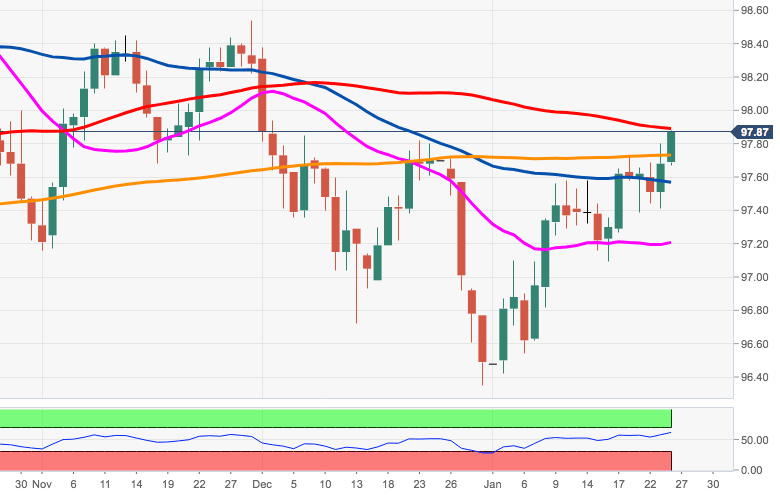

US Dollar Index Price Analysis: Looks firmer and now targets 98.00 and beyond

- DXY has left behind the 200-day SMA and keeps pushing higher.

- The outlook on the dollar has now shifted to constructive.

DXY is now testing the key 97.90 region, where coincide the 100-day SMA and a Fibo retracement of the 2017-2018 decline.

The index has managed to surpass the 200-day SMA and is now expected to prolong the upside to the 98.00 neighbourhood.

Further north emerges November’s high at 98.54.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.