USD/JPY Price Analysis: Drops back below 135.00 but sellers have a bumpy road

- USD/JPY holds lower ground after rising for four consecutive weeks.

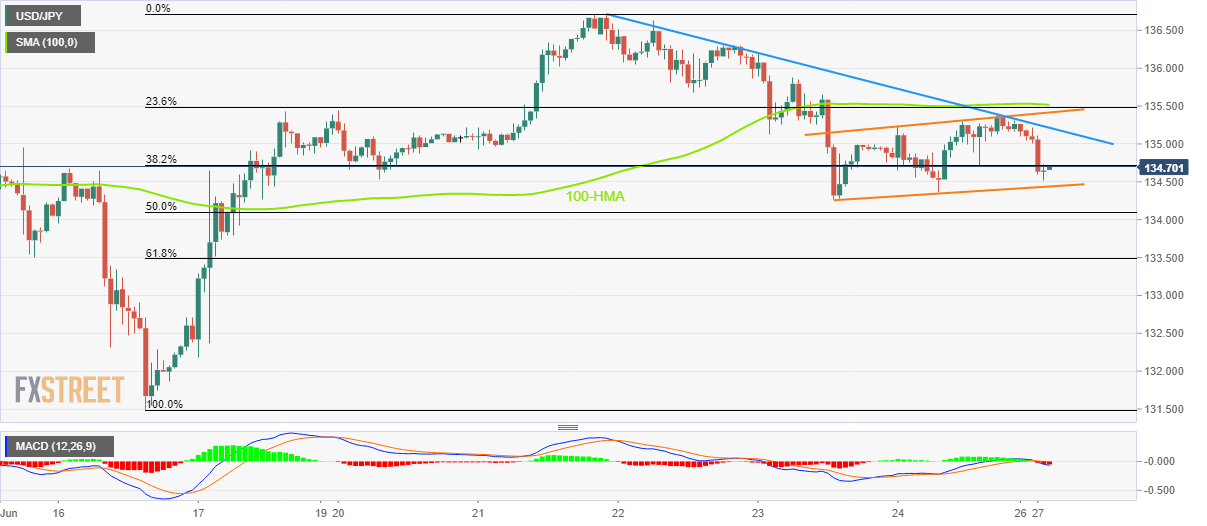

- Two-day-old ascending trend channel, monthly support line challenge bears.

- Bulls need a clear break of 100-HMA to retake control.

USD/JPY takes offers to refresh intraday low around 134.50 following a four-week uptrend. In doing so, the yen pair extends its pullback from a short-term bullish channel’s resistance line, as well as a downside break of the 100-HMA.

Also adding to the bearish bias are the downbeat MACD signals and a weekly falling trend line.

That said, the bottom line of the aforementioned channel from Thursday, near 134.40, restricts the immediate downside of the yen pair before directing it towards an upward sloping support line from May 27, near 133.90 by the press time.

In a case where the quote drops below 133.90, it becomes vulnerable to fall towards the mid-month low near 131.50.

On the contrary, the weekly resistance line near 135.25 and the stated channel’s upper line, close to 135.40 by the press time, limit the short-term recovery of the USD/JPY pair.

Following that, the 100-HMA level of 135.55 challenges the bulls before directing them to the monthly peak near 136.70.

Overall, USD/JPY is likely to witness limited downside as bulls take a breather.

USD/JPY: Hourly chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.