USD/JPY at critical juncture with Japan's political risk and monetary policy in focus

- Japan's upcoming elections and political risk add to USD/JPY price action.

- USD/JPY trades with view to risks of a double-top building.

- Monetary and fiscal policy remain key drivers for the USD/JPY pair.

The Japanese Yen (JPY) is trading in a narrow range against the US Dollar on Friday, with monetary policy and political factors influencing the pair.

At the time of writing, USD/JPY is trading above 148.00 as traders look ahead to Japan's upcoming election.

Risks from Japan's election feature in USD/JPY price action

The upcoming July 20 Upper House election in Japan has injected fresh uncertainty into currency and bond markets.

Prime Minister Shigeru Ishiba’s LDP-Komeito coalition is facing mounting pressure, with recent polls suggesting they may fall short of the 50-seat threshold needed to retain their majority.

Failure to do so could open the door for opposition and populist parties to influence policy, potentially advocating for expansionary fiscal measures, such as large-scale government spending and tax cuts.

This prospect has already unsettled investors, sparking a sell-off in Japanese government bonds and driving long-term yields to multi-decade highs. In response, the Yen has weakened, nearing one-year lows against the US Dollar.

Should the ruling bloc suffer a decisive loss, or Ishiba be forced to resign, markets may interpret the outcome as a pivot toward looser fiscal policy and a likely pause in the BoJ's efforts to advocate for higher rates, reinforcing the interest rate divergence with the US and keeping USD/JPY elevated.

Conversely, if the coalition narrowly holds onto power, political stability may return, supporting the Yen and calming bond markets.

Notably, the election comes at a time when USD/JPY is testing a key resistance level around 149.00, with price action suggesting a possible double top formation. A spike in post-election uncertainty could act as the catalyst for a breakdown, confirming the bearish reversal pattern. On the other hand, a stable political outcome could restore confidence and trigger a bullish breakout, opening the door to higher levels.

USD/JPY sees risks of a double-top build

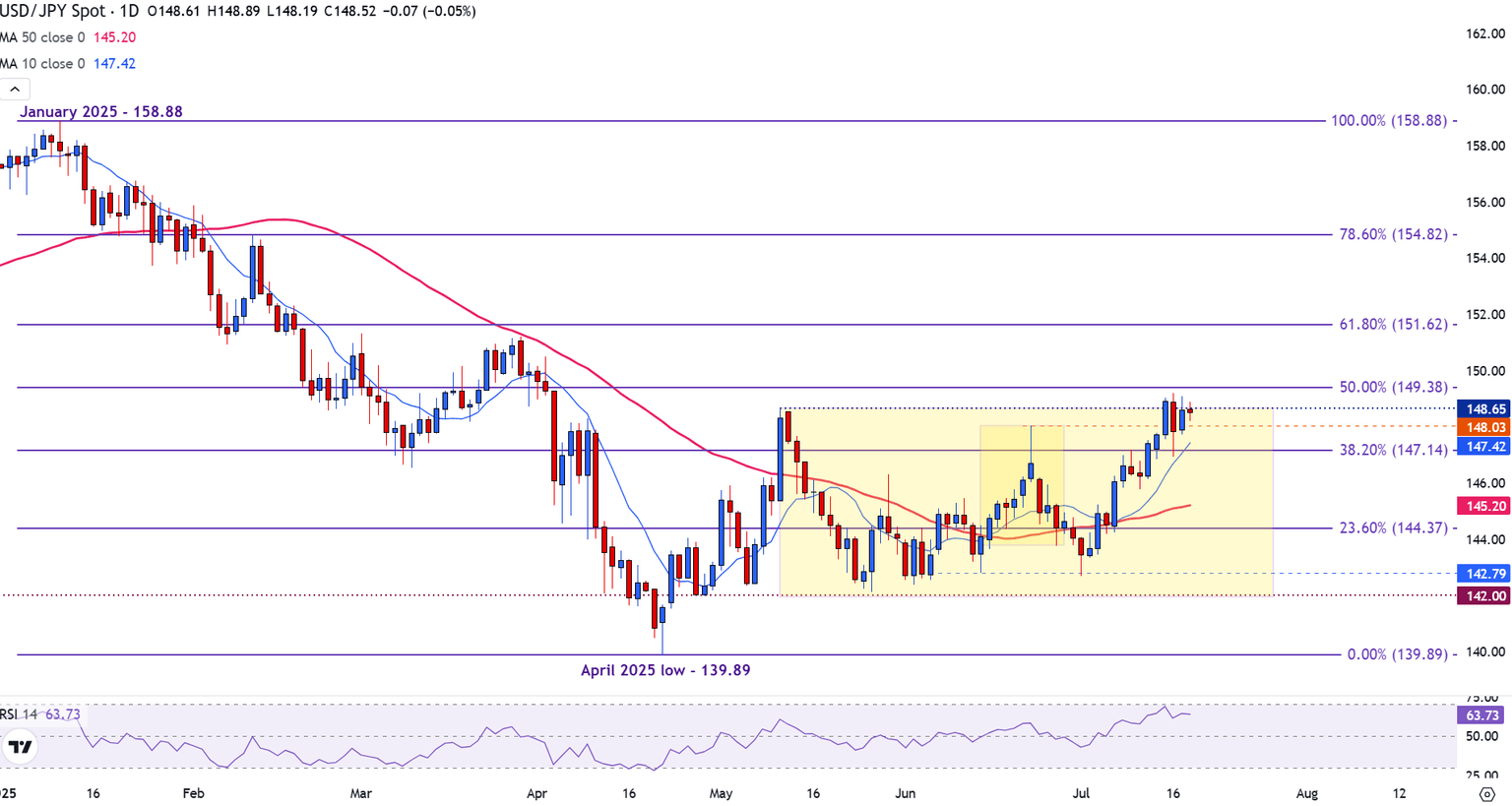

From a technical perspective, USD/JPY appears to be in a consolidation phase beneath a well-defined resistance zone that has formed between 148.65 and 149.00.

Price action on the daily chart has formed two distinct peaks near this area, suggesting the early formation of a potential double-top pattern, a bearish reversal signal. However, the structure remains unconfirmed until a decisive break occurs below the neckline support near 147.14, which also coincides with the 38.2% Fibonacci level of the January-April decline adding to its technical importance.

USD/JPY daily chart

Momentum indicators, such as the Relative Strength Index (RSI), are beginning to roll over near overbought territory, hinting at a potential loss of bullish strength. Despite this, the broader trend remains constructive as the pair continues to trade above its 10-day Simple Moving Average (SMA) at 147.43 and the 50-day SMA at 145.20, reflecting underlying bullish momentum.

A confirmed break below 147.14 could accelerate downside toward 144.37 or lower, while a sustained close above 149.00 would invalidate the double-top scenario and open the door to a possible retest of the 151.62 level.

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.