USD/CHF limited upside as tariff uncertainty weighs on sentiment

- USD/CHF trades near a critical resistance zone as markets assess ongoing tariff uncertainty and soft US economic data.

- US consumer sentiment weakened in early May, raising concerns about the economic outlook.

- Technical levels suggest upside is capped near 0.8540, with strong support around 0.8320.

The USD/CHF pair is trading higher on Friday, testing a significant resistance zone near 0.8380 as traders digest mixed economic signals from the United States and ongoing global trade tensions. Despite a modest 0.28% gain on the day, the pair's upside remains constrained by broader concerns over US economic resilience and tariff policy uncertainty. The US Dollar Index (DXY), a gauge of the greenback's performance against six major currencies, is trading flat around 100.80, reflecting a cautious market tone.

The US Dollar is finding support as broader risk sentiment remains fragile. However, recent economic data has added to concerns about the US growth outlook. The University of Michigan's preliminary May Consumer Sentiment Index fell to 50.8, down from 52.2 in April, undershooting market expectations and highlighting a decline in household confidence. Inflation expectations have also ticked higher, with the one-year forecast rising to 7.3% from 6.5%, while the five-year outlook increased to 4.6% from 4.4%, suggesting that price pressures are becoming more entrenched.

Adding to this, the April PPI data came in softer than expected, with headline PPI at -0.5% month-over-month, while core PPI also contracted by -0.4%, raising fresh concerns about the pricing power of US businesses. Meanwhile, US President Donald Trump has hinted at a new wave of tariffs to be implemented over the next two to three weeks, further clouding the outlook for global trade and US economic stability.

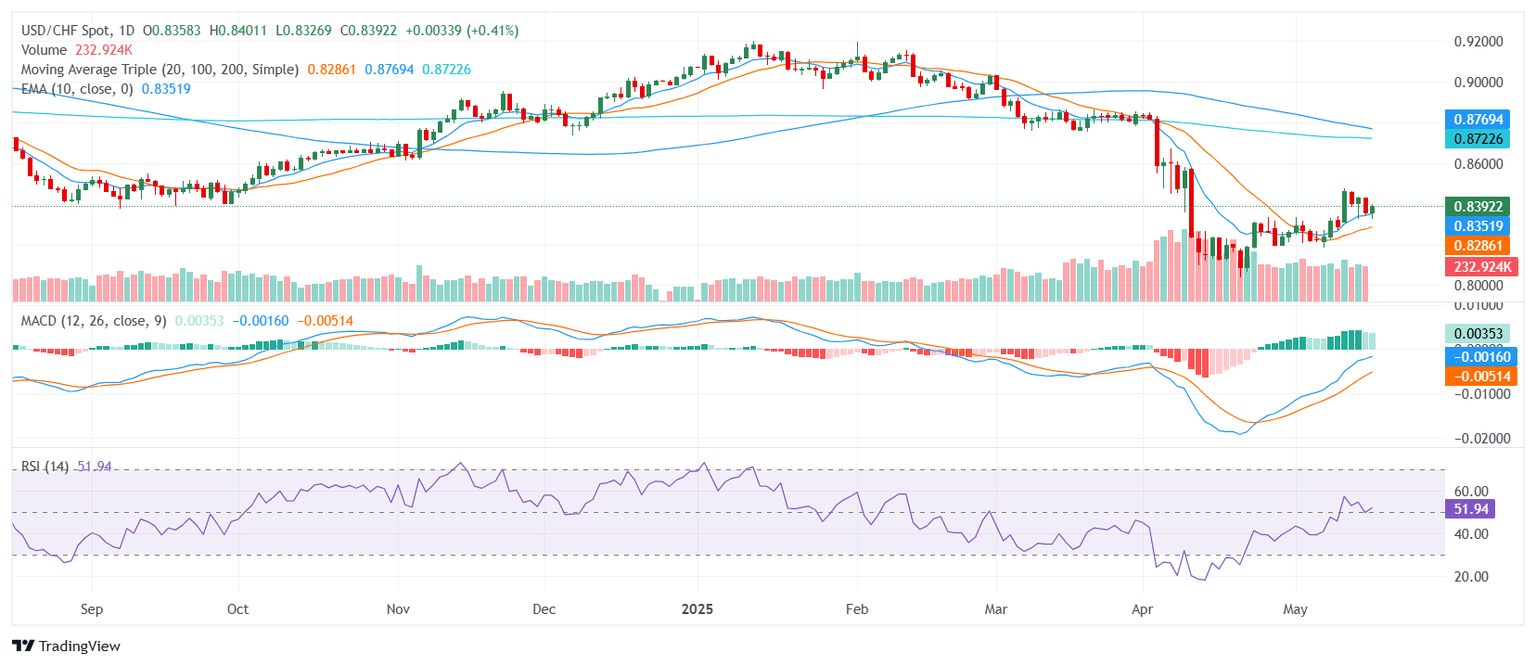

Technical Analysis

From a technical perspective, USD/CHF is facing a critical test at 0.8540, which aligns with the 23.6% Fibonacci retracement of the downtrend from the 2022 peak. This level also marks a significant former support from 2015 that broke earlier this year, reinforcing its importance as a resistance zone. A sustained break above this area would indicate a broader trend reversal, potentially targeting the mid-point of the 2022-2025 decline at 0.8706.

However, failure to clear 0.8540 could trigger a deeper pullback, with immediate support at 0.8320, a key long-term Fibonacci level that previously acted as a structural base in 2015-2016. Further downside targets include 0.8185 and the long-term cycle low near 0.7770.

The Relative Strength Index (RSI) remains subdued, hovering around 37.2 on the weekly chart, indicating that bearish momentum is easing but far from reversing. The pair is also testing its 10-week Simple Moving Average (SMA) near 0.8419, a critical short-term resistance level.

Without a decisive breakout above 0.8540, USD/CHF is likely to remain capped in the near term, with the risk of renewed selling pressure if US data continues to disappoint. The broader technical picture remains bearish, with the pair needing a confirmed monthly close above this level to confirm a trend reversal.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.