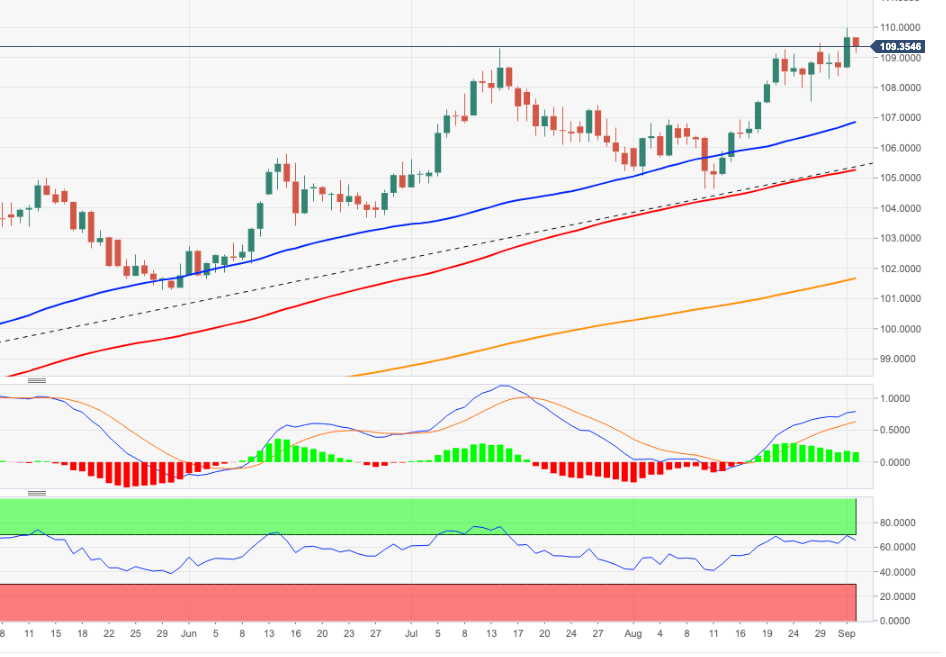

US Dollar Index Price Analysis: Short-term top around 110.00?

- DXY corrects lower after hitting 20-year tops around 110.00.

- Occasional weakness in the dollar could be a buying opportunity.

DXY gives away part of Thursday’s strong advance to new cycle highs just below the 110.00 mark.

The short-term bullish view in the dollar remains well in place for the time being and propped up by the 7-month support line, today around 105.65. The surpass of recent peaks, however, could face the next barrier at the weekly highs at 111.90 (June 6 2002) and 113.35 (May 24 2002).

Looking at the long-term scenario, the bullish view in the dollar remains in place while above the 200-day SMA at 100.99

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.