USD/INR rallies to record highs above 90.00, RBI's policy comes into focus

- The Indian Rupee slumps to 90.30 against the US Dollar, the lowest level ever.

- Continuous FIIs selling in the Indian stock market and rising fiscal deficit have weighed on the Indian Rupee.

- White House economic adviser Hassett’s selection as the Fed’s chair could dampen the central bank’s independence.

The Indian Rupee (INR) extends its losing streak against the US Dollar (USD) for the third trading day on Wednesday, sliding to a fresh all-time low around 90.50. The USD/INR pair enters uncharted territory as the synergetic effect of consistent foreign outflows and soaring fiscal deficit is hitting India’s forex reserves, resulting in significant pressure on the Indian Rupee.

Foreign Institutional Investors (FIIs) have been paring stake in the Indian equity market for months. Overseas investors have turned out to be net sellers in the first two trading days of December, extending their five-month selling spree further. Cumulatively, FIIs have pared their stake worth Rs. 4,813.61 crore on Monday and Tuesday.

Additionally, India’s surging Balance of Payments (BoP) deficit due to higher tariffs on imports from India to the United States (US) is also a major drag on the Indian Rupee. In the third quarter, net capital flows fell to just $0.6 billion, from $8 billion recorded in the second quarter this year.

Going forward, the next major trigger for the Indian Rupee will be the monetary policy announcement by the Reserve Bank of India (RBI) on Friday. The Indian central bank is expected to cut its Repo Rate by 25 basis points (bps) to 5.25% as inflation in India has remained well below the tolerance range of 2%-6% in the past few months.

The table below shows the percentage change of Indian Rupee (INR) against listed major currencies today. Indian Rupee was the weakest against the British Pound.

| USD | EUR | GBP | JPY | CAD | AUD | INR | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.21% | -0.26% | -0.14% | -0.08% | -0.23% | 0.34% | -0.22% | |

| EUR | 0.21% | -0.05% | 0.07% | 0.13% | -0.02% | 0.56% | -0.01% | |

| GBP | 0.26% | 0.05% | 0.12% | 0.18% | 0.03% | 0.61% | 0.04% | |

| JPY | 0.14% | -0.07% | -0.12% | 0.06% | -0.09% | 0.50% | -0.08% | |

| CAD | 0.08% | -0.13% | -0.18% | -0.06% | -0.14% | 0.44% | -0.14% | |

| AUD | 0.23% | 0.02% | -0.03% | 0.09% | 0.14% | 0.59% | 0.00% | |

| INR | -0.34% | -0.56% | -0.61% | -0.50% | -0.44% | -0.59% | -0.58% | |

| CHF | 0.22% | 0.01% | -0.04% | 0.08% | 0.14% | -0.01% | 0.58% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Indian Rupee from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent INR (base)/USD (quote).

Investors await US ADP Employment Change and ISM Services PMI data

- The Indian Rupee struggles to gain ground against the US Dollar, even as the latter underperforms broadly. During the press time, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades 0.12% lower to near 99.20, narrowly distant from its monthly low of 99.00.

- The US Dollar has come under pressure amid growing expectations that White House Economic Adviser Kevin Hassett could be hired as the next Federal Reserve (Fed) Chairman.

- While addressing reporters at a White House event on Tuesday, US President Donald Trump stated that he has narrowed his choices for Fed Chair Jerome Powell’s successor to one, whose term will end in May 2026, and took the name of economic adviser Hassett in the end of his comments.

- "I guess a potential Fed chair is here too. Am I allowed to say that? Potential. He’s a respected person, that I can tell you. Thank you, Kevin," Trump said, Reuters reported.

- White House economic adviser Hassett’s selection as the Fed’s next chair would raise questions over the credibility of the central bank’s decisions going forward, assuming that his decisions will be biased towards US President Trump’s economic agenda.

- US President Trump has criticized Fed Chair Powell several times for maintaining a restrictive monetary policy stance despite inflationary pressures remaining well above the 2% target.

- White House economic adviser Hassett’s decisions, bent towards Trump’s favoured policies, will be unfavourable for the US Dollar.

- On the economic data front, investors await the US ADP Employment Change and the ISM Services PMI data for November, which will be published during the North American session. Economists expect private employers to have added 5K fresh workers, significantly lower than 42K in October. The ISM Services PMI is expected to come in lower at 52.1 from 52.4 in October.

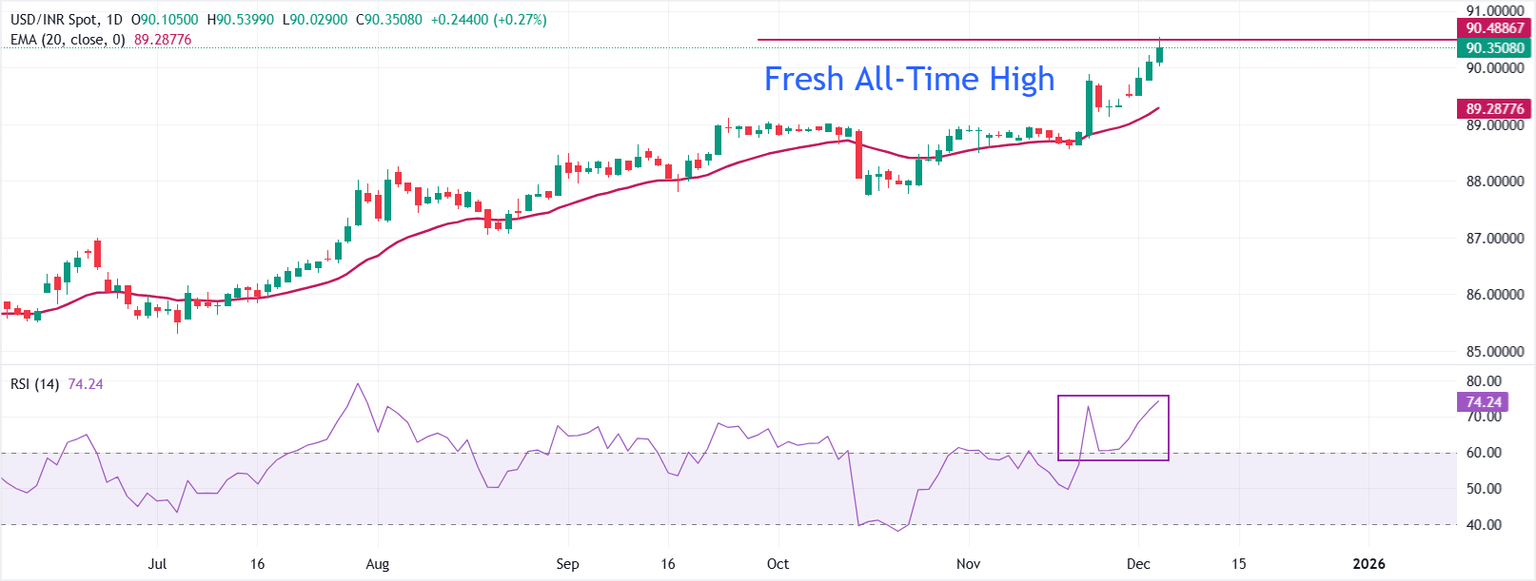

Technical Analysis: USD/INR posts fresh all-time high near 90.50

USD/INR jumps to near 90.50 on Wednesday. The 20-day Exponential Moving Average (EMA) keeps rising, and the price holds above it, reinforcing a bullish short-term tone.

RSI at 72.86 is overbought, flagging stretched momentum that could prompt consolidation. Initial support is the 20-day EMA at 89.2748; above this gauge, the uptrend would stay in place.

The 20-day EMA slope has accelerated in recent sessions, confirming trend strength and suggesting buyers retain control on pullbacks.

RSI remains elevated, and a cooling of momentum could precede another push higher rather than mark a trend change. A daily close back below the average would start to ease upward pressure, while sustained trade above it keeps risks tilted to the upside.

(The technical analysis of this story was written with the help of an AI tool)

Economic Indicator

ADP Employment Change

The ADP Employment Change is a gauge of employment in the private sector released by the largest payroll processor in the US, Automatic Data Processing Inc. It measures the change in the number of people privately employed in the US. Generally speaking, a rise in the indicator has positive implications for consumer spending and is stimulative of economic growth. So a high reading is traditionally seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Wed Dec 03, 2025 13:15

Frequency: Monthly

Consensus: 5K

Previous: 42K

Source: ADP Research Institute

Traders often consider employment figures from ADP, America’s largest payrolls provider, report as the harbinger of the Bureau of Labor Statistics release on Nonfarm Payrolls (usually published two days later), because of the correlation between the two. The overlaying of both series is quite high, but on individual months, the discrepancy can be substantial. Another reason FX traders follow this report is the same as with the NFP – a persistent vigorous growth in employment figures increases inflationary pressures, and with it, the likelihood that the Fed will raise interest rates. Actual figures beating consensus tend to be USD bullish.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.