USD/JPY edges higher around no change BoJ following a shallow correction

- USD/JPY bulls take the lead and run towards 115 the figure.

- The bulls have broken critical resistance, clearing the way for further upside.

USD/JPY is catching a fresh wave of demand as bulls continue to drive the price towards a 115 objective for the forthcoming sessions. The Bank of Japan has left rates unchanged and updated its forecasts as follows. Meanwhile, USD/JPY trades around 114.70 and has climbed from a low of 114.44 to reach a 114.73 high so far.

BoJ key takeaways

The BoJ has left the 10-year yield target unchanged at 0.00% and leaves the policy balance rate unchanged at -0.10%.

The BoJ cut the 2021 median Gross Domestic Product forecast to 2.8% from 3.4% but raised the 2022 median GDP forecast to 3.8% from 2.9%.

The central bank's 2023 median GDP forecast has moved to 1.1% from 1.3%.

It has left the 2021 core Consumer Price Index median forecast unchanged at 0.00% but has raised the 2022 core CPI median forecast to 1.1% from 0.9% and the 2023 core CPI median forecast to 1.1% from 1.0%.

The BoJ says the positive economic cycle will strengthen as rising income push up expenditure, including that for households.

The central bank says the developments in overseas economies seen as risks to the economic outlook while wage earners' income is likely to gradually rise reflecting higher wages for sectors facing labour shortages.

USD/JPY technical analysis

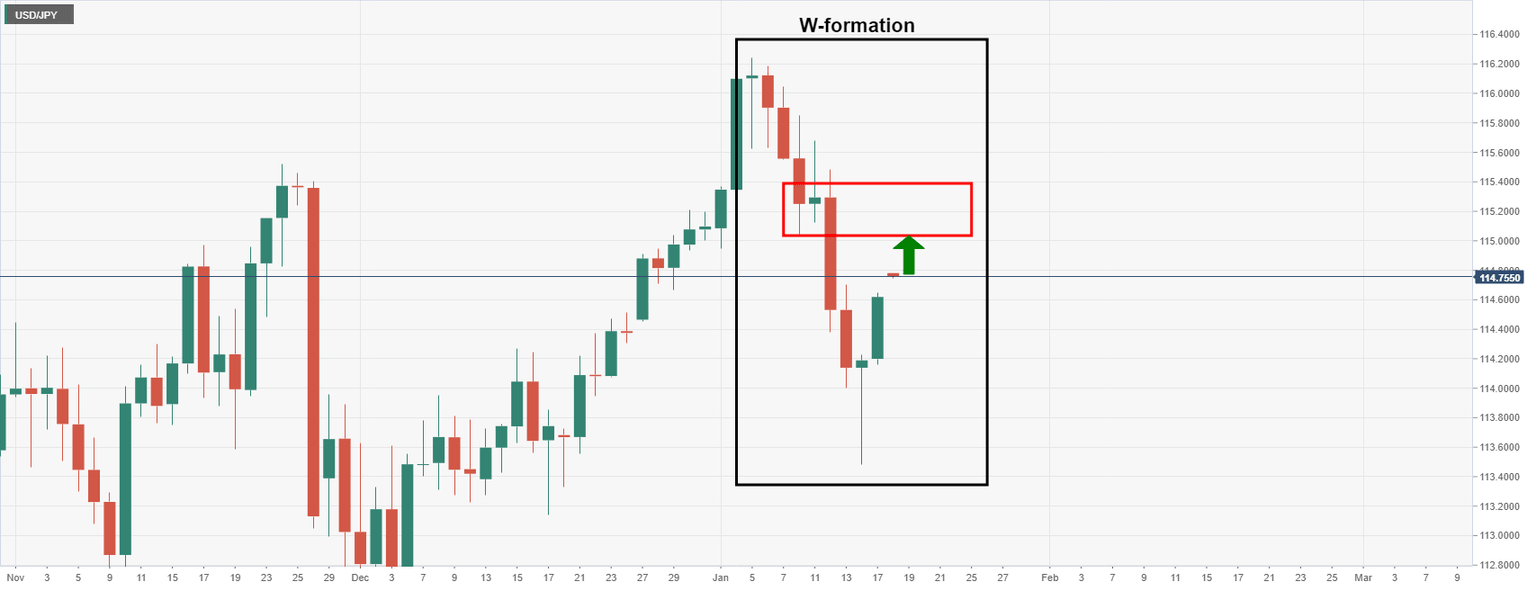

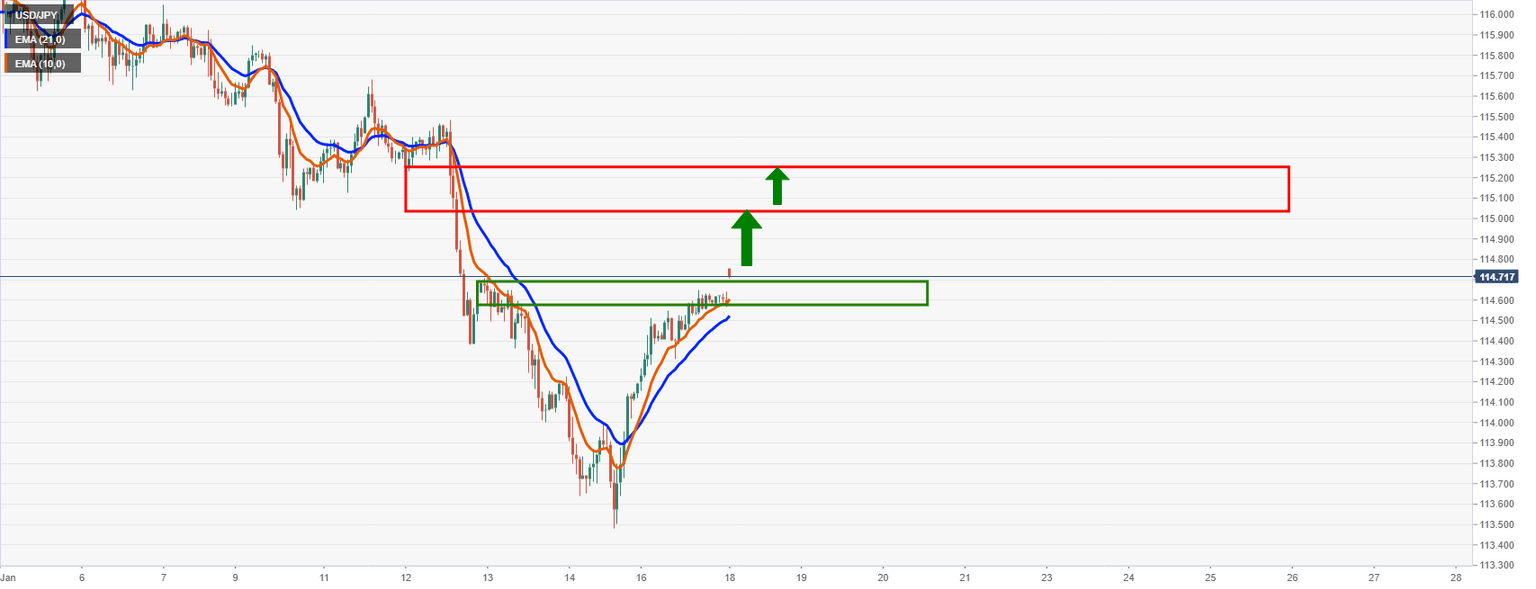

Following a shallow correction in late New York trade, The price is on target for a test of the neckline of the M-formation near 115 the figure. A break there could mitigate a further portion of the bearish impulse's range towards 115.50 as per the hourly chart below.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.