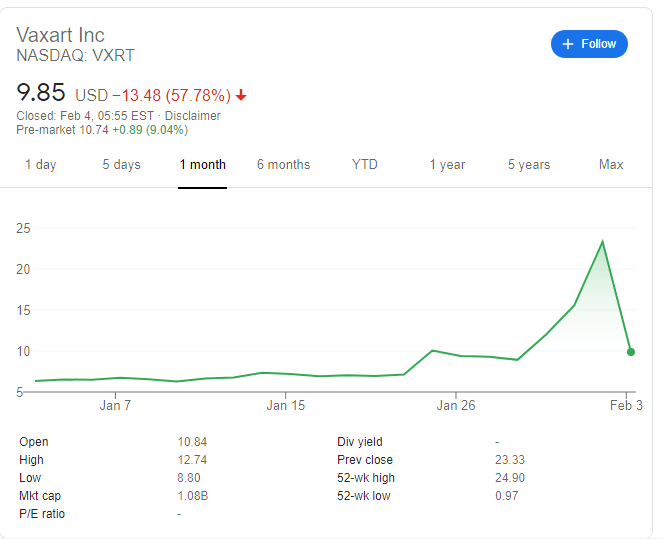

VXRT Stock Price and News: Vaxart Inc set to bounce after the crash on T-Cell hopes

- NASDAQ: VXRT has crashed some 57% on Wednesday following disappointing results from its coronavirus vaccine trial.

- Thursday's premarket trading is pointing to a bounce, possibly related to a sliver-lining.

- Vaxart Inc's shares are still above the pre-boom and busy levels.

Not all covid vaccine trials end in success – as Vaxart Inc (NASDAQ: VXRT) has shown – and as investors have learned. Shares of the South San Francisco-based company crashed by 57.78% on Wednesday, all the way from $23.33 to $9.85.

VXRT erased three days of spectacular gains, as retail traders organizing on Reddit bought shares in droves in anticipation of the company's COVID-19 immunization Phase 1 results. Vaxart's solution is an oral one, which does not require extremely cold storage temperatures – making it an attractive alternative to the other jabs offered by Pfizer/BioNTech and Moderna.

However, the trial concluded that the product does not produce neutralizing antibodies – critical to beating the disease that is beating the world. High hopes and a disappointing outcome resulted in a crash.

VXRT Stock News

Nevertheless, Thursday's premarket trading is pointing to a bounce as there are some silver linings in Vaxart's trial. First, the vaccine was well-received and did not cause any adverse effects among those tested.

Secondly, it did create a substantial amount of T-cells, which are also able to give a fight to covid, potentially complementing other vaccines. VXA-CoV2-1 could provide some support against new variants, as they emerge.

Third, while other firms' vaccines are already being deployed, there is still a deficit in what the world needs and what the world gets – especially if booster shots are needed.

it is essential to remember that after the dust settles, NASDAQ:VXRT remains above levels seen before the recent frenzy, showing that some investors see Vacart's potential – either with improvements to its vaccine candidate or via other products.

Best Stocks to Buy Forecast 2021: Vaccines and zero rates to broaden recovery

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.