USD/CHF Price Analysis: Evolves a new short-term uptrend

- USD/CHF is making higher highs and higher lows as it tracks higher since the August 4 lows.

- The pair is probably in a short-term uptrend which is expected to continue rising.

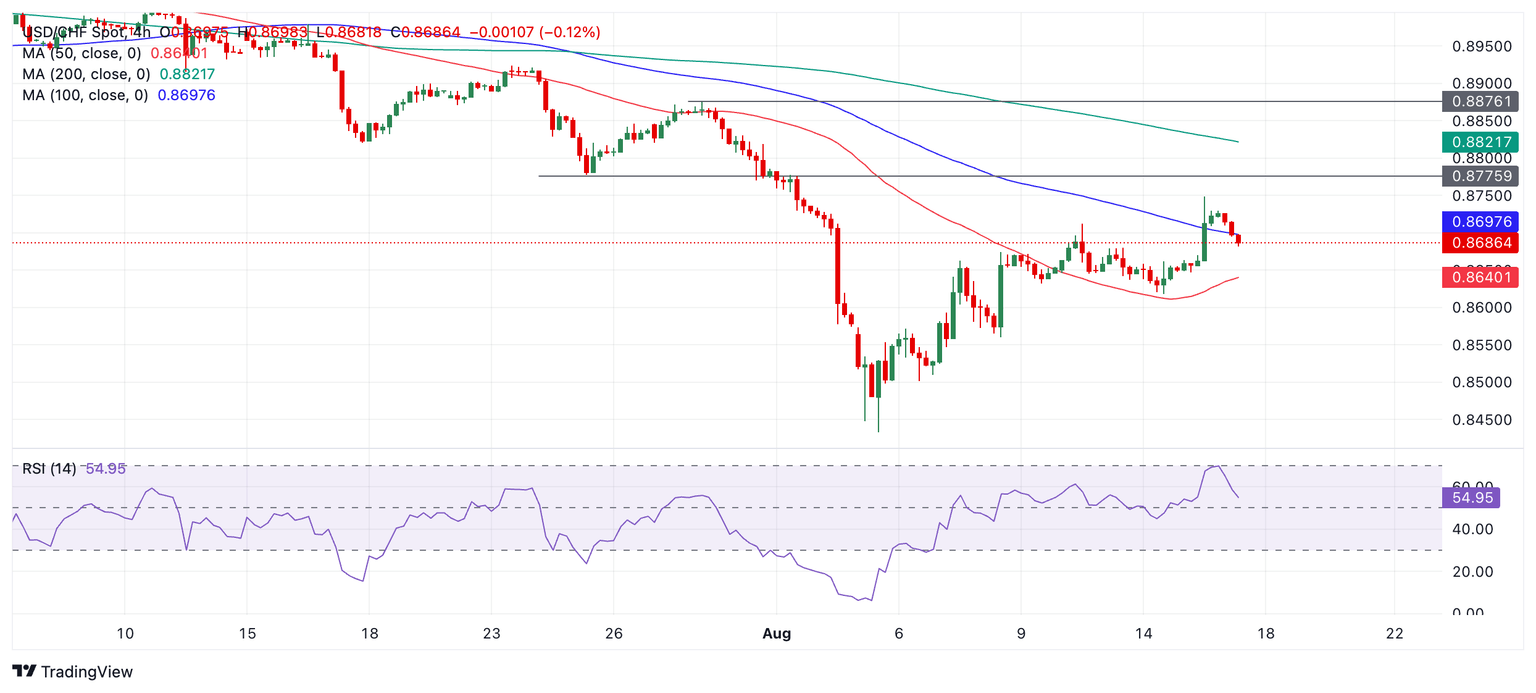

USD/CHF has established a sequence of rising peaks and troughs on the 4-hour chart (since the pair bottomed on August 4). This suggests the pair is now in a short-term uptrend. Given the old adage that “the trend is your friend” the uptrend is more likely than not to extend higher, at least in the near term.

USD/CHF 4-hour Chart

USD/CHF has closed above both the 50 and 100-period Simple Moving Averages (SMA) further reinforcing the view that it is trending higher. The next target to the upside is 0.8776 (July 25 swing low). Above that is the 200-period SMA at 0.8822, which is likely to present a tough barrier of resistance. If USD/CHF can close above that, then the 0.8876 July 30 swing high comes into view.

The Relative Strength Index (RSI) momentum indicator flirted briefly with the overbought zone on Thursday but never quite entered it and at 54.95 still has scope for more upside before it signals an over extension. A move above 70 would increase the risk of a pullback evolving but it would require a break below 0.8560 (August 8 swing low) to indicate a change of trend and the evolution of a more bearish environment.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.