US President Biden’s SOTU: Announcing a ban on Russian flights from using US airspace

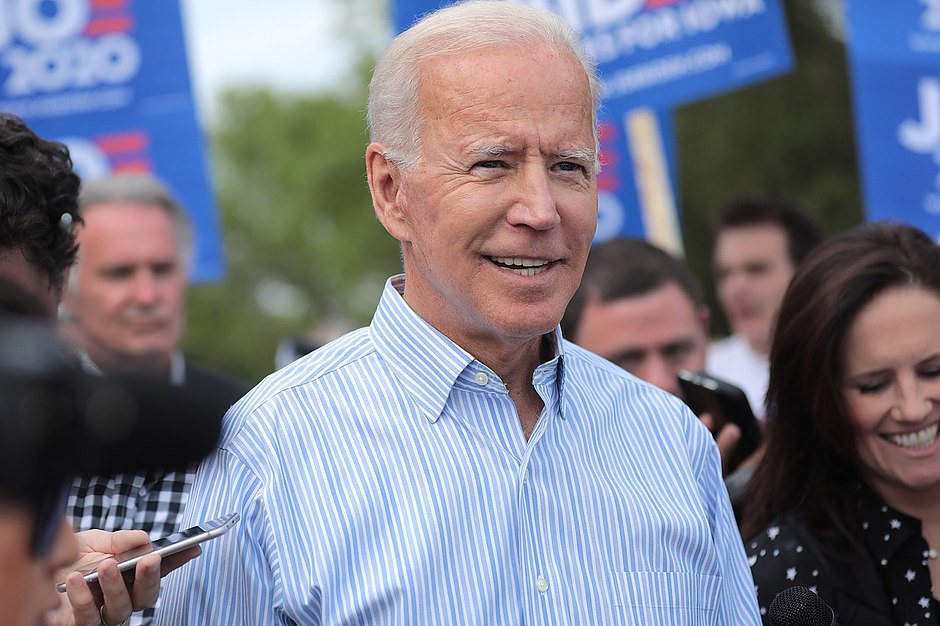

US President Joe Biden is delivering his first State of the Union address before a joint session of the 117th Congress in the chamber of the House of Representatives at the Capitol on Wednesday.

US President Biden’s State of the Union speech – Live stream

Key takeaways

Confirms US banning Russian flights from using US airspace.

We are choking off Russia's access to technology that will sap its economic strength and weaken its military for years to come.

Putin is now isolated from the world more than he has ever been.

We are cutting off Russia’s largest banks from the international financial system.

Preventing Russia’s central bank from defending the Russian ruble, making Putin’s $630 Billion `war fund` worthless."

Getting prices under control is his highest priority.

The US in coordination with the allies will release 60 billion barrels of oil from reserves.

We stand ready to do more if necessary. United with our allies. These steps will help blunt gas prices here at home.

To compete for jobs of the future, we also need a level playing field with China and other competitors.

That’s why it is so important to pass the Bipartisan Innovation Act sitting in Congress that will make record investments in emerging technologies and American manufacturing"

INTC is ready to increase its US manufacturing investment from $20 billion to $100 billion if Congress passes the American Innovation Act (that has a lot of $$ incentives for companies).

Related reads

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.