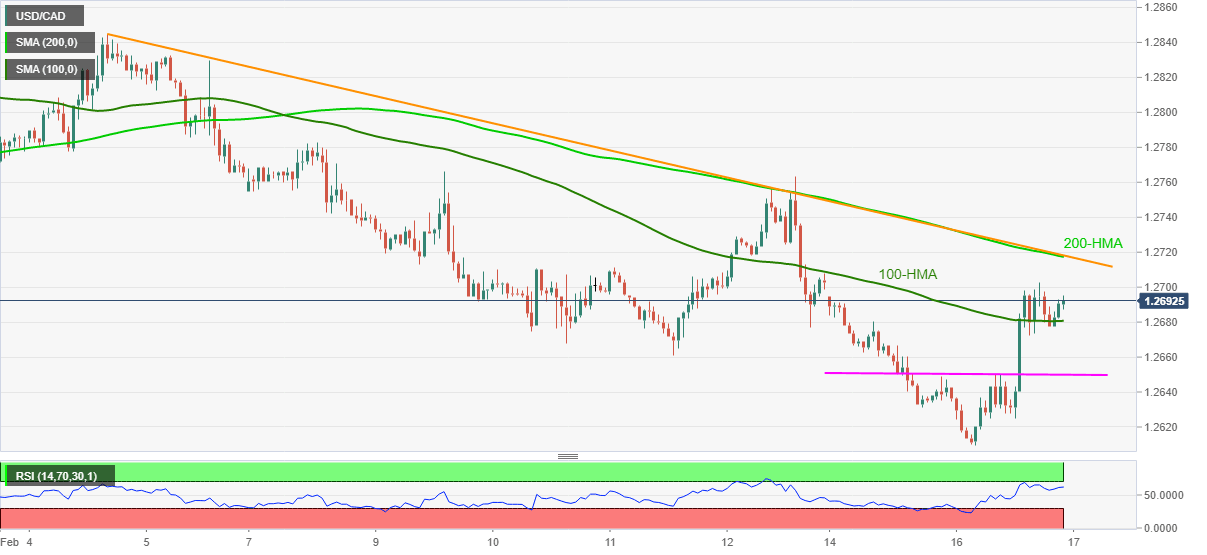

USD/CAD Price Analysis: 200-HMA, two-week-old hurdle probe bulls below 1.2700

- USD/CAD keeps upside break of 100-HMA, attack the immediate range resistance.

- Strong RSI suggests further upside, 1.2720 become the key hurdle.

- Weekly horizontal support restricts the short-term seller’s entry.

USD/CAD picks up bids around 1.2690 while trying to extend the previous day’s upside momentum during the initial Asian session on Wednesday. In doing so, the quote holds above 100-HMA amid the strong RSI conditions.

However, a confluence of 200-HMA and a downward sloping trend line from February 04, currently around 1.2720, question the pair’s further upside. Also acting as the key resistance is Friday’s top near 1.2765.

In a case where the USD/CAD bulls hold controls above 1.2765, the 1.2800 and the monthly top around 1.2845 will be on their radar.

Meanwhile, pullback moves need to break 100-HMA support, at 1.2680 now, before directing the sellers toward the horizontal line near 1.2650.

Should USD/CAD sellers break 1.2650, the price-drop below the monthly low of 1.2609, flashed on Monday, can’t be ruled out.

USD/CAD hourly chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.