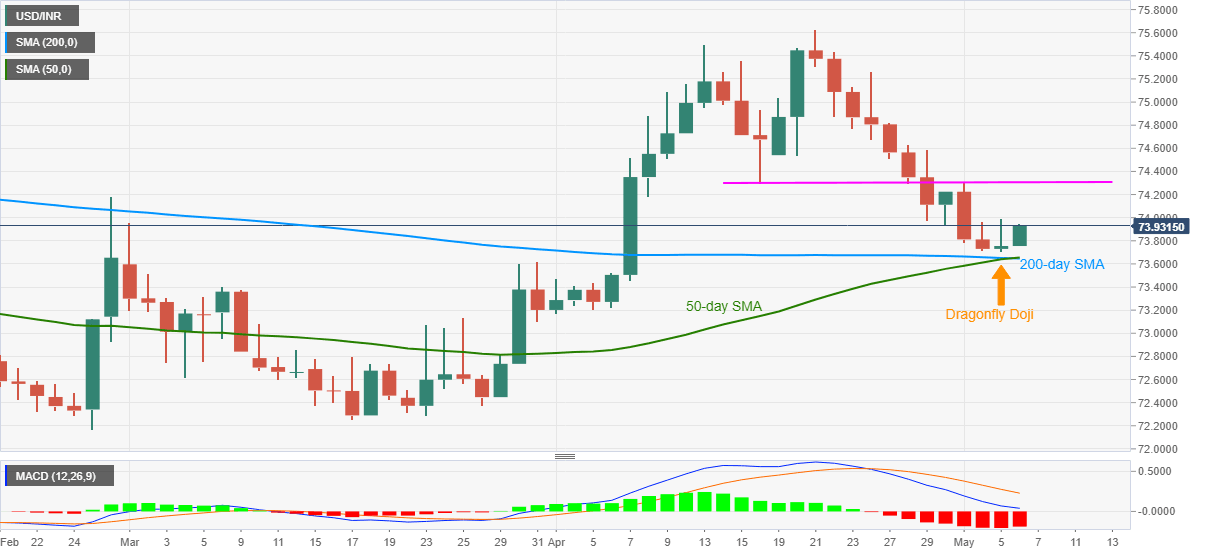

USD/INR Price News: Indian rupee sellers attack 74.00 on Dragonfly Doji near key SMA joint

- USD/INR extends the previous day’s recovery moves, refreshes intraday high.

- Bullish candlestick, strong support battle bearish MACD near monthly low.

- Three-week-old horizontal resistance tests buyers but sellers have a bumpy road ahead.

USD/INR stays well bid around intraday top of 73.95, up 0.22% on a day, amid the initial Indian session on Thursday. In doing so, the quote justifies the previous day’s bullish candlestick above a convergence of 50-day and 200-day SMA.

While the recent corrective pullback is ready to cross the 74.00 threshold, late February tops near 74.20 and a short-term horizontal line close to 74.30 will challenge the further upside.

If at all USD/INR buyers keep reins above 74.30, odds of witnessing the 75.00 round-figure on the chart can’t be ruled out.

Alternatively, a daily closing below 73.65 won’t be enough for USD/INR seller’s entry as March month’s top near 73.60 add extra filter to the south.

Even if the bears manage to break 73.60, multiple levels near 73.20-15 and the 73.00 round-figure may trouble them during further downside.

USD/INR daily chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.