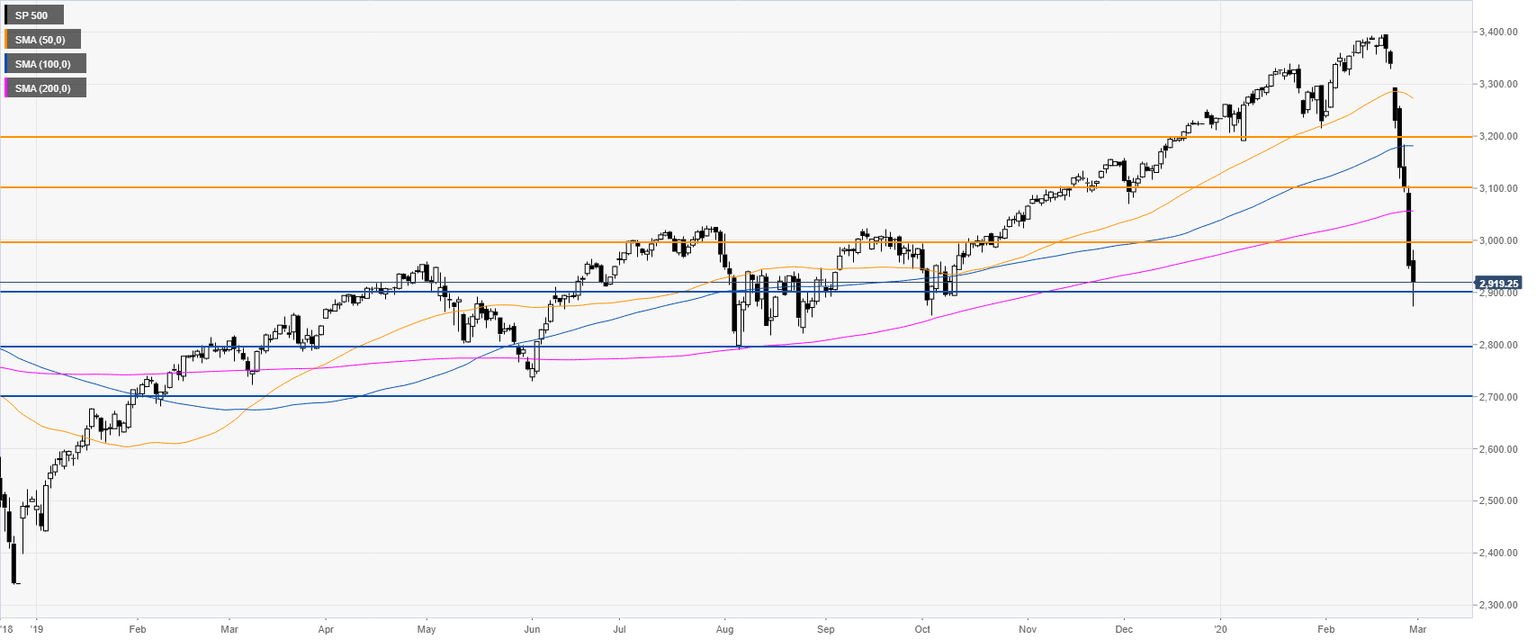

S&P500 Price Analysis: Index crashes more than 15% in 7 days, lowest since October 2019

- The S&P 500 is down more than 15% in only seven days.

- The S&P 500 is trading below the 200-day simple moving average (DMA).

- The Coronavirus spread is sending global markets into panic.

S&P 500 daily chart

Additional key levels

Author

Flavio Tosti

Independent Analyst