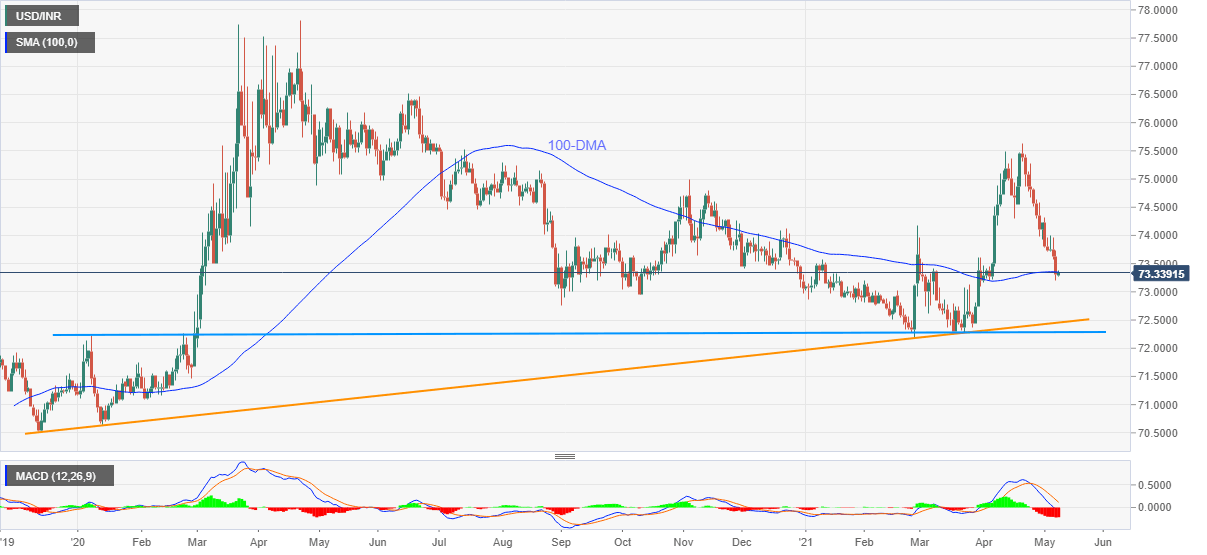

USD/INR Price News: 100-DMA tests Indian rupee pullback from five-week top above 73.00

- USD/INR fades bounce off multi-day low but snaps two-day downtrend.

- 72.80 lures bears ahead of the key support trend lines.

- Bulls may remain worried below mid-April lows, corrective bounce may eye 73.60.

USD/INR trims intraday gains while easing to 73.32 amid the initial Indian session on Monday. The Indian rupee pair dropped to the lowest since early April on Friday before recently witnessing a short-covering move.

However, bearish MACD and 100-day SMA (DMA) seem to test the USD/INR buyers around 73.35, a daily closing beyond which may eye for the 74.00 threshold and February’s top surrounding 74.20.

It should be noted, though, that a clear run-up beyond 74.20 becomes necessary for the USD/INR bulls to retake control.

On the contrary, the 73.00 round figure, followed by multiple supports near 72.80, may please short-term USD/INR sellers.

In a case where the USD/INR prices drop below 72.80, an ascending trend line from December 2019 and a 16-month-old horizontal support line, respectively near 72.45 and 72.30, will be in the spotlight.

USD/INR daily chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.