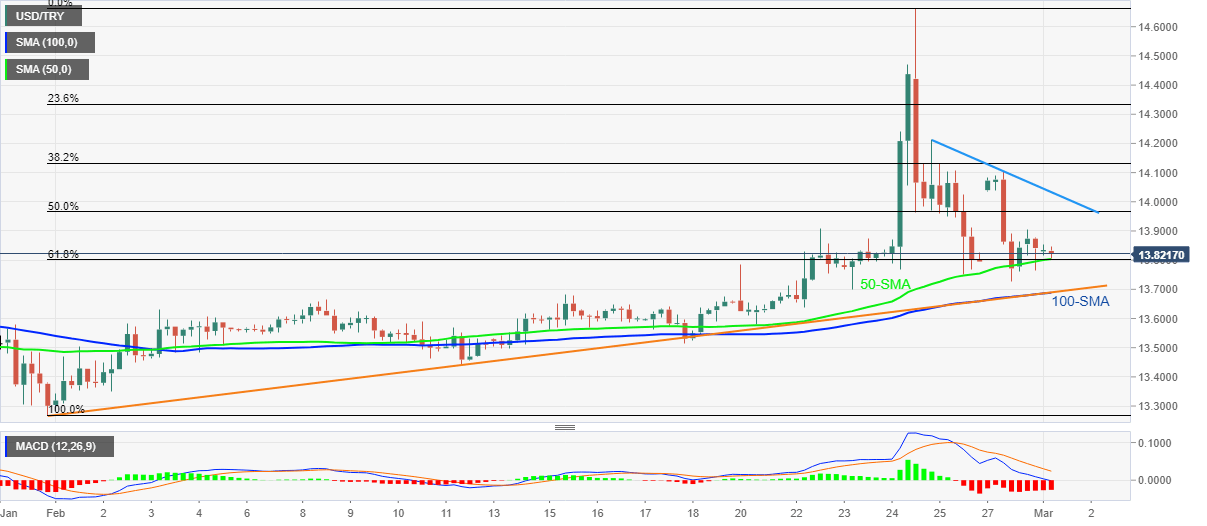

USD/TRY Price Analysis: $13.68 appears tough nut to crack for sellers

- USD/TRY remains pressured around intraday low, prints three-day downtrend.

- 50-SMA, 61.8% Fibonacci retracement limits immediate declines but bearish MACD hints at further weakness.

- Three-day-old resistance line restricts recovery moves ahead of February’s top.

USD/TRY prints mild intraday losses around $13.80, down 0.20% on a day while heading into Tuesday’s European session.

That said, the bearish MACD signals and sustained trading below a 50% Fibonacci retracement (Fibo.) level of January-February upside keep sellers hopeful to conquer the immediate support near $13.80, comprising 50-SMA and 61.8% Fibo.

Even son a convergence of the 100-SMA and an upward sloping trend line from late January becomes strong support to challenge USD/TRY bears around $13.68.

Should the quote drops below $13.68, a downward trajectory towards $13.55 and February’s low near $13.28 can’t be ruled out.

Meanwhile, recovery moves may initially aim for the 50% Fibonacci retracement level of $13.97 before challenging the falling trend line from Thursday, near $14.03.

In a case where USD/TRY bulls cross the $14.03 hurdle, a gradual run-up towards February’s peak of $14.66 can’t be ruled out.

USD/TRY: Four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.