USD/JPY Price Forecast: Bulls are testing 145.35, aiming for higher levels

- The Dollar remains bid on risk-off markets, with downside attempts limited.

- A hawkish Powell, coupled with dovish comments by BoJ's Ueda, are underpinning the USD.

- USD/JPY: Above 145.35, the next targets are 14615 and 147.25.

The US Dollar is faring better than the Japanese Yen in the current risk-averse scenario, with geopolitical concerns driving markets, which keeps the USD/JPY trending higher, with bulls testing resistance at the 145.35 level.

Investors' fears of an escalation of the Middle East conflict have been boosted by Trump’s ambiguous comments on Wednesday and a Bloomberg report suggesting that US Senior officials would be preparing for a strike on Iran, which would probably take place during the weekend.

Beyond that, the Federal Reserve kept interest rates and the dot plot unchanged after Wednesday’s meeting, but Chairman Powell curbed hopes of further monetary easing, warning about a higher inflation increase as the effect of tariffs filters in.

In Japan, the BoJ also kept rates unchanged earlier this week, but cast doubt on further monetary tightening over the coming months in some dovish tweak to its recent rhetoric, which added pressure on the Yen

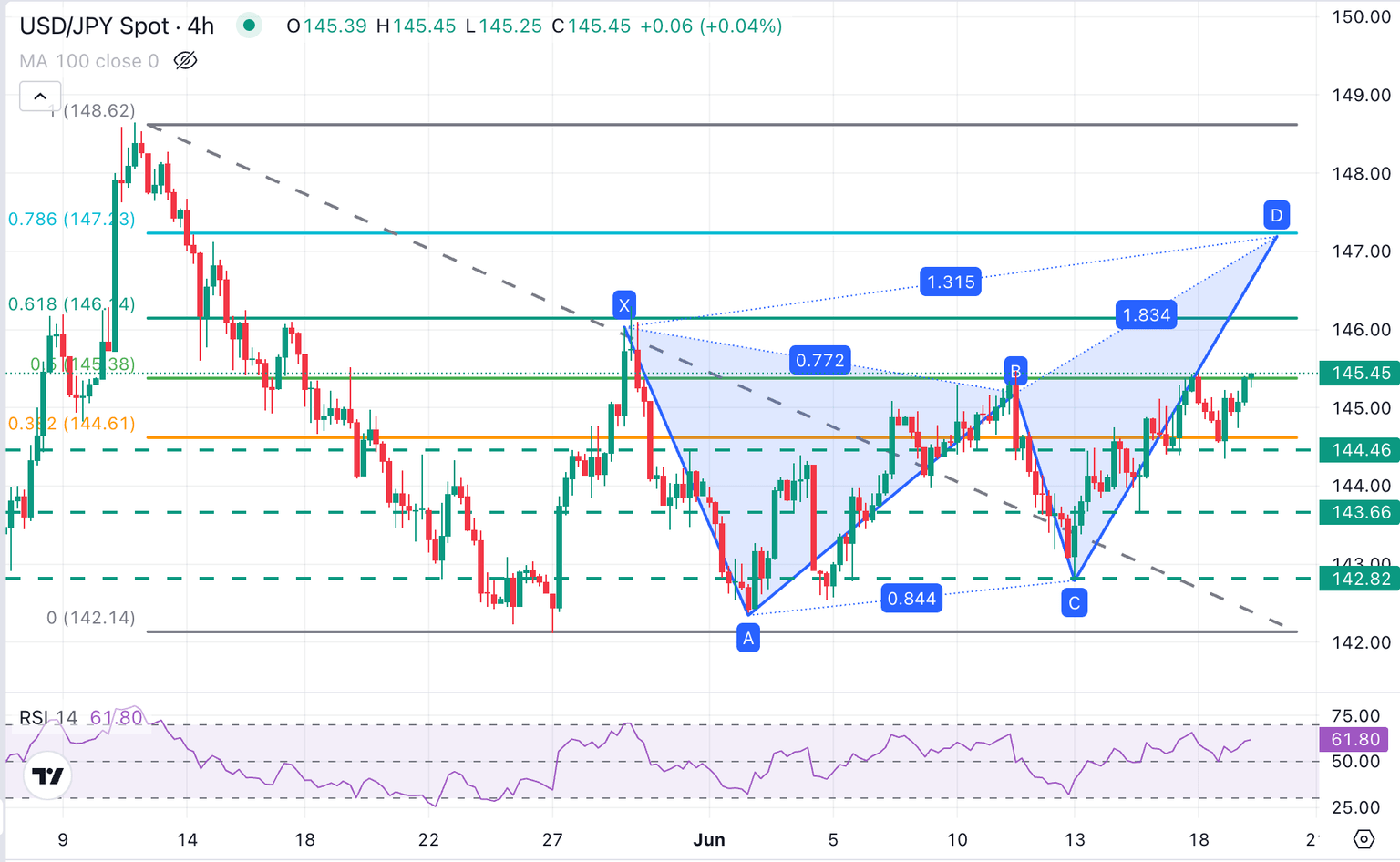

Technical analysis: Above 145.35, the next targets are 146.15 and the 147.00 area

The USD/JPY is on a bullish trend, with downside attempts finding buyers. From a longer-term perspective, the pair seems to have found a significant bottom at 142.15. The higher low printed last week suggests that a deeper recovery is on the cards.

The pair is now testing a key resistance area at 145.35 with harmonic pattern studies suggesting that we might be in the C-D leg of a Butterfly formation heading to levels past the mentioned June 11 high, at 145.35, aiming for the May 29 high, at 146.15 and the 78.6% Fibonacci retracement of the late May sell-off, at 147.25.

On the downside, support is at the Jun 18 low, at 144.45 intra-day ahead of the 16 June low, at 143.65. A break of 142.80 cancels this view.

USD/JPY 4-Hour Chart

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.