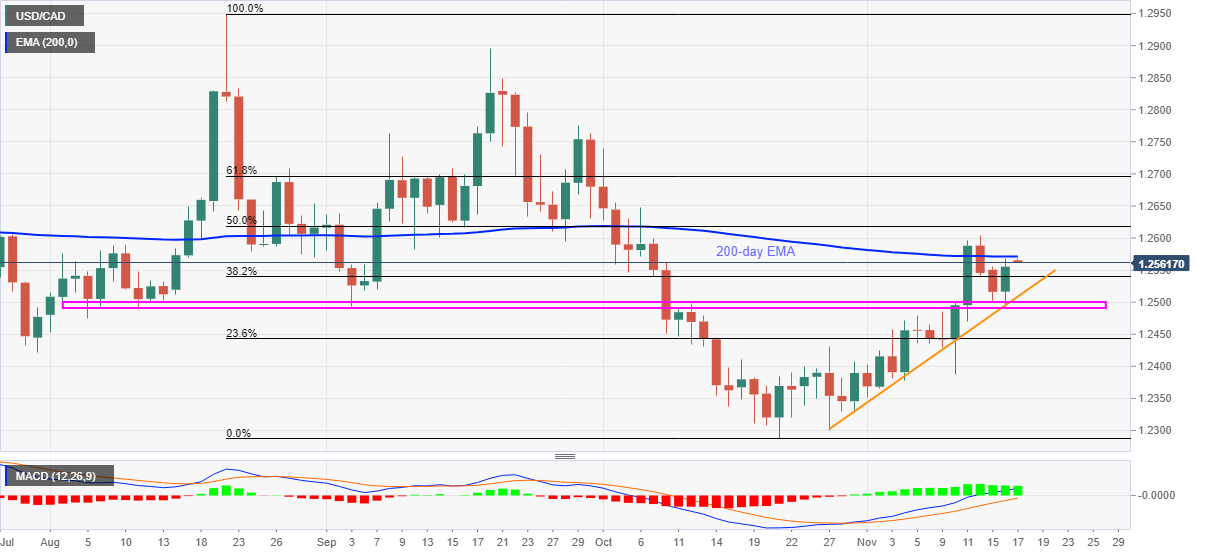

USD/CAD Price Analysis: Bulls again flirt with 200-day EMA around 1.2550

- USD/CAD grinds higher after bouncing off three-week-old support line.

- Bullish MACD, sustained trading beyond horizontal support stretched from August favor buyers.

- Key Fibonacci retracement levels add to the upside filters, bears have a bumpy road beyond 1.2400.

USD/CAD holds onto the bounce off 1.2490-2500 support confluence around the weekly top of 1.2568 during early Wednesday morning in Asia.

The loonie pair’s rebound from an ascending trend line from October 27, as well as a horizontal area from early August, gains support from the bullish MACD signals to keep the buyers hopeful.

That said, a clear upside break of the 200-DMA level near 1.2570 is on the cards to challenge 50% and 61.8% Fibonacci retracement (Fibo.) levels of August-October downside, respectively near 1.2620 and 1.2700.

However, the 1.2765-70 and September’s peak near the 1.2900 threshold will challenge the pair buyers afterward.

Alternatively, a downside break of the 1.2500-2490 support area won’t offer a green pass to the USD/CAD bears as 23.6% Fibo. level of 1.2443 and multiple tops marked during the latest October can keep challenging the downside before the 1.2400 round figure.

In a case where the quote remains weak past 1.2400, the yearly low of 1.2288 will be in focus.

USD/CAD: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.