A tough road ahead for the Bank of Japan

The BoJ paused rates at 0.75%, expressing greater confidence in growth and reaching the 2% inflation goal. The challenge is balancing rate hikes to support JPY without slowing growth. Timing is uncertain, but we now see a June hike as the base case. Meanwhile, PM Takaichi dissolved the lower house for the 8 Feb election, adding economic uncertainty.

The BoJ expresses greater confidence in growth and inflation, leaving rate hikes as an option

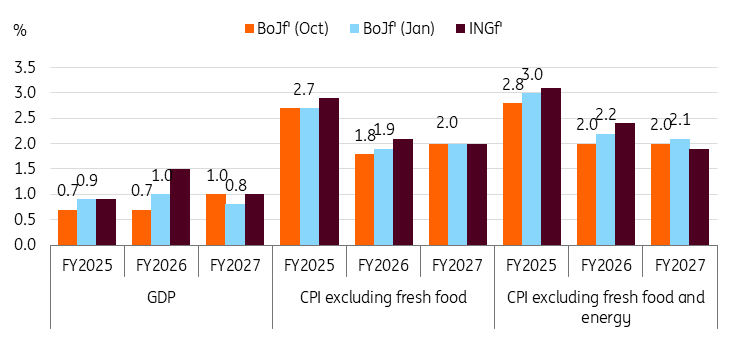

Summing up the quarterly outlook updates and statements, the BoJ seems to have more confidence in growth and achieving a 2% inflation target.

We believe that the BoJ's upward revision of core-core inflation suggests it views the recent weakness of the yen as increasing inflationary pressures, and that there is growing confidence among board members regarding wage growth.

Although it reiterated its stance of raising rates if its economic outlook is achieved, its assessment of economic risks is now generally balanced despite the recent tension escalation between China and Japan, suggesting greater confidence in growth.

The government's fiscal stimulus has been a reason for the GDP upward revision. Meanwhile, the BoJ keeps its view that the real interest rate is at a significantly low level. We believe these all signal further rate hikes.

The BoJ lifted its core-core inflation outlook, above 2% for the next three years

Source: Bank of Japan and ING estimates

Governor Ueda comments remain neutral

As expected, BoJ Governor Kazuo Ueda's comments did not provide any strong signal for immediate rate hikes. He repeated that the path and pace of future rate hikes depend on economic conditions. He also acknowledged that market rates rose very rapidly, but partly attributed it to the end of fiscal year factor.

Instead, he highlighted that the BoJ is monitoring bank lending and financial conditions, which remain accommodative after the December hike in its own assessment. He mentioned the possibility of conducting bond market operations in extraordinary conditions to encourage stable yield formation, but it sounded to us that he would like to keep a distance from committing to actual adjustment in operations. We interpret his remarks to mean the BoJ's main focus is on financial conditions, not necessarily long-end tenor yields.

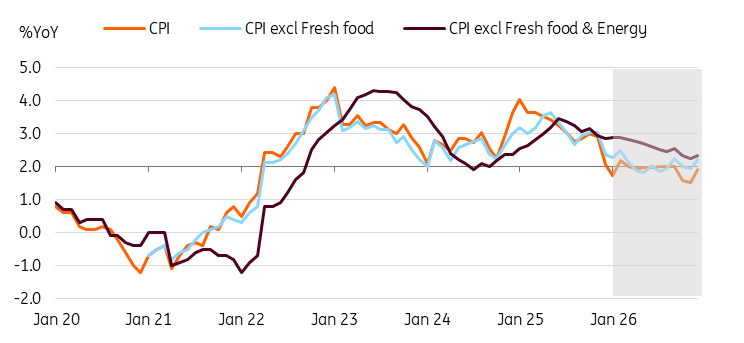

He refrained from commenting on JPY, instead, he spent ample time explaining the inflation outlook and possible FX impact. The BoJ expects headline inflation to fall below 2% but underlying inflation to keep slowly accelerating. The BoJ's focus is on underlying inflation, not headline. Board members have different views on underlying inflation, but on average, the board sees some distance still to 2%. Also, April price behaviour is a factor in considering rate hikes.

Core-core inflation will follow the path of headline with a time lag

Source: CEIC

BoJ watch

The positive tone on growth and inflation doesn't necessarily mean the BoJ will expedite its rate hikes much earlier than expected. After listening to Ueda's comments, we believe that the possible rate hike timing could be June, not October.

We still think that core-core inflation is expected to decline, but at quite a slow pace (see our latest inflation report: Slower inflation means only gradual Bank of Japan rate hikes). As long as it remains above 2% by the end of 1H26, this should give support for the BoJ hike.

Given the cautious approach by the majority of the board on inflation, we think the BoJ will wait until June, even if it sees a strong inflation hike in April. We will monitor how core-core inflation moves along with the BoJ's projection. As Ueda mentioned, the April Price Action is quite important. As April is the beginning of Japan's new fiscal year, businesses tend to adjust their price tags in that month. If the price action remains quite strong, supported by solid wage growth in Spring Wage Negotiations, the BoJ will hike in its June meeting.

We'd like to note that, depending on the snap election called by Prime Minister Takaichi, there is a lot more uncertainty surrounding the BoJ's policy.

Takaichi seeks public mandate to pursue expansionary fiscal policies through election victory

Today PM Takaichi dissolved the lower house and set the election for 8 February.

Takaichi’s path to becoming prime minister has been challenging from the start. Shortly before the prime ministerial vote last October, Komeito – a longstanding coalition partner of the LDP – unexpectedly withdrew from the alliance, citing irreconcilable differences with Takaichi’s right-leaning policies, forcing her to seek a new partner to support her prime minister position. She managed to get support from the Japan Innovation Party, but the ruling LDP only holds a slim majority.

Amid rising tensions with China, she needed to secure her position to implement her economic and foreign policy agenda more steadily. Since her approval ratings were strong at around 70%, she opted to call a snap election. Recent polls indicate the LDP is likely to win a majority in the lower house, and the CRA (Centrist Reform Alliance) may also exceed expectations.

JGB sell-off sparked by proposals to cut food consumption taxes

Market sentiment had already been fragile due to Takaichi’s strong support for an expansionary fiscal policy. When the CRA introduced the permanent abolition of food consumption taxes as part of its main election campaign, it led to a significant sell-off in JGBs. The government’s verbal interventions helped to calm some market worries, but underlying anxiety persists. Today’s remarks from Ueda regarding potential adjustments to the BoJ’s operations may help alleviate market anxiety for now. However, we believe that, regardless of the election results, markets are likely to grow increasingly concerned about fiscal sustainability.

Although both Takaichi and the opposition argue that the proposed tax cuts won’t be financed by debt issuance, the specific financing method remains unclear. One possibility is that, as the BoJ begins to sell its ETF holdings this year, the return from sales could support government revenues to some extent. Ultimately, we must await further clarification regarding the government's chosen measures to ensure fiscal health.

But for the BoJ, this will create a lot of uncertainty going forward. This wasn't commented on by Ueda at today's conference, but it will soon challenge the BoJ's rate decision.

Not easy to pinpoint the impact of tax cuts

If the consumption tax were removed, the CPI would likely drop by about 1ppt. With a simple calculation, food accounts for 25% of the total CPI basket, and an 8% tax cut, if fully passed onto prices, would result in a 2ppt decline. Yet realistically, the actual pass-through rate should be closer to 50%. Thus, we expect a rough 1% ppt decline. Nevertheless, counterfactors, such as a weaker yen, may keep inflation elevated depending on the currency movements.

Estimating the growth trajectory is far more complex. Consumption tax cuts will trigger sharp spikes when introduced and again when they expire in two years. How these temporary boosts are interpreted could prompt the BoJ to accelerate rate hikes, only to reverse course quickly once taxation normalises. For now, risks remain, and we’ll reassess as election outcomes, fiscal policy, and market reactions evolve.

Read the original analysis: A tough road ahead for the Bank of Japan

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.