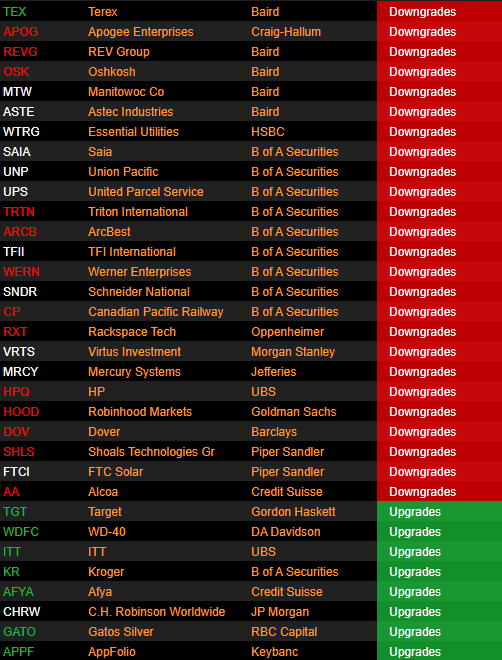

Upgrades and downgrades

Source: Benzinga Pro

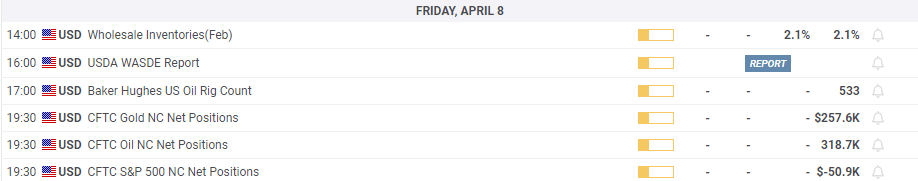

Economic releases

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.