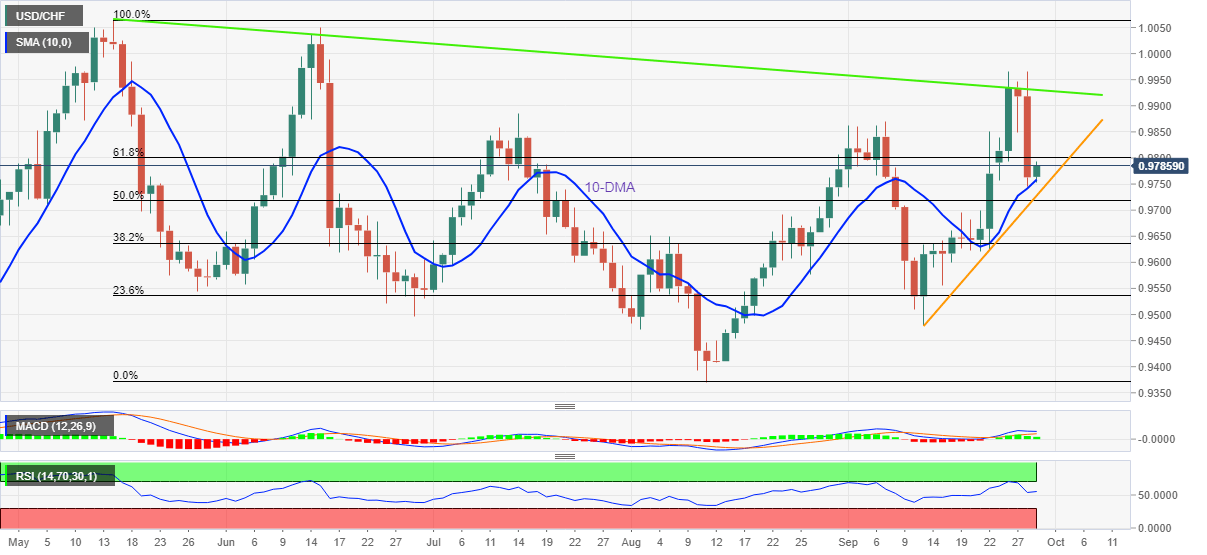

USD/CHF Price Analysis: Bounces off 10-DMA as bulls approach 0.9800

- USD/CHF pares the biggest daily loss in 15 weeks, snaps two-day downtrend.

- Firmer oscillators, rebound from 10-DMA direct buyers towards 61.8% Fibonacci retracement.

- Two-week-old ascending trend line adds to the downside filters.

- Descending trend line from mid-May acts as the key upside hurdle.

USD/CHF picks up bids to refresh intraday high around 0.9790 during Thursday’s Asian session while printing the first daily gain in three. In doing so, the Swiss currency (CHF) pair rebounds from the 10-DMA, as well as the weekly low, to pare the biggest slump since mid-June.

The pair’s sustained bounce off the 10-DMA support and the firmer RSI, not overbought, joins the bullish MACD signals to direct buyers toward the 61.8% Fibonacci retracement of the May-August downside, near the 0.9800 threshold.

Following that, tops marked in early September and July, around 0.9870 and 0.9885 respectively, will challenge the pair’s upside momentum.

If at all the USD/CHF bulls keep reins past 0.9885, a downward sloping resistance line from May, around 0.9930, could act as the last defense of the pair sellers.

Meanwhile, a downside break of the 10-DMA support of 0.9758 won’t be a welcome card for the USD/CHF sellers as a 12-day-old support line, close to 0.9725 by the press time, will test the declines.

Overall, USD/CHF is likely to remain firmer but the upside appears limited.

USD/CHF: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.