AUD/USD Price Forecast: AUD stalls ahead of RBA decision; bullish setup intact above 0.6600

- AUD/USD trades under pressure as traders turn cautious ahead of the RBA monetary policy announcement.

- RBA is expected to hold rates at 3.60%, with markets watching for any hawkish tilt in forward guidance.

- Technical setup stays constructive above 0.6600, with resistance seen at the 0.6707 year-to-date high.

The Australian Dollar (AUD) trades on the back foot against the US Dollar (USD) on Monday, with AUD/USD snapping a four-day winning streak as the Greenback steadies. At the time of writing, the pair is hovering near 0.6621, with traders turning cautious ahead of the Reserve Bank of Australia (RBA) interest rate decision on Tuesday.

Markets widely expect the RBA to keep interest rates unchanged at 3.60%, following back-to-back holds in September and November after delivering three cuts earlier in the year. With the move fully priced in, the focus shifts to the forward guidance, especially as speculation grows that policymakers may tilt toward tightening heading into 2026 if domestic conditions stay firm.

At the same time, investors are also looking ahead to Wednesday’s Federal Reserve (Fed) interest rate decision, where the central bank is expected to cut rates by 25 basis points. The diverging monetary policy paths leave the near-term outlook tilted in favor of AUD/USD upside, particularly if the RBA delivers a hawkish hold.

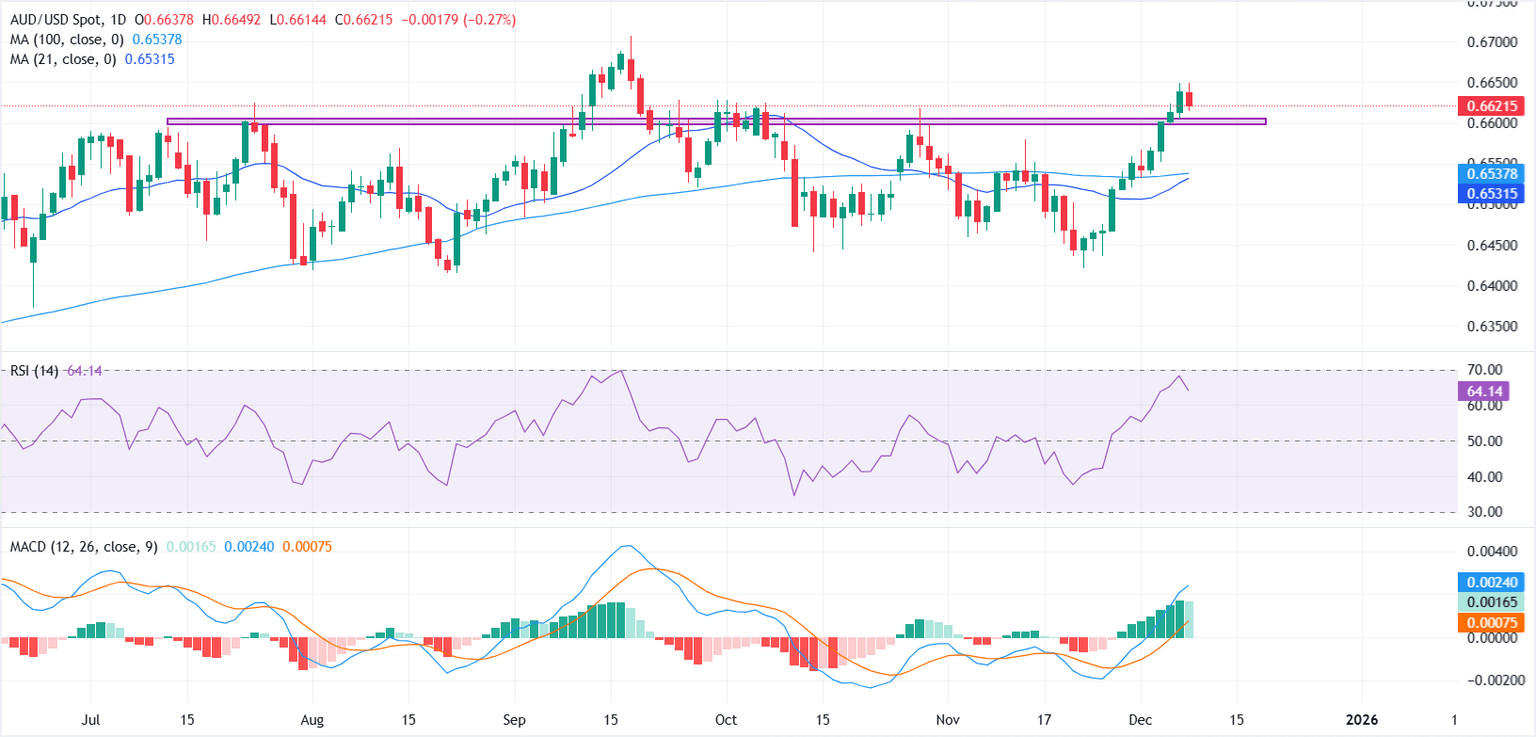

From a technical perspective, AUD/USD remains well-supported, following a clean break above the 0.6600 psychological level that now acts as immediate support.

Holding above this level reinforces the bullish tone and keeps the door open for a retest of this year’s peak at 0.6707, marked on September 17 and standing as the year-to-date high as well as the strongest level since October 2024.

A decisive break above 0.6707 would expose the psychological 0.6800 handle as the next upside target if momentum continues to strengthen.

On the downside, a daily close back below 0.6600 would undermine the short-term bullish bias and expose the next support region at 0.6540-0.6530, where the 21-day and 100-day Simple Moving Averages (SMAs) converge. A deeper pullback could extend toward the 0.6450 area.

Momentum indicators reinforce the constructive tone. The Moving Average Convergence Divergence (MACD) line advances in positive territory, suggesting strengthening bullish momentum. The Relative Strength Index (RSI) is holding around 65, keeping a firm upward bias without entering overbought conditions.

Economic Indicator

RBA Interest Rate Decision

The Reserve Bank of Australia (RBA) announces its interest rate decision at the end of its eight scheduled meetings per year. If the RBA is hawkish about the inflationary outlook of the economy and raises interest rates it is usually bullish for the Australian Dollar (AUD). Likewise, if the RBA has a dovish view on the Australian economy and keeps interest rates unchanged, or cuts them, it is seen as bearish for AUD.

Read more.Next release: Tue Dec 09, 2025 03:30

Frequency: Irregular

Consensus: 3.6%

Previous: 3.6%

Source: Reserve Bank of Australia

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.