Pound Sterling gains as BoE cuts interest rates to 4% with narrow majority

- The Pound Sterling gains as the BoE cuts interest rates by 25 bps to 4%, with a 5-4 vote split.

- BoE Taylor supported a larger-than-usual interest rate reduction of 50 basis points.

- More Fed officials support interest rate cuts this year amid growing labor market concerns.

The Pound Sterling (GBP) attracts significant bids against its major peers on Thursday after the Bank of England (BoE) reduces interest rates by 25 basis points (bps) to 4%, with a 5-4 majority. This is the fifth interest rate cut by the BoE since August 2024, when it started the monetary-expansion cycle.

Economists had projected that only two members of the Monetary Policy Committee (MPC) would support leaving interest rates at their current levels. BoE members: Megan Greene, Catherine Mann, Clare Lombardelli, and Chief Economist Huw Pill favored holding interest rates at 4.25%, while Alan Taylor voted for a bigger reduction in borrowing rates by 50 bps.

Meanwhile, the BoE has maintained a “gradual and careful” monetary easing guidance. Governor Andrew Bailey said in the monetary policy statement that "interest is still on a downward path, and any future rate cuts will need to be made gradually and carefully".

Traders were certain about the BoE reducing interest rates due to cooling labor market conditions. Employment demand has softened as business owners are cutting the labor force to offset the impact of an increase in employers’ contributions to social security schemes. In the last Autumn Statement, Chancellor of the Exchequer Rachel Reeves announced an increase in employers’ contribution to National Insurance (NI) to 15%.

The BoE has raised the Gross Domestic Product (GDP) forecast for the current year to 1.25% from 1% projected in May. Also, one-year forward Consumer Price Index (CPI) projections have also accelerated to 2.7% from 2.4%.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.02% | -0.51% | 0.03% | -0.06% | -0.32% | -0.32% | 0.07% | |

| EUR | -0.02% | -0.53% | 0.00% | -0.11% | -0.35% | -0.39% | 0.04% | |

| GBP | 0.51% | 0.53% | 0.55% | 0.46% | 0.21% | 0.14% | 0.60% | |

| JPY | -0.03% | 0.00% | -0.55% | -0.09% | -0.31% | -0.39% | 0.10% | |

| CAD | 0.06% | 0.11% | -0.46% | 0.09% | -0.25% | -0.31% | 0.17% | |

| AUD | 0.32% | 0.35% | -0.21% | 0.31% | 0.25% | -0.05% | 0.41% | |

| NZD | 0.32% | 0.39% | -0.14% | 0.39% | 0.31% | 0.05% | 0.47% | |

| CHF | -0.07% | -0.04% | -0.60% | -0.10% | -0.17% | -0.41% | -0.47% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily digest market movers: Pound Sterling extends its upside US Dollar

- The Pound Sterling advances to near 1.3430 against the US Dollar (USD) during the European trading session on Thursday. The GBP/USD pair strengthens as the US Dollar demonstrates weakness, following dovish interest rate guidance from a string of Federal Reserve (Fed) officials.

- At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, holds onto Wednesday’s losses around 98.20.

- On Wednesday, Minneapolis Fed President Neel Kashkari, San Francisco Fed President Mary Daly, and Fed Governor Lisa Cook argued in favor of reducing interest rates, citing concerns over the labor market and the economy.

- “The economy is slowing and the Fed needs to respond to the slowing economy,” Kashkari said in an interview with CNBC. “It may still be relevant in the near term to begin adjusting the policy rate, and two rate cuts this year still seem appropriate,” Kashkari added. When asked about whether interest rate cuts are appropriate at a time when the impact of tariffs has started flowing into the economy, Kashkari said: “If inflation does rise because of tariffs, the Fed could pause or even hike; meanwhile, the data on slowing is clear.”

- Fed officials have become worried about labor market conditions since the release of the United States (US) Nonfarm Payrolls (NFP) report for July, which showed employment numbers missed estimates by a wide margin, and figures for May and June were downwardly revised drastically.

- According to the CME FedWatch tool, traders have almost fully priced in a 25 bp interest rate reduction in September, which would push borrowing rates lower to 4.00%-4.25%.

- On the global front, sectoral tariff fears have resurfaced as US President Trump has announced a 100% additional duty on all imports of semiconductors.

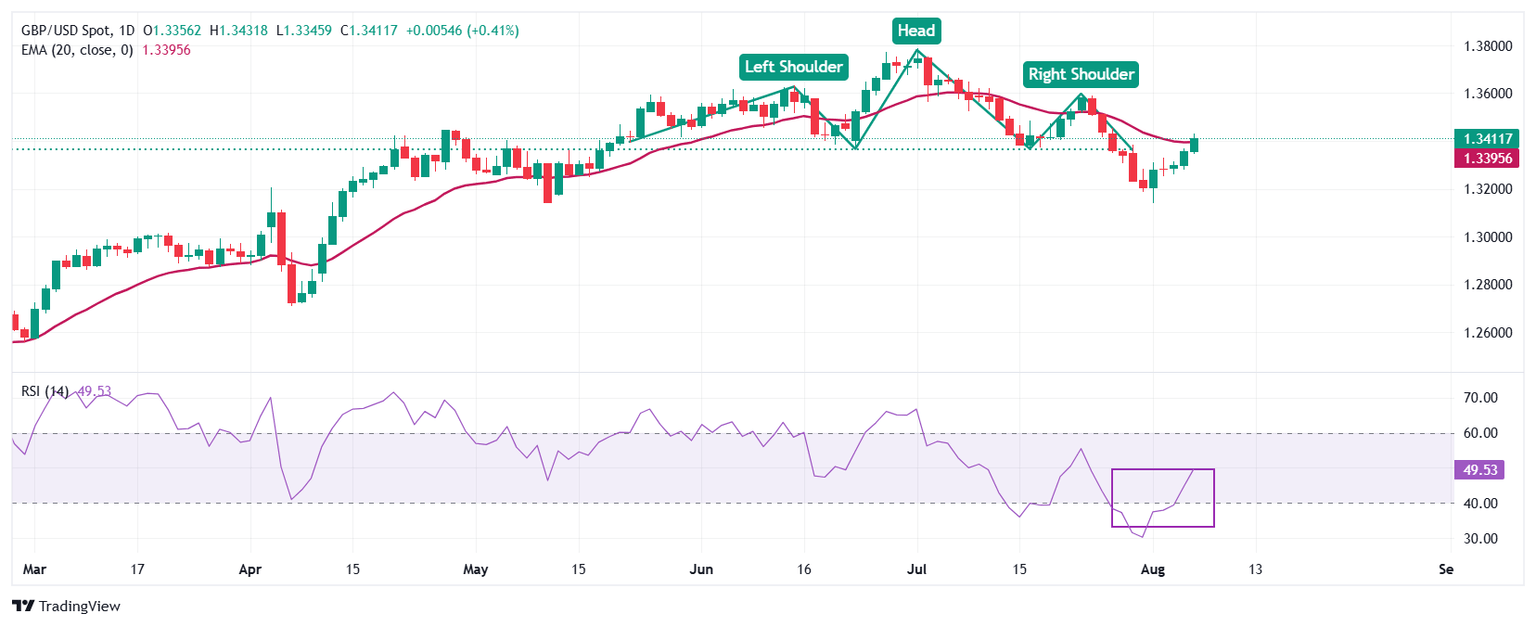

Technical Analysis: Pound Sterling reclaims 20-day EMA

The Pound Sterling extends its winning streak and jumps to near 1.3430 against the US Dollar on Thursday. The GBP/USD pair rises above the breakdown zone of the Head and Shoulders (H&S) chart pattern, which is around 1.3376. The Cable returns above the 20-day Exponential Moving Average (EMA), which trades around 1.3390.

The 14-day Relative Strength Index (RSI) returns to the 40.00-60.00 region from the 20.00-40.00 range, suggesting that the bearish momentum has come to an end for now. However, the bearish bias is still intact.

Looking down, the May 12 low of 1.3140 will act as a key support zone. On the upside, the July 23 high near 1.3585 will act as a key barrier.

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.