Wake Up Wall Street (SPY) (QQQ): Is this rally sustainable or a dead cat bounce

Here is what you need to know on Wednesday, March 9:

Equity markets look set for a markedly higher open on Wednesday as European markets stage a serious bounce. The proposals for joint EU debt issuance have been well received as have reports that the latest ceasefire is holding in Ukraine so civilians can be evacuated. The Dax is currently up about 5% and some beaten-down sectors such as European banks are surging. How this plays out is unclear but the latest noises on energy imports from Russia are probably not going to help as energy prices remain poised for more gains. These soaring prices have yet to make their way through to consumers and affect consumer demand but they will and it will be a serious hit to consumer spending, especially in Europe.

In the currency markets, the dollar continues its slide, to 98.44 now for the dollar index. Oil is down 5% to $119 and TTF European gas is also down 5% to $214. This is up from $70 at the start of the year though! Gold price also joins the haven falls and is at $2,003 down 2%.

European markets are higher: EuroStoxx +3.8%, FTSE +1.2% and Dax +5.25.

US futures are also higher: S&P +1.8%, Dow +1.6% and Nasdaq +2.3%.

Wall Street (SPY) (QQQ) news

EC President says the EU has enough LNG to last to the end of winter and doesn't need Russian gas.

Ukraine notifies IAEA of a power outage at Chernobyl.

Ireland Foreign Minister says Iran deal very near.

Campbell Soup (CPB) up 1% on earnings.

Express (EXPR) up 10% on sales data.

Amazon (AMZN) According to WSJ House Judiciary Committee is to ask DOJ to begin a criminal probe.

Stitch Fix (SFIX) drops 24% on poor guidance.

Bumble (BMBL) up 13% on earnings beat.

General Electric (GE) up 1% on buyback authorization.

Crypto stocks MARA, MSTR, and others are strong in the premarket.

Natera (NTRA) is down 14%, on a bearish note from Hindenburg.Natera: Pioneers In Deceptive Medical Billing – Hindenburg Research

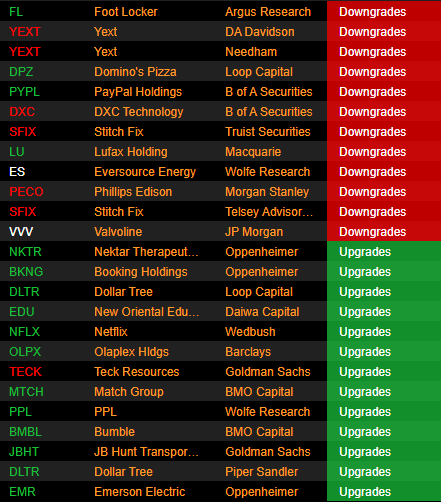

Upgrades and downgrades

Source: Benzinga Pro

Economic releases due

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.