USD/CAD Price Analysis: Big no to rate cuts in 2023 by Fed backs V-shape recovery above 1.3700

- USD/CAD has reclaimed the previous day’s high around 1.3740 as Fed’s Powell rules out hopes of rate cuts in 2023.

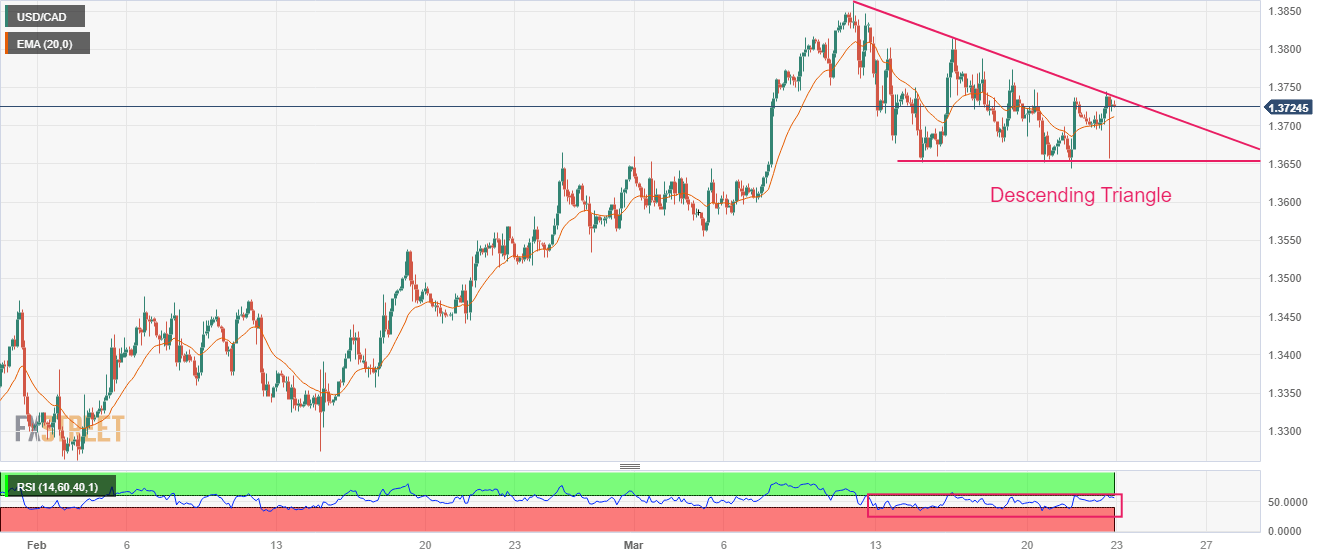

- The Loonie is hovering near the downward-sloping trendline of the Descending Triangle chart pattern.

- Investors should be aware of the fact that responsive selling is expected as the Loonie asset is at make-or-break levels.

The USD/CAD pair has recovered its entire losses and has reclaimed region around Wednesday’s high at 1.3740 in the early Asian session. The Loonie asset witnessed a significant buying interest near 1.3680 as the Federal Reserve (Fed) ruled out hopes of rate cuts in 2023 citing price stability as their utmost priority.

S&P500 futures were heavily dumped by the market participants as a continuation of higher rates by the Fed would bolster the case of a recession in the United States. The continuation of severe policy tightening in times when banking turmoil is promising a cooing demand and credit tightening is assuring a dismal economic outlook.

The US Dollar Index (DXY) has turned sideways below 102.60 after a stellar recovery from 102.00 as the market participants are digesting a whole lot of commentary from Fed chair Jerome Powell.

USD/CAD is hovering near the downward-sloping trendline of the Descending Triangle chart pattern on a two-hour scale, which is plotted from March 10 high at 1.3862. While the horizontal support of the chart pattern is placed from March 14 low around 1.3652.

The Loonie asset has scaled above the 20-period Exponential Moving Averages (EMAs) at 1.3713, which indicates that the short-term trend is bullish.

Investors should be aware of the fact that responsive selling can be kicked in as the Loonie asset is at make-or-break levels.

The Relative Strength Index (RSI) (14) is hovering near 60.00. A break above the same would trigger the upside momentum.

A decisive breakdown of March 14 low at 1.3652 would drag the loonie asset toward March 07 low at 1.3600, followed by March 03 low at 1.3555.

In an alternate scenario, a confident recovery above March 14 high at 1.3773 would drive the major toward March 09 high at 1.3835 and the round-level resistance at 1.3900.

USD/CAD two-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.