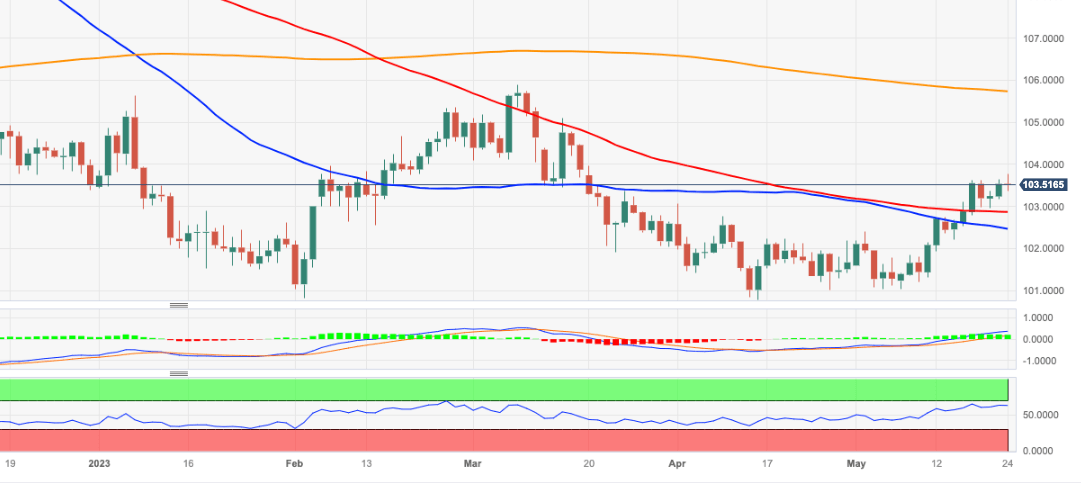

USD Index Price Analysis: Immediately to the upside comes 104.00

- DXY clinches fresh monthly highs near 103.80 on Wednesday.

- Further buying pressure could challenges the 104.00 zone.

DXY advances to fresh highs in the 103.75/80 band before losing some momentum on Wednesday.

In case bulls regain the upper hand, the next up-barrier emerges at the 104.00 hurdle prior to the key 200-day SMA, today at 105.73, and the 2023 peak of 105.88 (March 8).

Looking at the broader picture, while below the 200-day SMA the outlook for the index is expected to remain negative.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.