USD/CAD: Bulls eye 1.3500 amid US dollar bounce, technical breakout

- USD/CAD catches fresh bids in tandem with the US dollar.

- Weaker WTI also adds to the renewed uptick in the pair.

- Hourly chart signals technical break out, eyes 1.3500.

USD/CAD caught a fresh bid-wave and reached a fresh daily high of 1.3432 in the last hour, tracking the renewed uptick in the US dollar across its main peers. The pullback in the greenback from two-year lows extends on Monday, as investors resorted to profit-taking, with the recent sell-off seen as excessive, in the run-up to the crucial US NFP report.

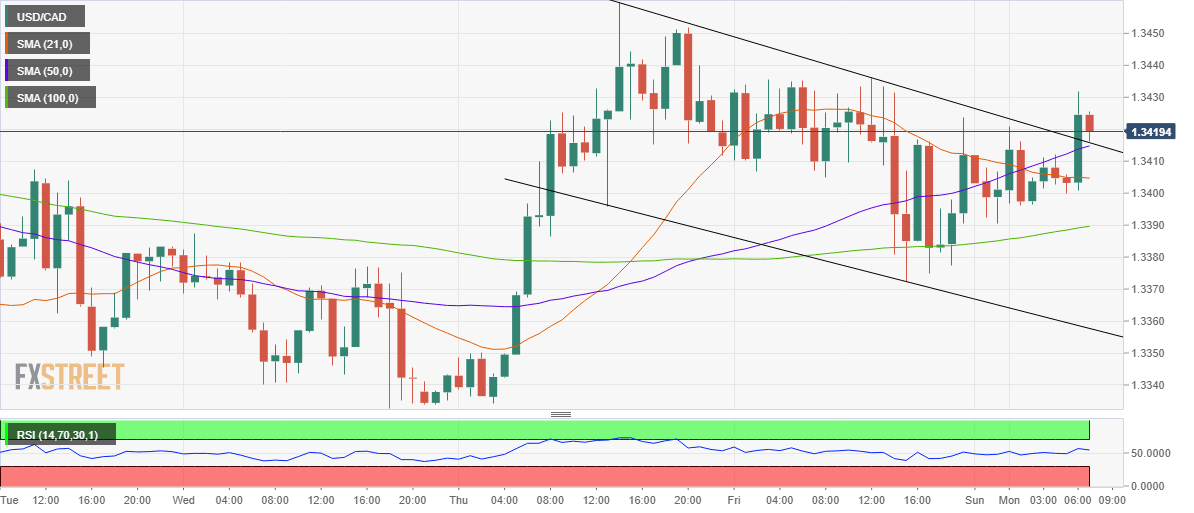

Meanwhile, fresh weakness in the resource-linked CAD, in the wake of a 1% drop in WTI prices, also adds to the gains in the major. Apart from the fundamental catalysts, the USD/CAD spike could be also chart-based, given the falling channel breakout on the hourly chart.

The bullish break exposes the 1.3500 level, as the path of least resistance appears north ahead of the US macro releases. The spot could face stiff resistance around 1.3460 region (intermittent tops) on its way to the pattern target of 1.3505.

To the downside, the pattern resistance-turned-support at 1.3417 will cushion immediate pullbacks. The upward-sloping 50-hourly Simple Moving Average (HMA) also coincides at the level.

Further down, the horizontal 21-HMA at 1.3404 will be the level to beat for the bears.

USD/CAD hourly chart

USD/CAD additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.