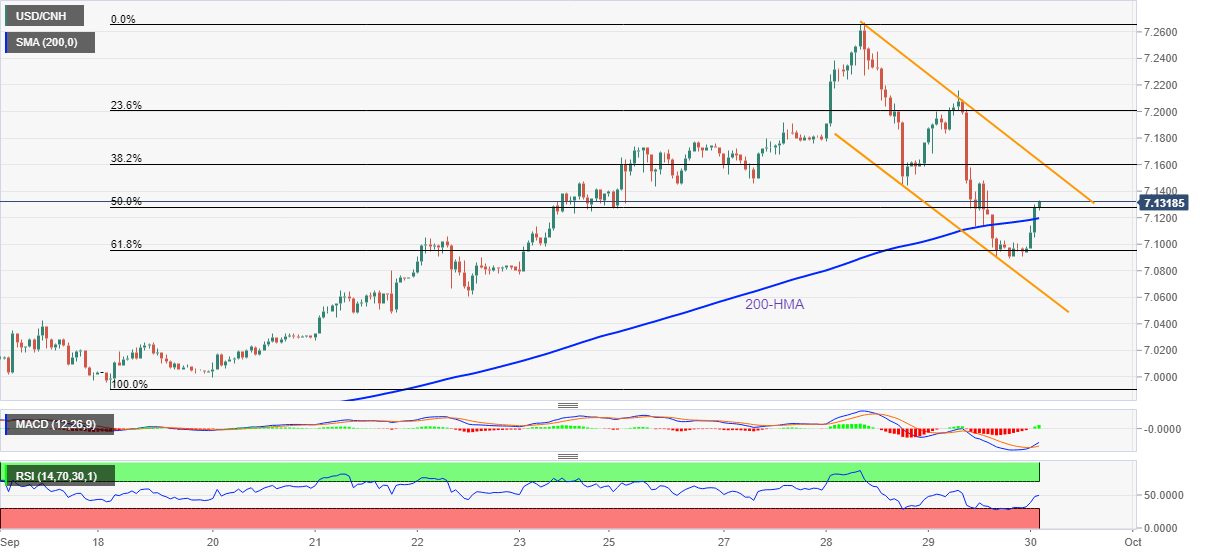

USD/CNH Price Analysis: Snaps two-day downtrend around 7.1300 after China PMIs

- USD/CNH crosses 200-HMA for the first time in two weeks after mixed China PMI data.

- NBS Manufacturing PMI improved but Non-Manufacturing PMI and Caixin Manufacturing PMI eased in September.

- Immediate bearish channel challenges upside momentum targeting the fresh record high.

- MACD, RSI conditions join the key HMA breakout to favor buyers.

USD/CNH picks up bids to add gains to the first daily positive in three after China’s mixed activity data for September, published early Friday. That said, the quote renews intraday high around 7.1300 by the press time.

China’s official NBS Manufacturing PMI rose to 50.1 versus 49.6 expected and 49.4 prior while the Non-Manufacturing PMI declined to 50.6 compared to 52.0 market forecasts and 52.6 prior readings. Further, China's Caixin Manufacturing PMI dropped to 48.1 during the stated month versus 49.5 expected and prior.

In addition to the unimpressive activity numbers but a clear rebound from the 61.8% Fibonacci retracement of the pair’s September 19-28 advances and the run-up beyond the 200-HMA for the first time in 13 days also lure USD/CNH buyers.

However, a downward sloping trend channel from Wednesday restricts immediate USD/CNH recovery, with its resistance line standing near 7.1630 by the press time.

Should the quote rises past 7.1630, the odds of witnessing a rally towards the recent record high near 7.2660 can’t be ruled out.

Alternatively, pullback moves may initially aim for the 61.8% Fibonacci retracement level, also known as the golden ratio, around 7.0950.

Following that, the stated nearby channel’s support line, close to 7.0650, could challenge the USD/CNH pair’s further weakness.

USD/CNH: Hourly chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.