Trump imposes additional 25% tariffs on Canada

United States (US) President Donald Trump revealed on his Truth Social account that he is imposing an additional 25% tariff, to 50% on aluminum and steel imports from Canada to the US. He added it would go into effect on March 12 morning.

Trump’s condition for removing tariffs is that Canada drops farm tariffs of 250% to 390% on various US dairy products, as shown in his post. He added that he would declare a national emergency on electricity in New York, Michigan, and Minnesota after Ontario’s premier imposed 25% tariffs on electricity.

Moreover, he threatens to apply duties on cars on April 2.

Market’s reaction

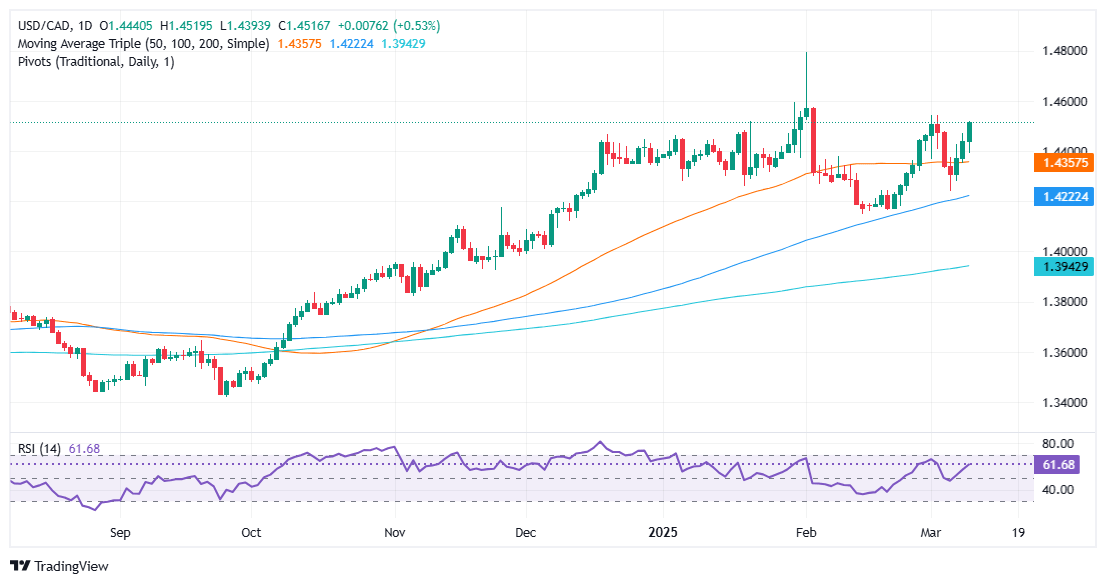

The USD/CAD rallied from 1.4410 to 1.4477 before clearing the 1.4500 psychological figure, with buyers eyeing March’s peak at 1.4542.

Canadian Dollar PRICE Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.77% | -0.43% | 0.03% | 0.55% | 0.12% | 0.01% | -0.20% | |

| EUR | 0.77% | 0.36% | 0.84% | 1.33% | 0.90% | 0.79% | 0.59% | |

| GBP | 0.43% | -0.36% | 0.61% | 0.97% | 0.55% | 0.43% | 0.24% | |

| JPY | -0.03% | -0.84% | -0.61% | 0.49% | 0.06% | -0.06% | -0.24% | |

| CAD | -0.55% | -1.33% | -0.97% | -0.49% | -0.42% | -0.54% | -0.73% | |

| AUD | -0.12% | -0.90% | -0.55% | -0.06% | 0.42% | -0.10% | -0.30% | |

| NZD | -0.01% | -0.79% | -0.43% | 0.06% | 0.54% | 0.10% | -0.19% | |

| CHF | 0.20% | -0.59% | -0.24% | 0.24% | 0.73% | 0.30% | 0.19% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.