USD/CHF Price Analysis: Technical setup points to more pain below 0.9700

- USD/CHF is flirting with monthly lows below 0.9700 as DXY sinks.

- Risk-off flows dominate amid China and Europe's optimism.

- The pair eyes more downside as daily RSI pierces into the negative zone.

USD/CHF is back in the red this Monday after Friday’s temporary reversal, as bears track the unrelenting decline in the US dollar across the board.

Optimism that loosening lockdowns in China could help global growth and an unexpected improvement in the German business morale lifted the overall market mood and weighed heavily on the safe-haven US dollar.

The dollar also takes the hit from the pre-FOMC minutes investors’ repositioning, shrugging off the rebound in the US Treasury yields.

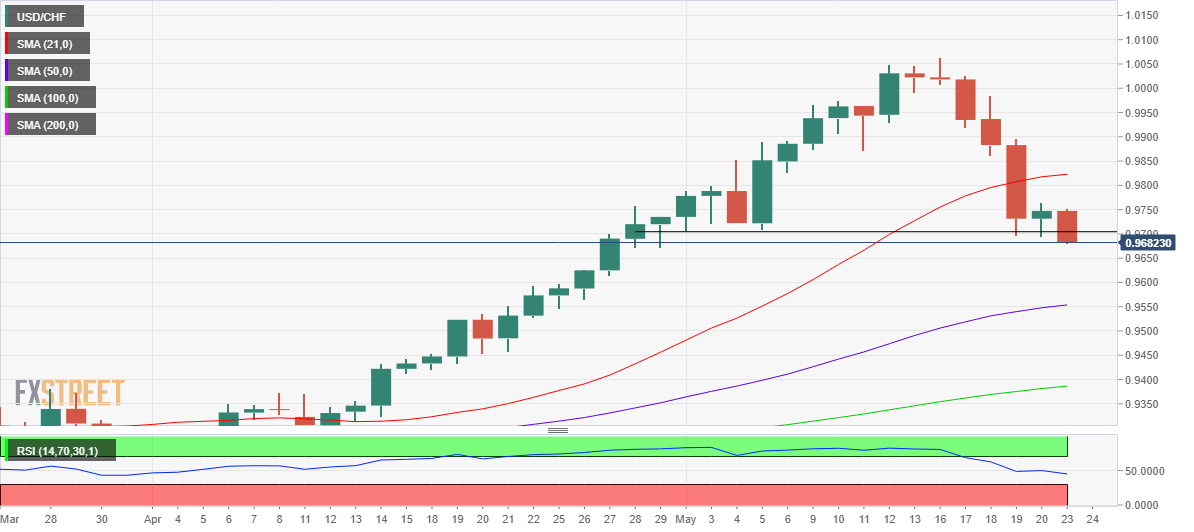

From a short-term technical perspective, USD/CHF has breached the 0.9700 support once again, with more losses likely in the offing, as the 14-day Relative Strength Index (RSI) has crossed the midline for the downside.

Daily closing below that level is needed to validate the downside break from the horizontal trendline support that defended the pair in early February.

The upward-sloping 50-Daily Moving Average (DMA) at 0.9553 will be tested if bears refuse to give up control in the near term.

USD/CHF: Daily chart

On the flip side, if bulls fight back control, managing to resist above 0.9700, then a brief rebound towards the 0.9750 psychological level cannot be ruled out.

Further up, USD/CHF buyers could aim for the ascending 21-DMA once again, now at 0.9822.

Note that the previous week’s downward spiral yielded a daily closing below the 21-DMA for the first time since April 11.

USD/CHF: Additional levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.