USD/CAD Price Analysis: Prepares for a fresh rally above 1.3360 ahead of US CPI and Fed policy

- USD/CAD is gathering strength for a fresh upside move above 1.3360 as the focus shifts to US CPI and Fed policy.

- The US Dollar Index (DXY) has deliberating reached to near 103.70 as investors are divided about Fed’s policy decision.

- USD/CAD has witnessed decent buying interest after testing the demand zone plotted in a narrow range of 1.3300-1.3315.

The USD/CAD pair is gathering strength for a fresh rally around 1.3350 ahead of the release of the United States Consumer Price Index (CPI) and the interest rate decision by the Federal Reserve (Fed). The Loonie asset is expected to remain in the bullish trajectory as anxiety among investors is deepening due to critical economic events.

S&P500 futures have posted decent gains in the Asian session. US equities remained choppy on Friday but managed to settle on a positive note. The overall market sentiment is risk-on, however, mild caution cannot be ruled out.

The US Dollar Index (DXY) has deliberating reached to near 103.70 as investors are divided about Fed’s policy decision. No doubt, United States labor market conditions are easing, the current inflation rate is more than twice the desired rate.

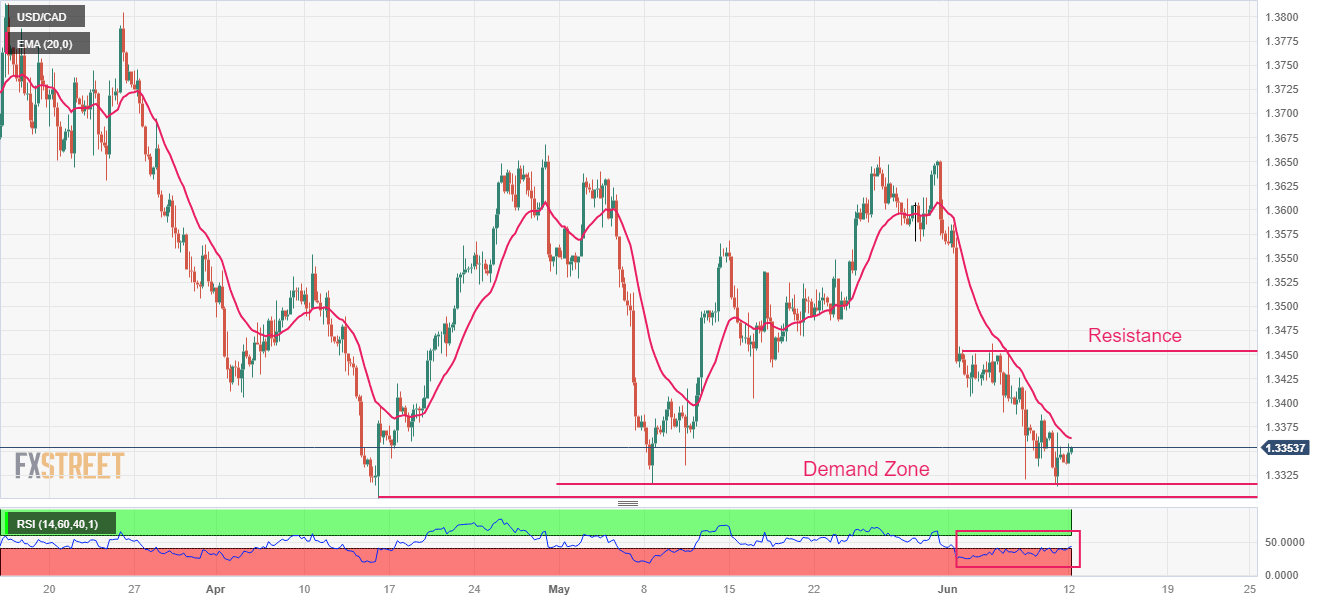

USD/CAD has witnessed decent buying interest after testing the demand zone plotted in a narrow range of 1.3300-1.3315 on a four-hour scale. The 20-period Exponential Moving Average (EMA) at 1.3363 is still acting as a barricade for the US Dollar bulls. Horizontal resistance is plotted around June 05 high at 1.3462.

The Relative Strength Index (RSI) (14) has tried to ditch the bearish range of 20.00-40.00 and enter into the 40.00-60.00 range, indicating an attempt of a bullish reversal.

Should the asset break above June 08 high at 1.3388, US Dollar bulls will drive the asset toward June 05 high at 1.3462 and the psychological resistance at 1.3500.

On the flip side, a breakdown below the round-levels support of 1.3300 will expose the Loonie asset to a fresh four-month low around 1.3274 followed by 15 November 2022 low at 1.3226.

USD/CAD four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.