Tesla Stock Price and Forecast: TSLA up 2% on technical call and Jefferies upgrade

- Tesla stock pops just over 2% on Monday to close above $700.

- TSLA still holding short-term bullish momentum as retakes 9-day MA.

- Electric vehicle sector leader still looks bullish once $697 held.

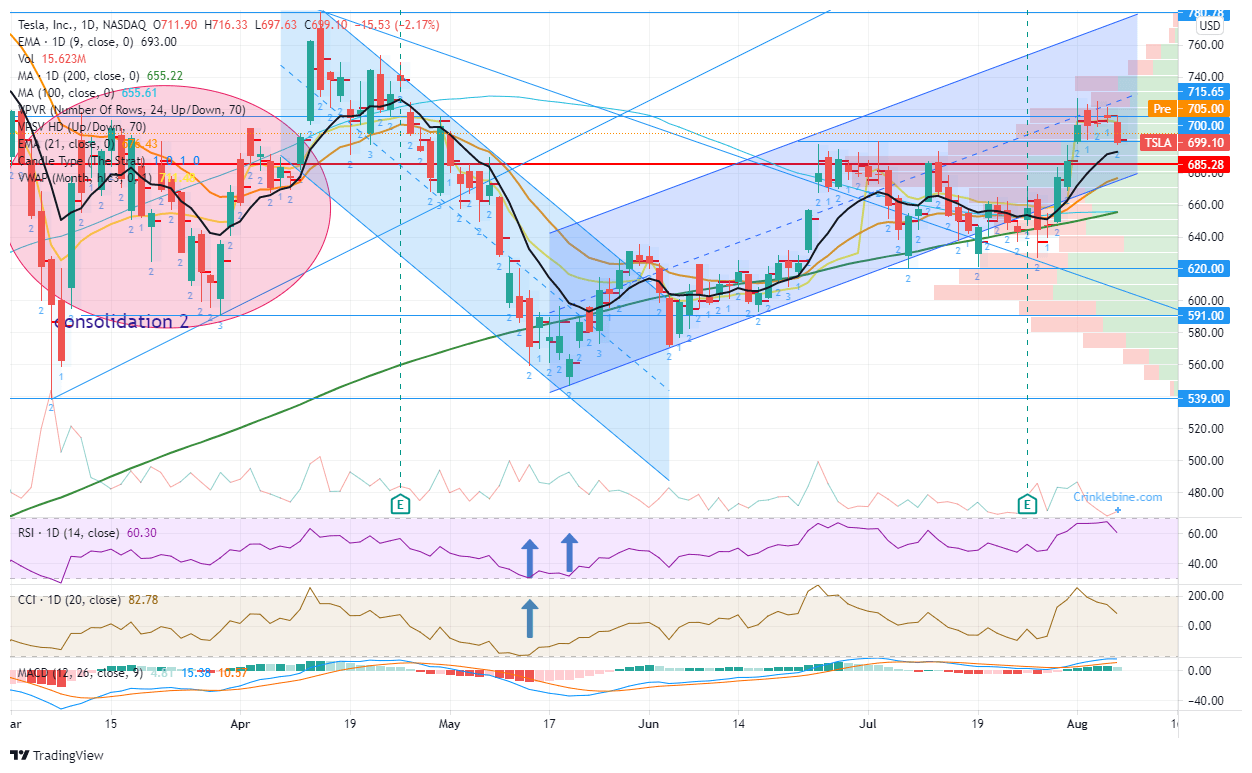

Update: Tesla stock held our $697 support perfectly and popped 2% on Monday to break back above $700 and stall jsut short of our $715 resistance level. The stock was helped by an upgrade from Jefferies but the move was also technically driven with the chart remaining bullish so long as $697 held. This was the small opening gap from last week and also the short term moving average.

Tesla has a rough day on Friday, putting a few doubts into the minds of bulls who felt they had done the hard work in pushing the electric vehicle sector leader above $700 last week. Nothing goes up in a straight line and all is not lost for bulls so long as $697 holds. This is the small gap from July 30 to August 2 and the point at which the move really accelerated above $700. The news this morning looks positive with Jefferies upgrading the stock to a Buy rating and putting an $850 price target on the stock. The news has helped push Tesla to $706 in Monday's premarket.

Tesla key statistics

| Market Cap | $702 billion |

| Price/Earnings | 358 |

| Price/Sales | 23 |

| Price/Book | 29 |

| Enterprise Value | $753 billion |

| Gross Margin | 22% |

| Net Margin |

6% |

| Average Wall Street Rating and Price Target | Hold, $711 |

Jefferies upgrade this morning has seen the average Wall Street price target move up from $706 to $711, but the stock still has an average Hold rating. Jefferies has upgraded the stock based on the latest results. Those results were better than expected, and Jefferies sees accelerating earnings and a strong return on invested capital. Earnings were strong with a beat on the top and bottom lines. Adjusted earnings per share (EPS) came in at $1.45 versus the estimate from Wall Street analysts for $0.96. Sales came in at $11.96 billion, also beating the $11.21 billion estimate. Delivery numbers were also high on investors' minds, and these too were ahead of estimates. Tesla delivered 201,304 vehicles in Q2 2021, an increase of 121% over the same period last year. Tesla said its average selling price had declined by 2% over the year, but its gross margin increased three percentage points from 25.4% to 28.4%

Tesla stock forecast

Tesla looks poised to make a really significant move this time, breaking $715 and triggering a volume vacuum move higher. Last week FXStreet said any pullback to $697 can be used to buy the dip so long as the level holds. So far so good, and FXStreet stands by the call. Just as always, use a stop. Above $715 the volume profile bars on the right of the chart show that there is little resistance until Tesla stock reaches $780, and this is our first and intermediate target. The stock is holding above the short-term moving averages, and the Moving Average Convergence Divergence (MACD) is trending higher with price and has crossed into bullish territory. The Relative Strength Index (RSI) and Commodity Channel Index (CCI) are both trending higher, confirming the price move.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637640987311251008.png&w=1536&q=95)