USD/JPY Price Analysis: Bulls seeking a significant correction from support

- USD/JPY bulls seek a correction to test bear's commitments at familiar resistance.

- DXY is on the verge of an upside correction.

It is a quiet start in most of the forex space, including USD/JPY. At the time of writing, USD/JPY is trading flat on the session and has hardly budged during the Tokyo open.

The day would be expected to lean slightly in favour of risk considering the risk-on session on Wall Street.

Having said that, the US dollar has already been downtrodden and is facing a wall of support at this juncture as measured by the DXY as follows:

DXY 4-hour chart

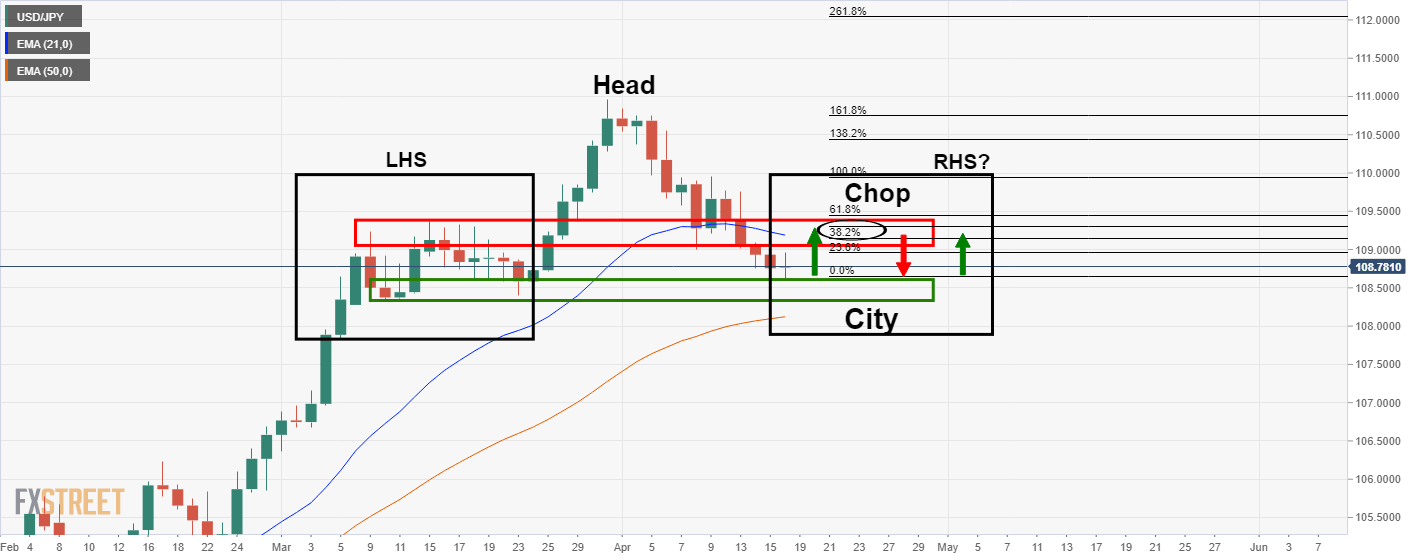

A bid in the greenback would be expected to see USD/JPY nudged higher also, which would raise prospects of a significant correction according to the confluence of market structure and a 38.2% Fibonacci retracement level.

USD/JPY daily chart

As illustrated, USD/JPY offers prospects of forming the right-hand shoulder of a bearish head and shoulders pattern on the daily chart.

The price would be expected to be contained within the 50 and 21 day EMAs and the daily support and resistance areas.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.