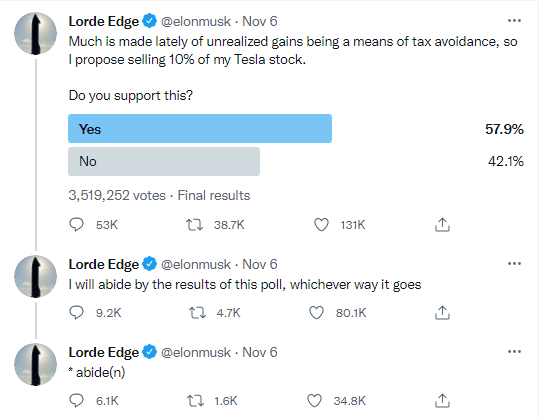

TSLA Stock Price and Forecast: Is Elon Musk going to sell Tesla stock?

- Tesla (TSLA) stock collapses premarket as Elon Musk tweets about selling 10% of his holding.

- TSLA shares have been surging, breaking records.

- Just as everyone is long, are they are about to be wrong?

Elon Musk is a copywriter's dream CEO – always controversial, always interesting and always going off-script. He has had a few run-ins with regulators for his commentary over the years and this latest one is not exactly going to endear him to those conservative regulators, or those long his stock for that matter. He is the ultimate long! Tesla shares had been charging along nicely last week, setting record after record, as options volume surged and retail loaded up on calls. The stock broke $1,000 and surged onwards and upwards, soon putting $1,200 in its rearview mirror as the frenzy continued.

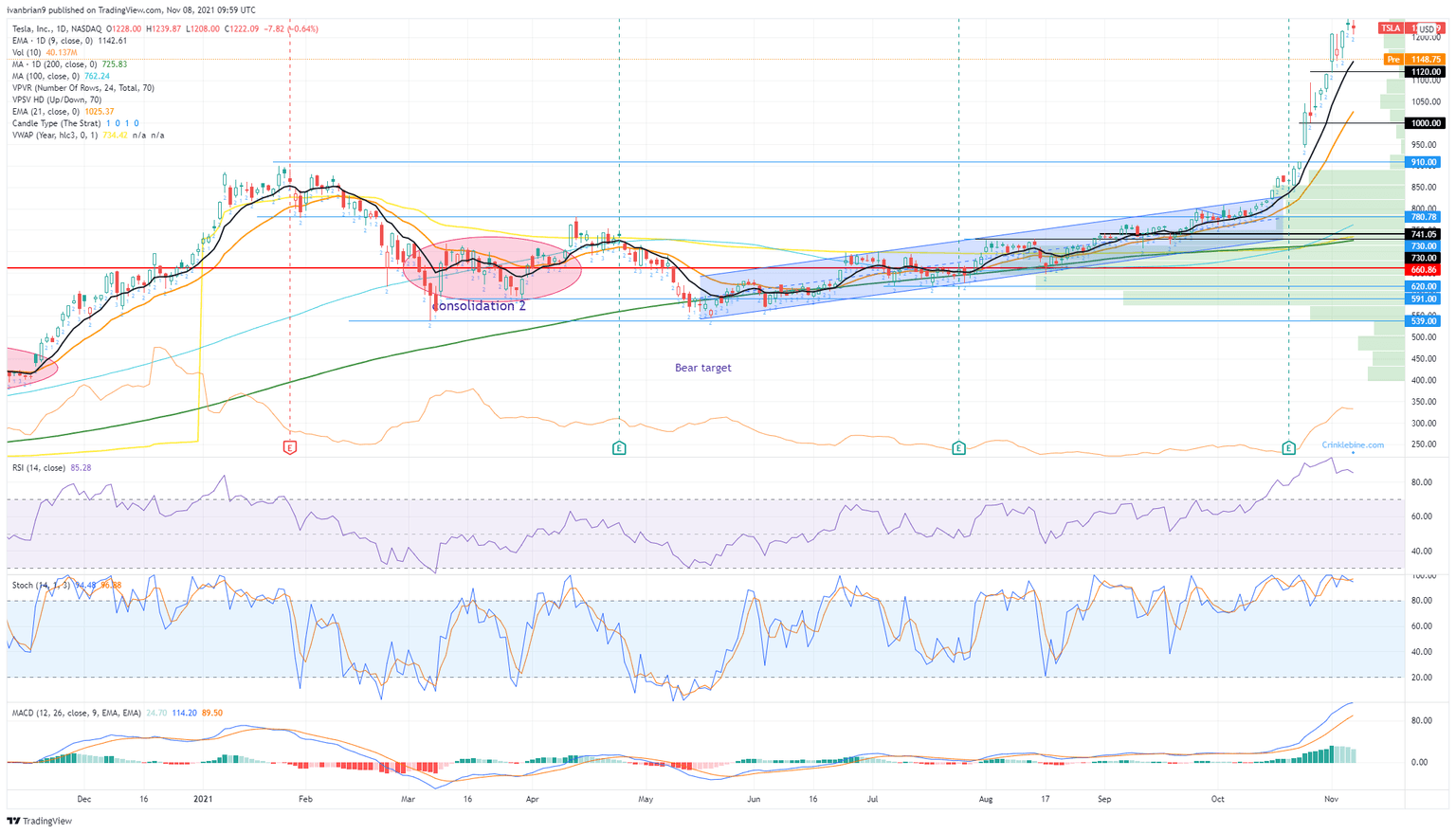

Tesla graph, 15-minute

Tesla (TSLA) stock news

Just in case you missed it, we present this tweet from Elon Musk on Friday night. And, yes, it is apparently from his own verified account.

Of course, there is no in-depth detail on how and why Elon Musk might sell the shares. Will it be this week, next week, next year, etc.? Either way, Daniel Ives of Wedbush Securities was not too worried, telling Bloomberg, “Selling 10% is probably going to add 1.5% to 2% to the float, so it doesn’t really significantly move the needle.”

After such a surge in the share price, it would make sense to take something off the table. Face it, if it was you or me, we would certainly be cashing something in to buy a few jets, a house in the Caribbean, a tungsten cube or whatever. But in all seriousness, this has affected the share price and in the wrong way too. TSLA shares are down a pretty hefty 6% in Monday's premarket.

Tesla (TSLA) stock forecast

Tesla stock was probably gearing up for a retracement after such a strong move anyway, and now Elon has set that in place. TSLA is trading at $1,154 in the premakret at the time of writing, a loss of 5.5%. Key short-term support is at $1,120 as we have highlighted on the Tesla chart below. This is where the second stage of the surge took off from. Breaking here puts the next breakout level at $1,000 as the target and support.

After that there is a gap to fill down to $910, and we all know by now how the market loves to fill gaps. Options buying will also be significantly reduced as most calls that were purchased were from last Friday's expiry. Market makers who have been caught long the gamma hedge will be unloading, so this could get ugly pretty quickly. Expect a move to test $1,000 this week in our opinion. The RSI remains massively overbought, the stochastics have just crossed over (giving a sell signal), but for now the MACD remains in long territory. It is very stretched though as we can see from the histogram bars.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637719616698586210.png&w=1536&q=95)