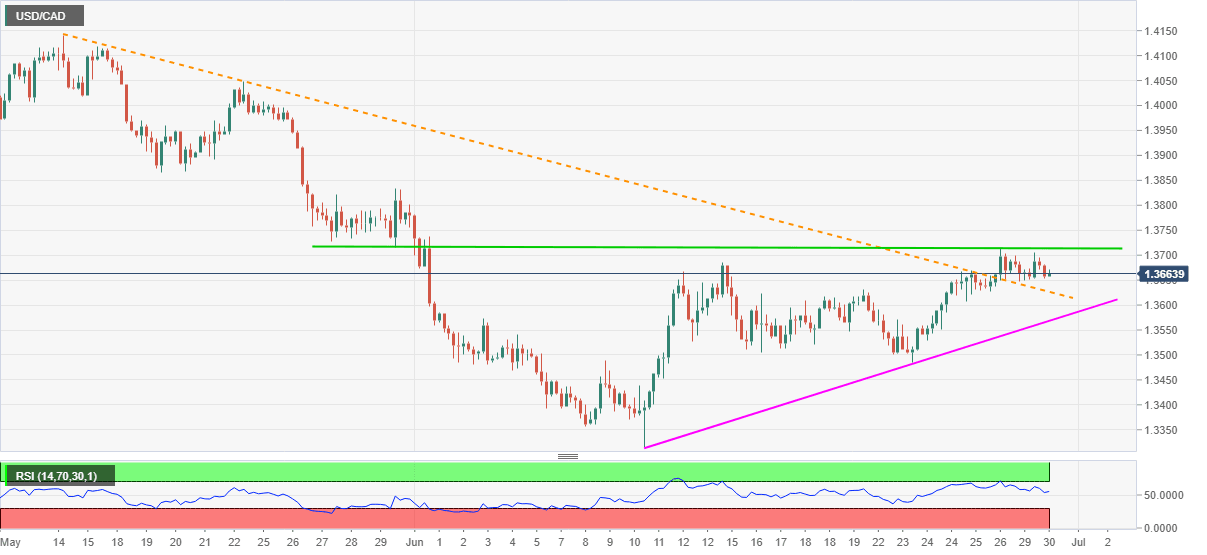

USD/CAD Price Analysis: Resistance-turned-support trendline favors bulls above 1.3600

- USD/CAD stays pressured after failing to keep the bounce off 1.3650.

- A descending trend line from May 10, an upward-sloping line from June 10 question short-term sellers.

- Bulls await a clear break of 1.3715 for fresh entries.

USD/CAD recedes to 1.3660 during Tuesday’s Asian session. Even so, the loonie pair stays above a short-term descending trend line, previous resistance, while also staying above the immediate support line.

As a result, the bulls might again challenge the monthly horizontal resistance around 1.3715 to aim for the late-May top surrounding 1.3830. Though, oversold RSI conditions might confine the pair’s additional upside, if not then May 19 low near 1.3870 could lure the bulls.

Meanwhile, the pair’s declines below the stated resistance-turned-support, at 1.3630 now, could fetch the quote to a short-term support line, currently around 1.3570. If at all the sellers dominate below 1.3570, 1.3500 and June 23 bottom close to 1.3485 can flash on the bears’ radars.

If at all there prevails a further weakness under 1.3485, traders’ odds of refreshing the monthly low of 1.3390 can’t be ruled out.

USD/CAD four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.