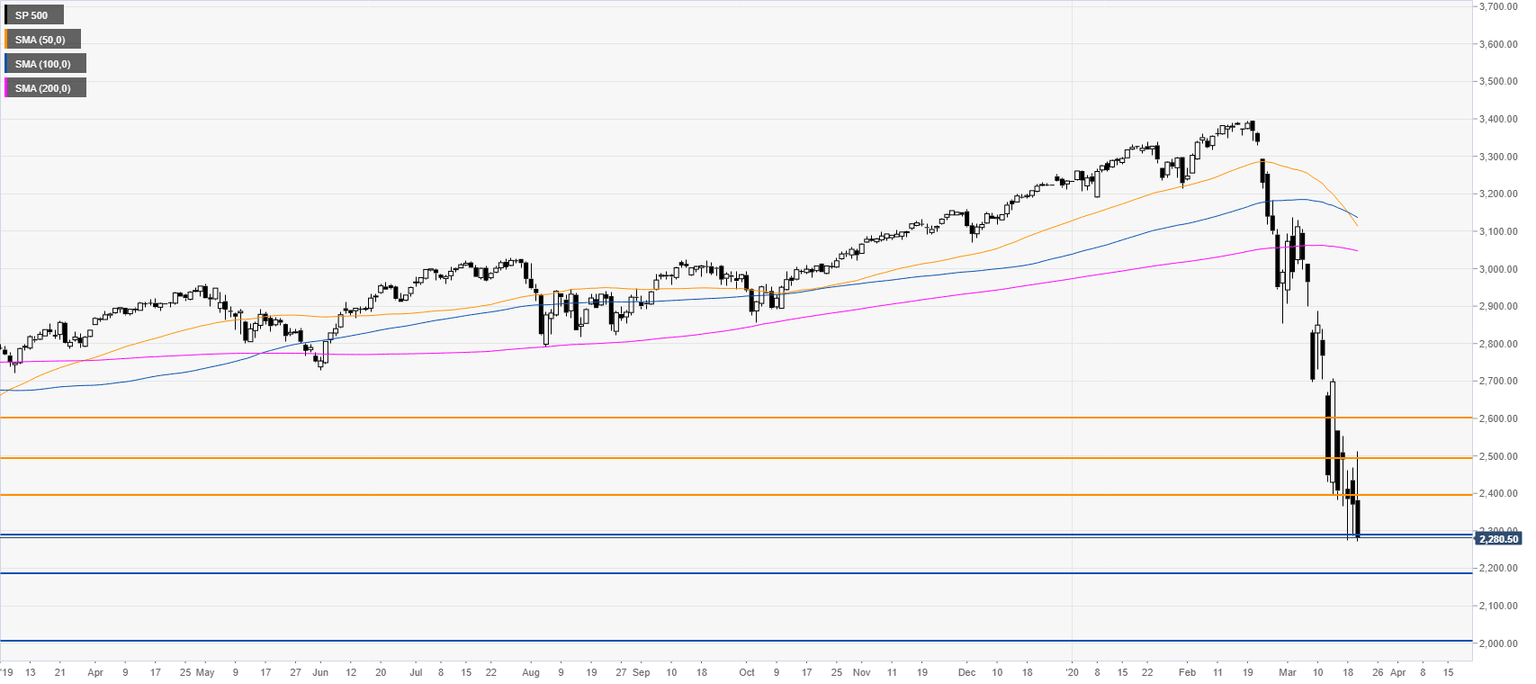

S&P500 Price Analysis: US stock index grinds down further, hits lowest since February 2017

- S&P500 is resuming down after a few days of consolidation.

- S&P500 is trading in 37-month lows as coronavirus crisis is taking its toll.

- The level to beat for bears is the 2300 support.

S&P500 daily chart

Additional key levels

Author

Flavio Tosti

Independent Analyst