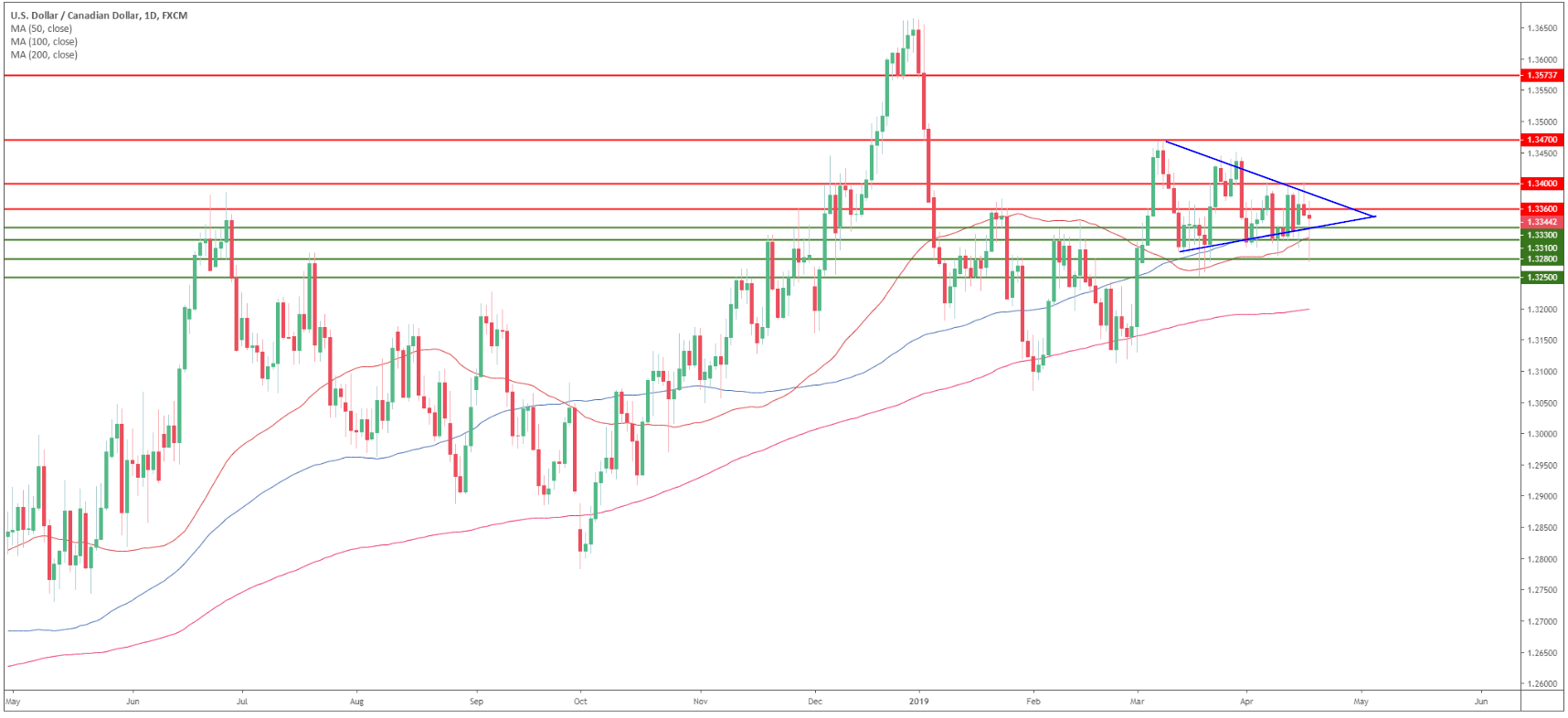

USD/CAD Technical Analysis: Loonie lost in a triangle - 1.3400 key resistance in play

USD/CAD daily chart

- USD/CAD is trading in a bull trend above its 200 simple moving average (SMA).

- The Loonie formed a triangle pattern.

- USD/CAD is finding some resistance below 1.3360 and the 50 SMA.

USD/CAD 30-minute chart

- In the very short-term USD/CAD is seen declining towards 1.3330/10 where the market can potentially find buying interest.

- The 1.3360 and 1.3400 level remain in play for bulls in the coming sessions.

Additional key levels

Author

Flavio Tosti

Independent Analyst