USD Index Price Analysis: There is a minor support around 104.70

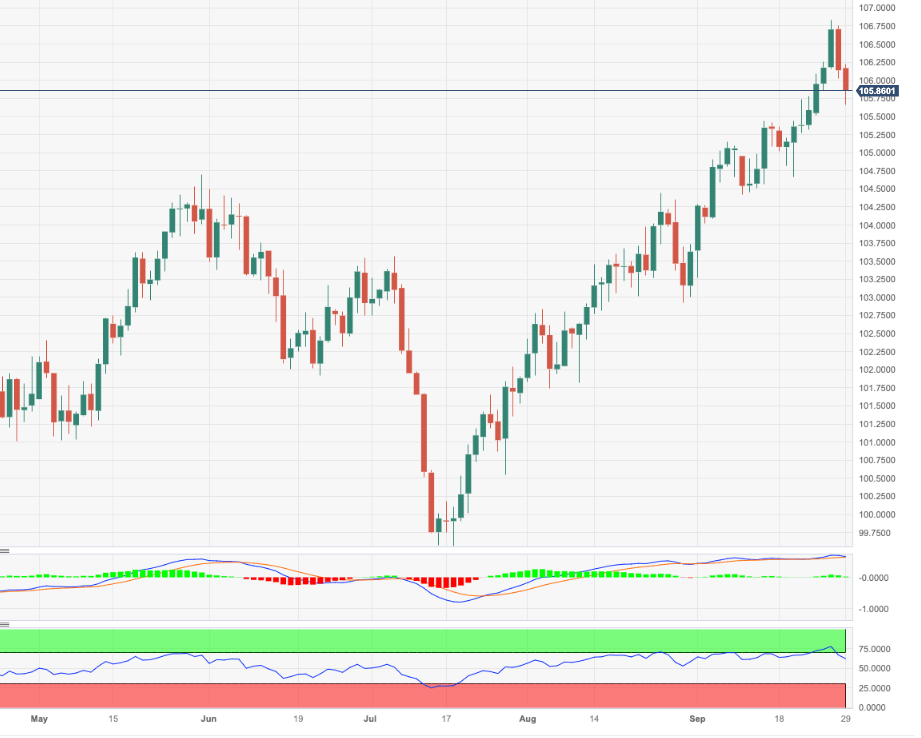

- DXY extends the correction to the 105.70/65 band.

- A deeper pullback should meet contention near 104.70.

DXY adds to Thursday’s losses and briefly visits the vicinity of the 105.70 zone at the end of the week.

Despite the ongoing technical correction, extra gains appear likely for the time being. The surpass of the yearly high of 106.83 (September 27) could encourage the index to challenge the weekly top at 107.19 (November 30, 2022) prior to another weekly peak at 107.99 (November 21 2022).

In the meantime, while above the key 200-day SMA, today at 103.09, the outlook for the index is expected to remain constructive.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.