USD/JPY Price Analysis: Bears lurking below key dynamic daily resistance

- USD/JPYbears eye a test of the trendline support.

- USD/JPY bulls look for a break of key dynamic resistance.

USD/JPY rallied on Monday but within a bearish structure on the charts. Nevertheless, the pair now consolidates ahead of key events on the US calendar this week, starting Tuesday. The May inflation rate on Tuesday will be a key focus and could shift the needle ahead of the Federal Reserve interest rate decision.

Trading could be quiet for the Asian and European day, however, as investors remain cautious ahead of several key policy decisions due this week, with the Federal Reserve expected to keep rates on hold for the first time since January 2022.

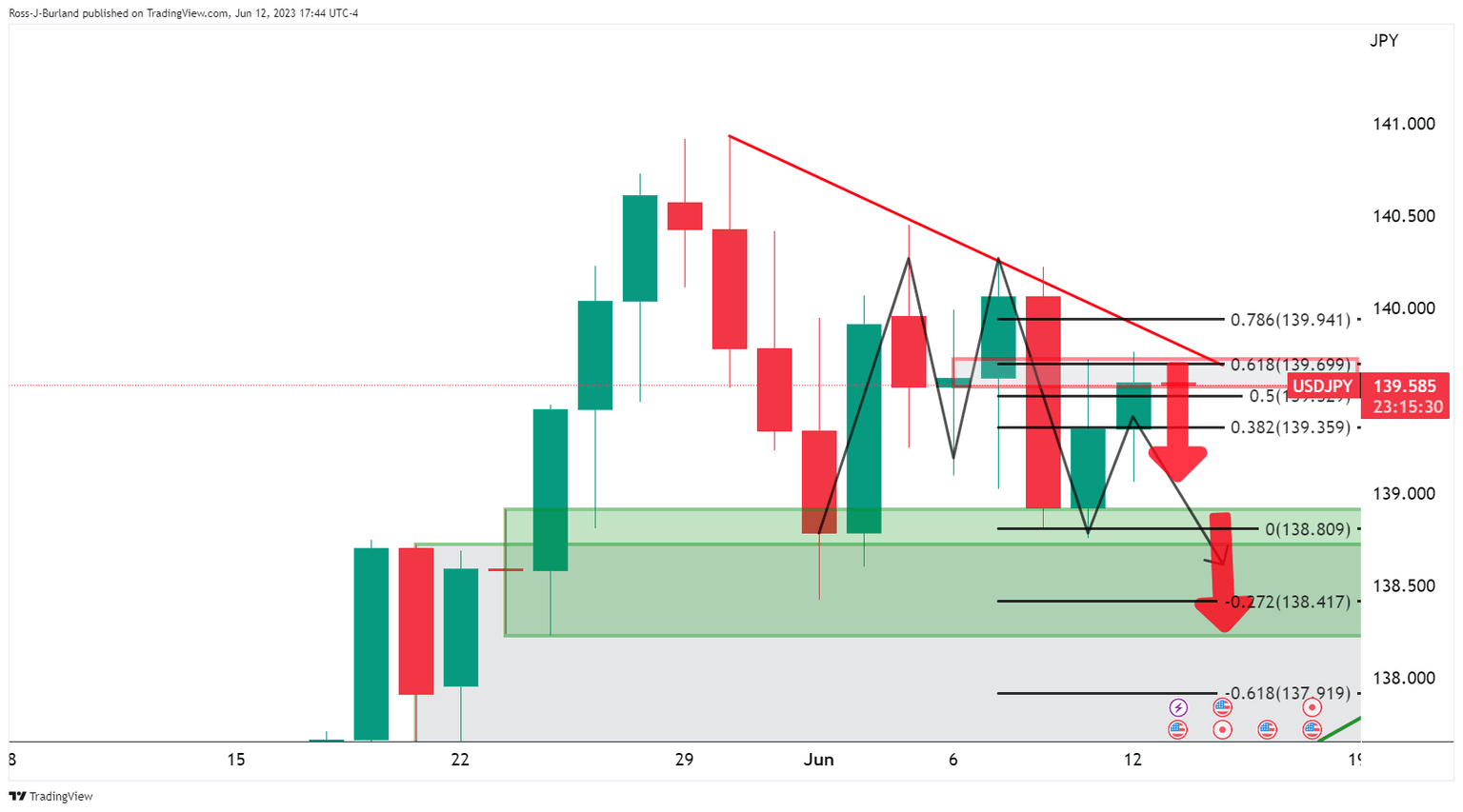

USD/JPY daily charts

Zoomed in...

As illustrated, the price is meeting the resistance of the M-formation's neckline. This could act as a resistance and the bias remains below the bearish trendline. If so, the bears will eye the daily chart's dynamic support line. On the other hand, a break of the trend line resistance opens the risk for a bullish extension with the price respecting the bullish trend.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.