US dollar embarking on a highly bullish weekly close

- USD on the move and breaking critical monthly resistances.

- All eyes on the Fed and covid as well as the US economic growth divergence.

The US dollar has been moving higher of late, scoring through a critical level of resistance and so far doing so convincingly.

It was net unchanged against fellow haven Japanese yen, but otherwise strong against the G10, CAD and AUD weakest.

This depicts the market sentiment of late and the divergence between the global central banks.

This is something that is explained in more detail here:

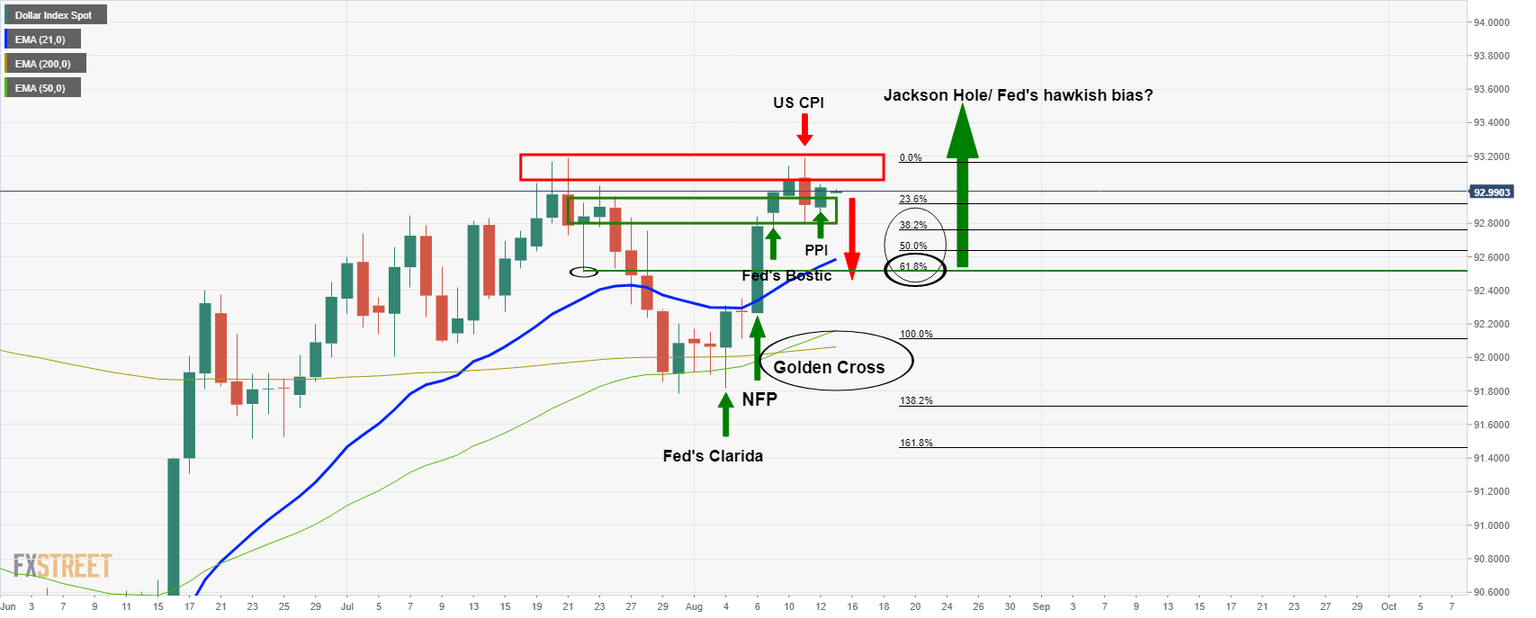

US dollar teases reversal traders, Golden Cross underpins

The DXY has been tracked for a number of articles that forecasted a break of the critical support mear 93.50.

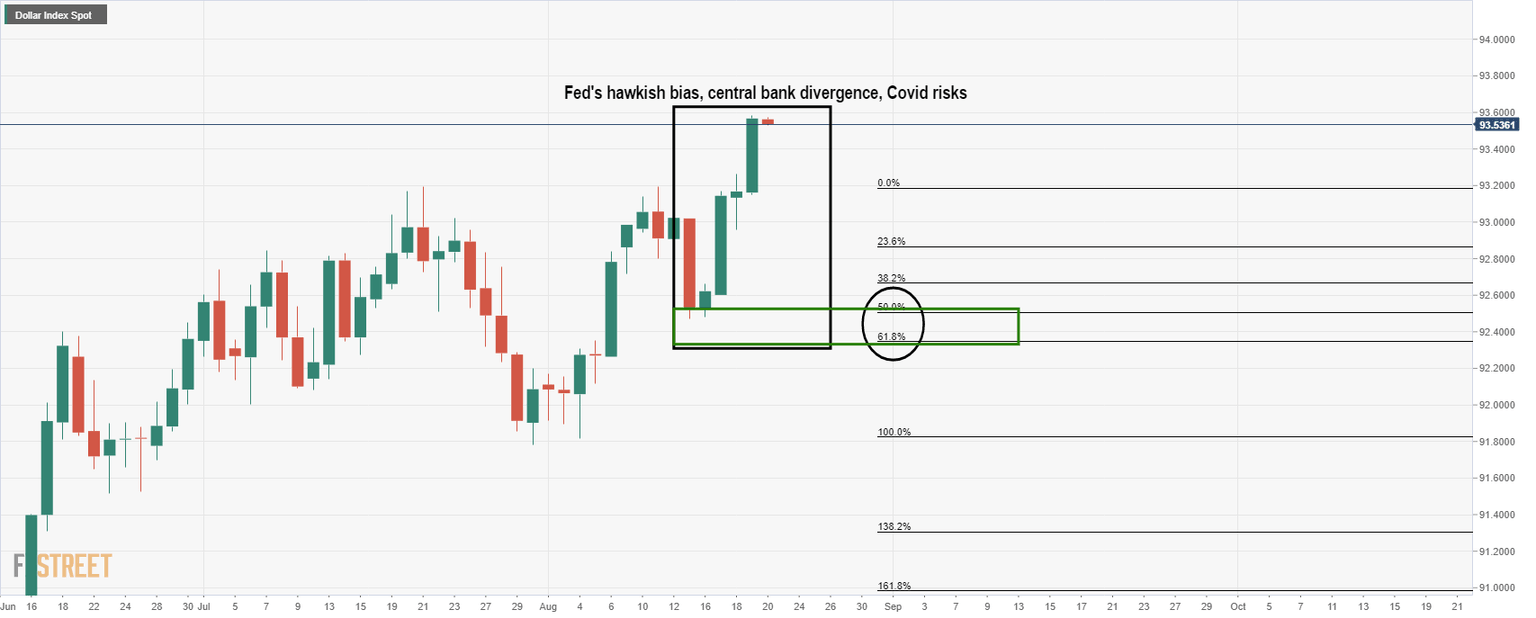

Prior analysis, projected path for DXY

''The above chart illustrates the series of fundamental events that have led to the recent Golden Cross on the daily time frame.''

As illustrated, the price had been building up for a correction and to then move back in the direction of the bullish and dominant trend.

Live market analysis

The price moved in the forecasted trajectory, if not a little prematurely considering the US dollar has made its move with the market second-guessing the outcome of the Jackson Hole.

The price is now taking on a critical resistance area on the longer-term charts:

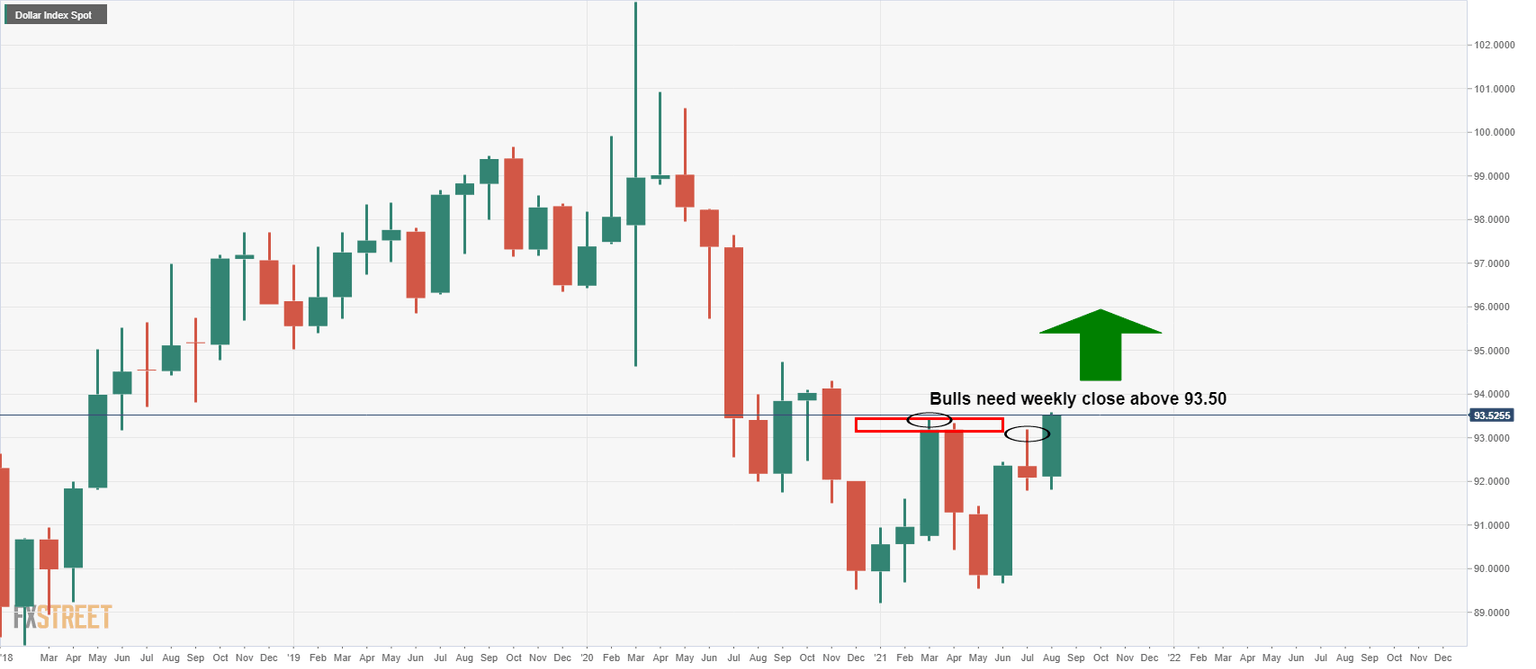

This is a monthly chart that shows the break of monthly highs of 93.43.

Bulls will want to see the price hold above here for a weekly close in the 93.50s. In doing so, it will embolden dollar bulls for the foreseeable future in the countdown to the Fed's tapering.

USD smile theory firmly in play

The US dollar smile theory continues to play out to the point that it has broken technical structure and resistance confluences on the longer-term charts.

These were the 10 and 20 EMA bullish cross-over, as well as the 200, smoothed simple moving average.

This has confirmed the monthly double bottom as well as the cup and handle:

''US data are feeding into increased dollar bullishness and the Fed continues to take tentative steps towards tapering. On the other hand, risk-off and uncertainty pertaining to the global pandemic are also expected to support the US dollar recently.

Therefore, the greenback is likely to benefit in either situation. Hence, the ''dollar smile'' as the dollar turns up at both ends of the risk spectrum,'' analysts at Brown Brothers Harriman explained.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.