Wake Up Wall Street (SPY) (QQQ): Markets wake up to higher yields, higher oil, but not higher stocks

Here is what you need to know on Monday, October 18:

Monday is not a great day for stocks. Historically, it is one of the worst-performing days. Thursday is the best, and this Monday is proving that theory with more losses likely. The reasons are pretty obvious and will not take a lot of searching through macro research papers. Oil is nearing $84 this morning, yields are back above 1.6% for the US 10-year, and the dollar is higher again. This is not exactly a bullish cocktail for stocks then. Added to this is the likely default of Chinese developer Sinic, and you have a hangover before the week has even begun. Maybe earnings season can change. This week sees another big slate with Tesla (TSLA) and Netflix (NFLX) probably the highlights.

The dollar is higher at 1.1590 versus the euro. Oil is surging to nearly $84, Bitcoin is lower at $60,900, Gold is at $1,766, and the 10-year yield is 1.6%.

European markets are lower: Eurostoxx -1%, FTSE -0.5% and Dax -0.6%.

US futures are lower: S&P -0.3%, Dow -0.4% and Nasdaq -0.3%.

Wall Street (SPY) (QQQ) news

Chinese industrial output and GDP miss economist estimates.

Zillow (Z) down 5% premarket on a Bloomberg report that it has stopped home-buying services.-CNBC

Apple (AAPL) is set to unveil new Mac laptops today.

Walt Disney (DIS) down nearly 2% premarket as Barclays downgrades it.

Amazon (AMZN): "Five members of the U.S. House Judiciary committee wrote to Amazon.com’s chief executive on Sunday and accused the company's top executives, including founder Jeff Bezos, of either misleading Congress or possibly lying to it about Amazon's business practices."-Reuters

Netflix (NFLX) puts the value of Squid Game at $900 million, according to a Bloomberg report.

Facebook (FB) to add up to 10,000 jobs in the EU over the next five years as it builds out a metaverse.

NetApp (NTAP) is downgraded by Goldman Sachs.

Square (SQ) Chief Executive Officer Jack Dorsey said on Friday that the fintech company will build a Bitcoin mining system.-Reuters

Corsair (CRSR): Cowen&Co cuts price target.

Baidu (BIDU) up 4% premarket on a report that China is considering rules making some content accessible in Baidu's search engine.

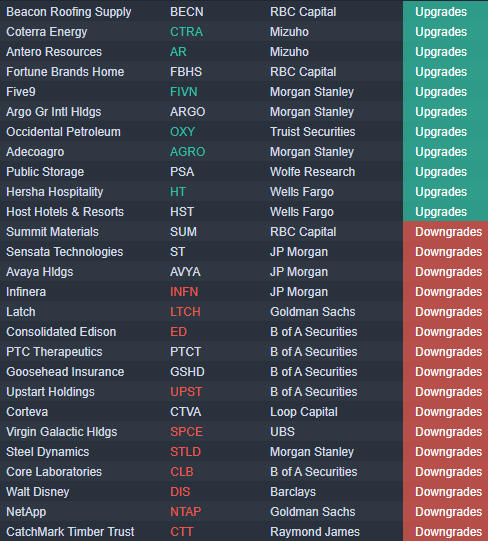

Upgrades, downgrades and premarket

Source: Benzinga Pro

Economic releases

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.