SRNE Stock Forecast: Sorrento Therapeutics to extend rally amid broader COVID-19 portfolio

- NASDAQ: SRNE is on course for a 10% above $20, on top of the 30% rally on Monday.

- Sorrento Therapeutics is benefiting after announcing buying a COVID-19 therapy developer.

- Demand for coronavirus immunization is on the rise despite Russia's vaccine breakthrough.

Serenity for Sorrento Therapeutics investors – NASDAQ: SRNE is set to extend its gains, proving it is more than a one-day wonder in equity markets. The California-based pharma firm's shares are on the rise following its move into the coronavirus space.

Sorrento announced it is planning to acquire SmartPharm Therapeutics, a company providing therapy for COVID-19. Managers also said it licensed the rights to a rapid test – identifying the virus in saliva within 30 minutes.

While some skeptics doubt Sorrento's fast and furious announcements, investors are piling up, pushing SRNE's valuation to around $4.5 billion at the time of writing.

Demand for any cure or vaccine for the novel coronavirus is at elevated levels. Companies that announce progress – whether in a clinical or earlier trial – see their shares rise quickly, especially from the Robinhood crowd.

Russian President Vladimir V. Putin declared that his country registered the world's first coronavirus vaccine – and that his daughter already received it. If immunization is already available, why would other efforts still make sense?

First, Putin's claims are met with doubts –scientists want to see the underlying data before hailing Moscow's Gamaleya Institute's achievement. This is not another Sputnik moment. Moreover, it is unclear how long any vaccine is effective – antibodies tend to disappear from recovered coronavirus patients.

And while those that have a large number of defenses against the SARS-Cov-2 virus may avoid illness, they could remain infectious and those who are unprotected could suffer. There is still a need for a coronavirus cure, not only a vaccine.

SRNE Stock Price

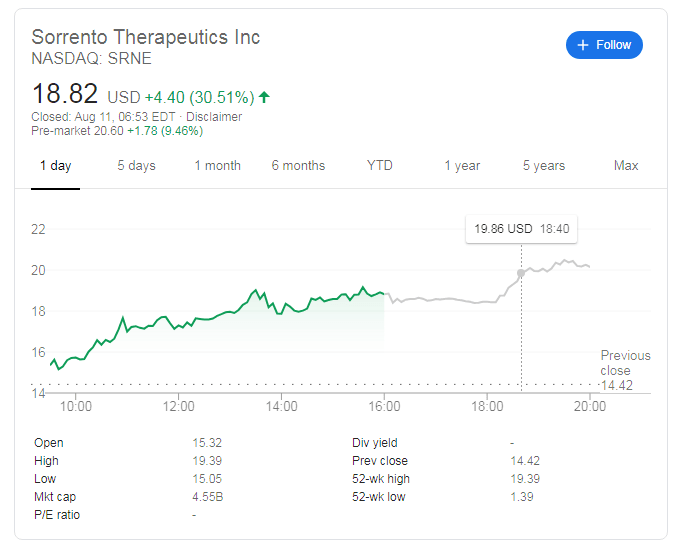

NASDAQ: SRNE soared by over 30% to close at $18.82 on Monday. Tuesday's pre-market trading is pointing to another leap of around 10% to above the $20 mark, putting Sorrento's share price above the 52-week high of $19.39.

It is essential to stress that SRNE changed hands as low as $1.39 in the past 52 weeks.

More: Novavax receives bullish $290 share target amid coronavirus vaccine progress

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.