VXRT Stock Price: Vaxart Inc set to extend winning streak with its dark horse coronavirus vaccine

- NASDAQ: VXRT is set to complete a full week of daily gains with another rise on Friday.

- Vaxart Inc may emerge as a dark horse in the race to achieve a COVID-19 vaccine.

- The pharma firm's oral tablet solution would be more practical than any competing company.

Protection against coronavirus with just a pill? Vaxart Inc (NASDAQ: VXRT) is aiming for an easy-to-digest solution to the disease that is gripping the world. Another advantage of the pharma firm's immunization candidate is that it can be stored at room temperature – contrary to inoculations from Pfizer and Moderna, which require cold chain storage during most of their transport.

While also Inovio's immunization doses can survive in normal room temperatures – a fact pushing NASDAQ: INO higher – they require application via the skin. Vaxart's orally administered tablet has a substantial advantage over any competitor.

The South San Francisco-based company's "dark horse" status is due to its backward position in the race – it is still in preclinical trials with hamsters, rather than advanced phases such as the companies mentioned above. Nevertheless, the hamsters have shown the results the firm wanted to see – a potent immune response in animals receiving doses of the vaccine.

Moreover, the animals were exposed to COVID-19 and showed a considerable reduction in lung viral load. Those that hadn't been granted the doses suffered substantial weight loss and ruffled furs.

Can Vaxart eventually surpass competitors? With production, storage, and distribution issues, there will likely be more than one, two, or even a dozen winners. Moreover, if vaccines' impact lasts only one season or two years, the second generation of covid immunizations could have significant room for Vaxart's oral solution.

Vaxart Stock Forecast

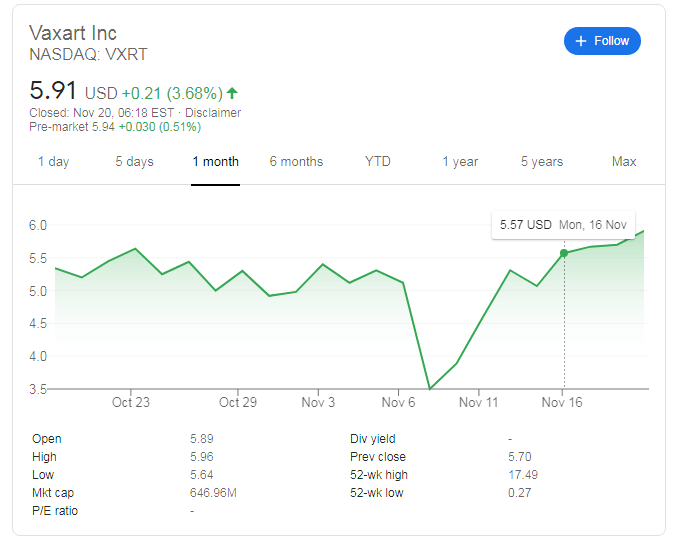

NASDAQ: VXRT is changing hands at $5.94 on Friday's premarket trading, up from $5.91. While the increase is minimal, if sustained, it would be the fifth consecutive day of increases. A steady rise may provide confidence for CEO Andrei Floroiu and investors.

Shares have been fluctuating between a 52-week low of $0.27 to a 52-week high of $17.49. A more solid uptrend could imply a healthier increase with fewer drawdowns.

More

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.