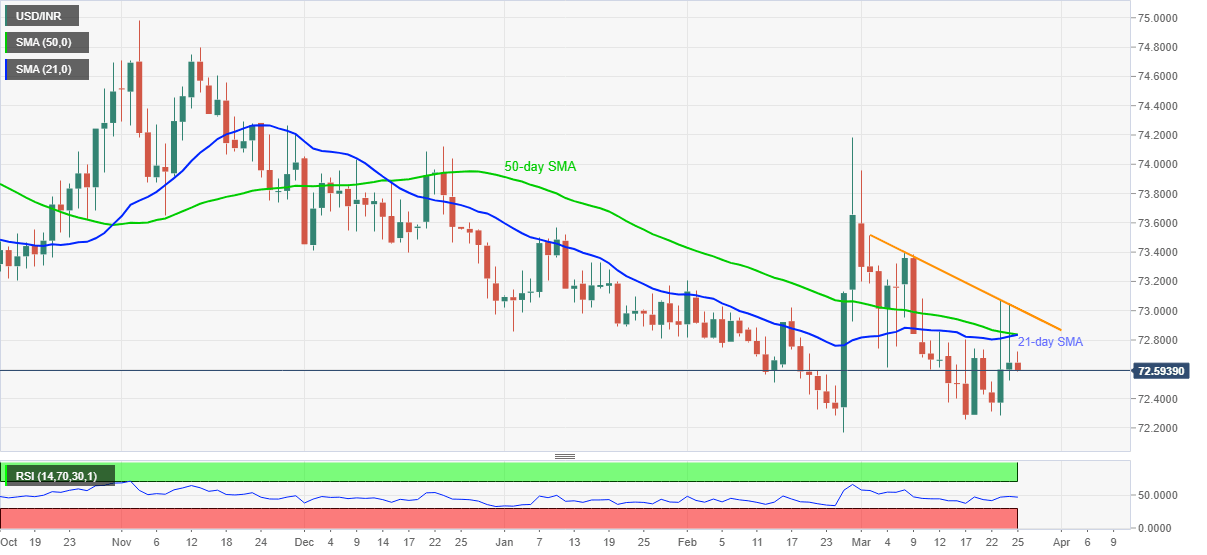

USD/INR Price News: Indian rupee regains below key SMA confluence of 72.85

- USD/INR snaps two-day winning streak, stays depressed near intraday low off-late.

- 21-day, 50-day SMA convergence guards immediate upside ahead of 17-day-old resistance line.

- 72.50 lures intraday sellers but multiple barriers can test bears afterward.

USD/INR extends pullback from 72.20 to around 72.60, down 0.07% intraday, during the initial Indian session on Thursday. In doing so, the quote rejected the previous two-day upside bias while easing below a confluence of 21-day and 50-day SMA.

Given the normal RSI conditions joining the pair’s repeated failures to cross the key SMA joint and a descending trend line from March 02, USD/INR is likely to hold lower grounds.

During the fall, the 72.50 round-figure comprising the mid-February lows can offer immediate support ahead of the monthly bottom near 72.25.

However, the yearly low near 72.17 and the 72.00 threshold can test the USD/INR bears afterward.

Meanwhile, a daily closing beyond the stated SMA convergence near 72.85 will need validation from the short-term resistance line, at 73.01 by the press time, before recalling the USD/INR buyers.

If at all the quote successfully stays above 73.01, March 08 high near 73.40 and the yearly top near 74.20 will be the key to watch.

USD/INR daily chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.