US Dollar Index Price Analysis: Another drop to 105.00 appears likely

- DXY comes under further downside pressure near 106.00.

- Extra weakness could see the 105.00 zone retested near term.

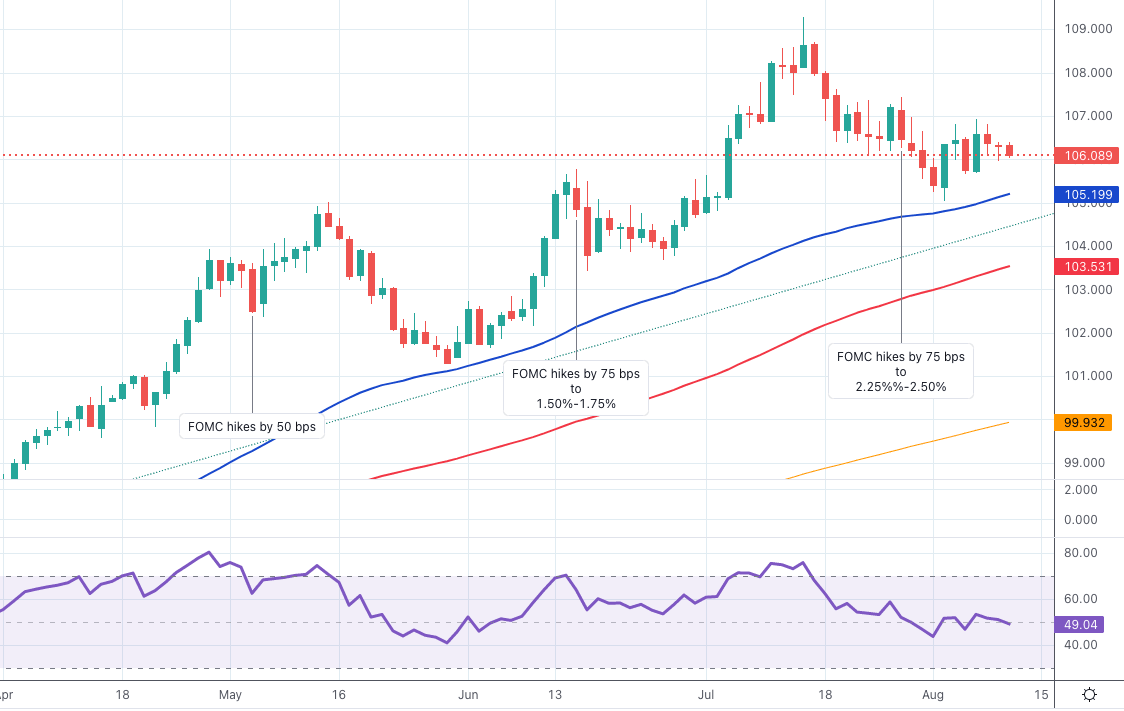

DXY retreats for the third session in a row and challenges once gain the 106.00 neighbourhood ahead of the release of US inflation figures.

If the selling bias picks up extra pace, the dollar risks a deeper pullback to, initially, the August low near 105.00 (August 2). This area of initial contention appears reinforced by the 55-day SMA, today at 105.19.

The short-term constructive stance is expected to remain supported by the 6-month support line, today near 104.50.

Furthermore, the broader bullish view in the dollar remains in place while above the 200-day SMA at 99.93.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.