United Kingdom FX Today: GBP holds firm before critical GDP report

The British Pound (GBP) is trending flat against the US Dollar (USD) on Thursday, trading at 1.3535 despite a spike in volatility following the release of US inflation data.

Traders are now turning their attention to the release of UK Gross Domestic Product (GDP) data for July, due on Friday at 06:00 GMT.

GDP is expected to shed new light on the country's economic dynamics and could mark a turning point in the market's perception of the Bank of England's (BoE) monetary policy and the economic program of UK Prime Minister Sir Keir Starmer's government.

The analyst consensus is for monthly growth to stagnate after an unexpected 0.4% rebound in June.

The GBP's evolution on the Forex market will depend heavily on the macroeconomic signal sent by this reading.

Macroeconomic factors influencing the GBP

The UK's economic growth has been in the spotlight for several quarters now. After a respectable second-quarter performance of 0.3%, albeit slowing from 0.7% in the first quarter, forecasts for July remain modest.

As Chris Williamson, Chief Economist at S&P Global, points out, "It would be optimistic to expect a further monthly jump in GDP after the June surprise", but recent Purchasing Managers Index (PMI) releases still point to growth at its highest level for a year.

James Smith, economist at ING, notes that "second-quarter growth was helped by anticipation of US tariffs and tax changes. These effects will not last.”

Friday's GDP figures, therefore, look crucial, especially as the British economy seems to be caught in a "low-growth trap", according to the British Chambers of Commerce (BCC).

Indeed, growth prospects for 2025 have been revised upward to 1.3% from 1.1% but remain anemic. Business investment, already burdened by increases in social security contributions, has been revised down to 1.6% in 2025 from 4.8% previously, and export prospects are held back by persistent trade tensions, notably with the United States and the European Union.

Against this backdrop, the Bank of England lowered a key interest rate to 4% in August, but with only two further cuts planned between now and the end of 2026.

This position is justified by ongoing inflationary pressure with the Consumer Price Index (CPI) expected to peak at 3.7% this year, according to the BCC, before slowing down again. This monetary prudence could, however, strengthen the Pound if GDP figures prove solid.

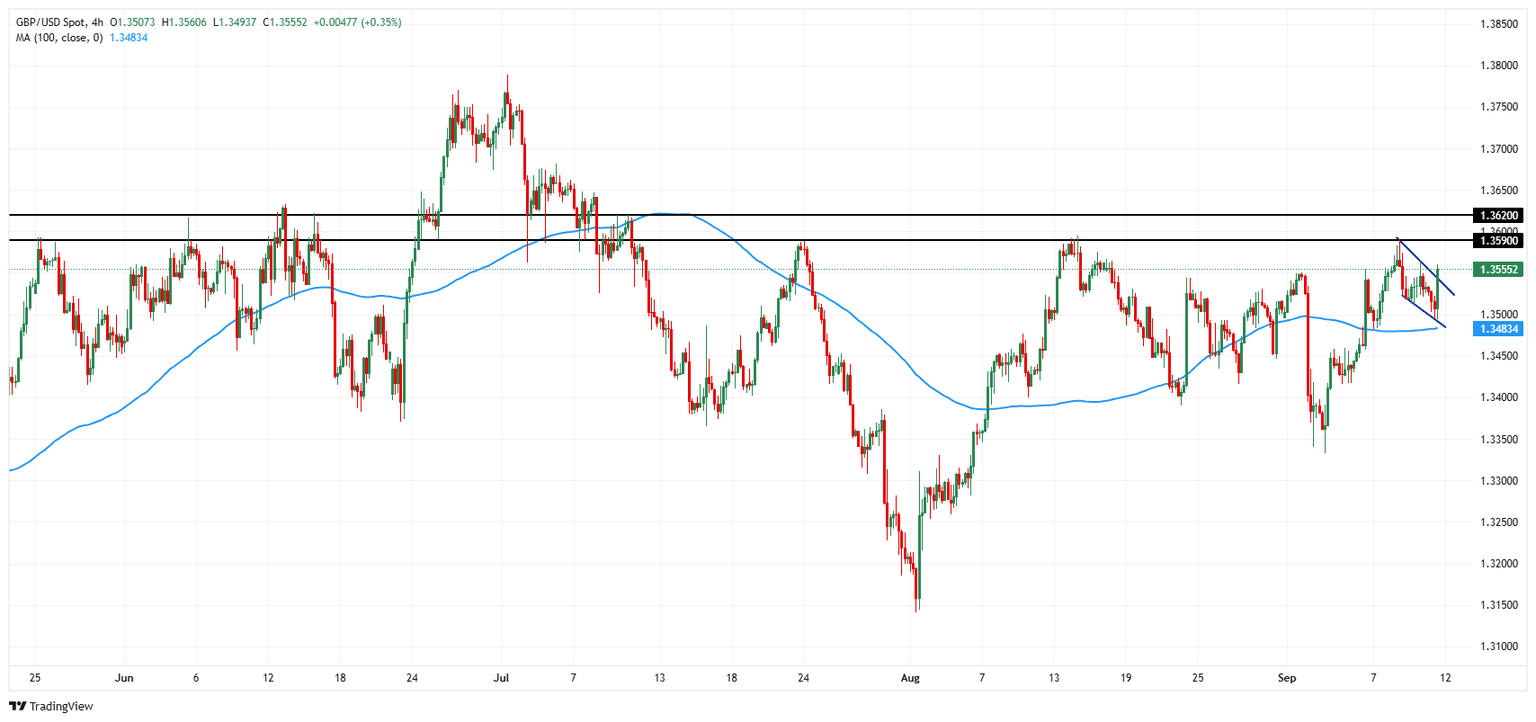

Technical analysis of GBP/USD: Rebound to be confirmed

GBP/USD 4-hour chart. Source FXStreet

The GBP/USD pair rebounded on Thursday, supported by US Dollar weakness following the release of inflation data.

The bullish impulse thus broke out of the flag, a chartist configuration suggesting further upside in the short term.

However, the Cable is not far from an important resistance around 1.3590, a level which has blocked any bullish attempt since July. A break of this level is, therefore, necessary before any upward acceleration can be envisaged.

On the downside, a reintegration of the flag below 1.3540 could encourage a stronger pullback toward the flag's lower boundary at 1.3500 and the 100 Simple Moving Average (SMA) on the 4-hour chart, currently at 1.3484.

Pound Sterling Price Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.34% | -0.12% | 0.10% | -0.01% | -0.16% | -0.17% | -0.27% | |

| EUR | 0.34% | 0.20% | 0.31% | 0.33% | 0.15% | 0.20% | 0.02% | |

| GBP | 0.12% | -0.20% | 0.10% | 0.11% | -0.11% | 0.00% | -0.17% | |

| JPY | -0.10% | -0.31% | -0.10% | -0.04% | -0.22% | -0.12% | -0.29% | |

| CAD | 0.00% | -0.33% | -0.11% | 0.04% | -0.28% | -0.14% | -0.26% | |

| AUD | 0.16% | -0.15% | 0.11% | 0.22% | 0.28% | 0.05% | -0.09% | |

| NZD | 0.17% | -0.20% | -0.00% | 0.12% | 0.14% | -0.05% | -0.19% | |

| CHF | 0.27% | -0.02% | 0.17% | 0.29% | 0.26% | 0.09% | 0.19% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Ghiles Guezout

FXStreet

Ghiles Guezout is a Market Analyst with a strong background in stock market investments, trading, and cryptocurrencies. He combines fundamental and technical analysis skills to identify market opportunities.