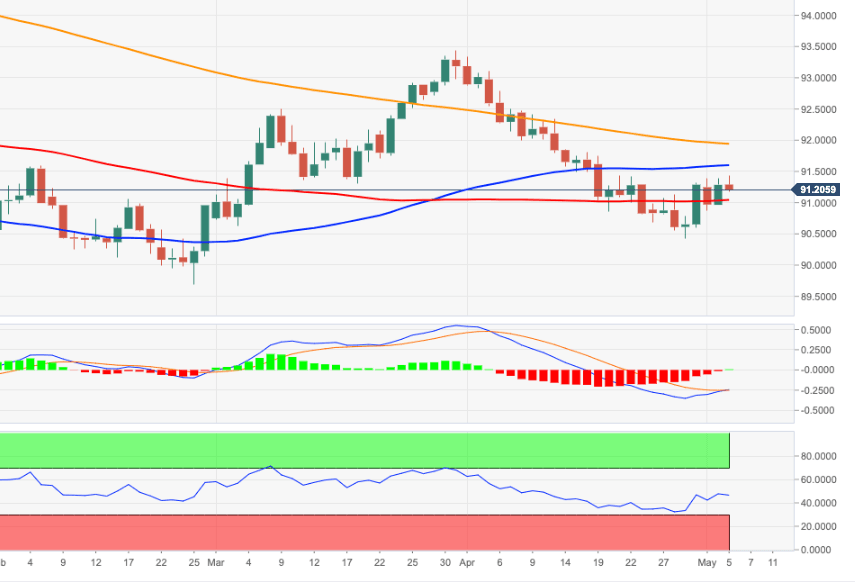

US Dollar Index Price Analysis: Downside pressure alleviated above 91.94

- DXY meets initial hurdle near the 91.50 level on Wednesday.

- There is an interim hurdle at the 50-day SMA near 91.75.

The bullish attempt in DXY seems to have met some decent hurdle around the 91.50 region this month so far.

Further recovery should not be ruled out in the near-term, with the interim resistance at the 50-day SMA near 91.75. If cleared, then a move to the more relevant 200-day SMA (91.94) could emerge on the horizon.

Above the latter the downside pressure is expected to mitigate somewhat, and the outlook could start shifting to a more constructive one.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.