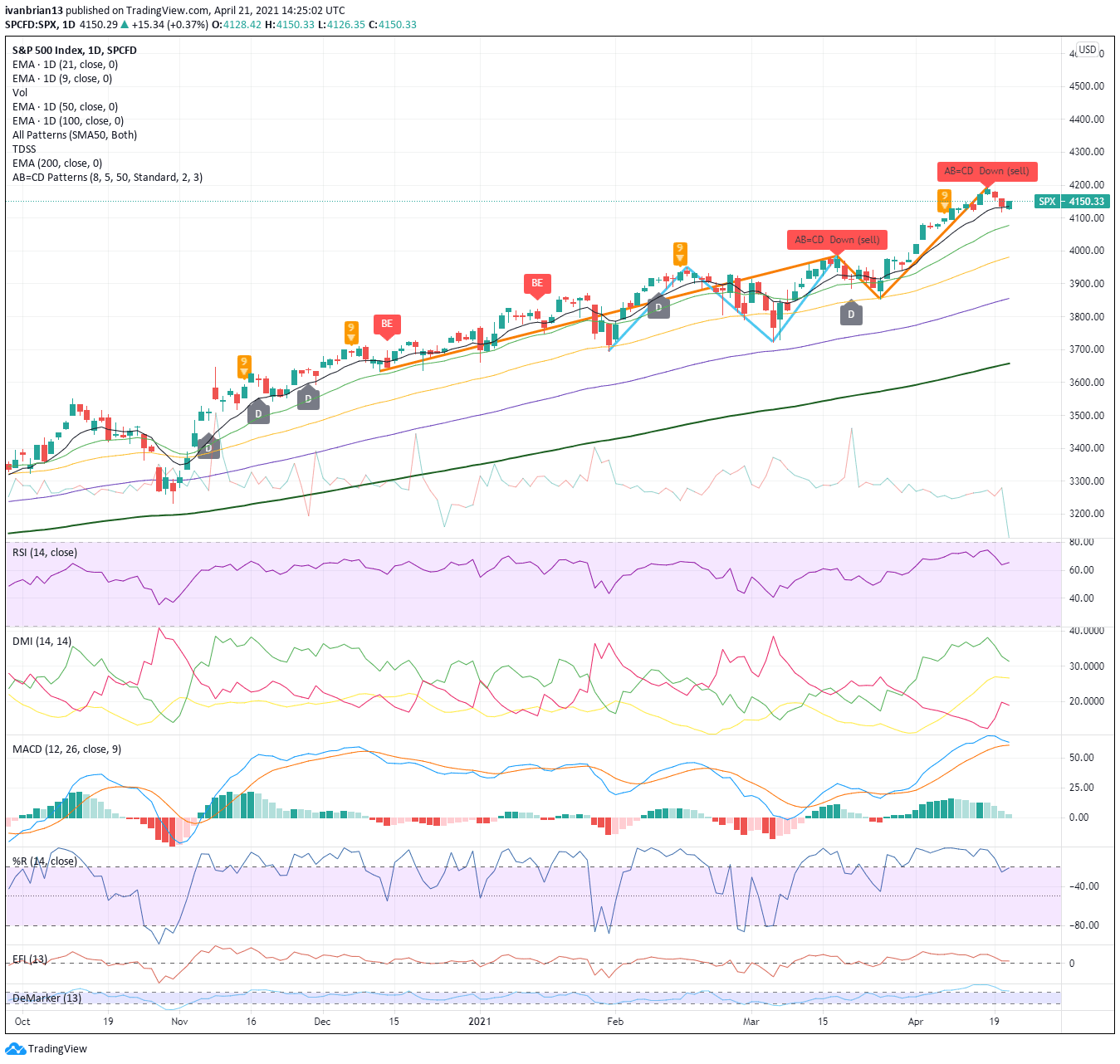

S&P 500 (SPX) Nasdaq (QQQ) Update: S&P tests 9 day MA support as sell signals flash

Update: Equity markets remain weak as the S&P has a close look at its 9 day moving average support. For now, it holds but the ABCD pattern which gave nic esell signal on April 16 remains in place. RSI remains elevated and the MACD is closing and may flash up a sell signal crossover.

The S&P and Dow remain in the green while the Nasdaq is down 0.3%.

Sectors: Industrials and Energy are both +0.7% while Tech +0.2% and Consumer +0.2% are the weakest.

Selected Stocks: TSLA -1.3%, FB -1.6%, GME -1%, COIN -3%, PLTR +3%, NFLX -85, Peleton -35, Carnival and Royal Carribean +3%, Citrix +4%.

Here is what you need to know on Wednesday, April 21:

Equity markets suffered a little wobble on Tuesday as most indices closed in the red. Inflation was cited as one concern, but in fact traders were just looking to justify the fear sell-off after record highs. Inflation will be a long-term problem as you just cannot keep printing money with no consequence, economics 101. However, in the short term, 10-year yields remain subdued at 1.57%.

Netflix then dropped another bombshell after the close, falling as much as 10%. Again here the market looked for the appropriate excuse to justify what it wanted to do – sell off. NFLX smashed EPS and revenue expectations. It raised Q2 guidance above analyst estimates, but subscriber numbers missed. A $5 billion buyback also seems an odd choice as Netflix could surely better invest the cash in its own business.

The post-financial crisis simplicity of either risk-on or off is still in play. The dollar, gold and the Vix rally, while equities, and in particular emerging markets and Asia, dump. The KOSPI and Nikkei dropped nearly 2% overnight.

Oil drops 2% to $61.26, Bitcoin shrinks to sub $55,000 and the EUR/USD sets itself up for a break of 1.20.

Stay up to speed with hot stocks' news!

S&P 500 (SPX), Nasdaq (QQQ) top news

Russia President Putin warns against crossing Russia's red lines.

UK inflation picks up as March CPI rises +0.7%.

The US reaches 200 million covid vaccines administered.

Netflix (NFLX) beats earnings but misses on subscriber numbers. Announces buyback. see more.

Apple (AAPL) launches new products in a virtual unveiling.

SPAC deals dry up. 109 SPACs in March, just 10 in April-CNBC.

JNJ is to resume the EU rollout of its covid vaccine as EMA says ok to go ahead.

Verizon (VZ) beat EPS results and also beat on revenue but lost subscribers. Shares down in pre-market.

Haliburton (HAL) beats on earnings, shares up in pre-market.

Baker Hughes (BKR) earnings beat forecast, shares down in premarket.

Nasdaq (NDAQ) results beat forecasts, 10% dividend increase.

Moderna (MRNA) strikes a new covid vaccine supply deal with Israel.

AZN: Israel does not want AZN's covid vaccine and asks to send it elsewhere.

BHP says annual iron ore production to be at the upper end of forecasts.

Coinbase (COIN) Deutsche Boerse says it will delist COIN shares as missing reference data from an incorrect ticker LEI code.

Pfizer (PFE): Brazil in talks to buy 100 million covid vaccine doses.

Tesla (TSLA) registrations in California drop for Model 3 by 54% YoY, according to Cross-Sell.

Ups and downs

Netflix (NFLX): UBS, Evercore, Cowen & Co, Morgan Stanley and Piper Sandler cut price target. Wedbush and Stifel raise price target.

IBM: Credit Suisse, BMO and Morgan Stanley raise price target.

Apple (AAPL): Morgan Stanley raises price target. Goldman Sachs reiterates Sell rating.

Coinbase (COIN): Rosenblatt initiates coverage with a Buy rating, $450 price target.

Norwegian Cruise (NCLH): Goldman Sachs upgrades to Buy.

United Airlines (UAL): Deutsche Bank says a catalyst buy idea.

Economic releases

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author is short SPY. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637546070875394353.png&w=1536&q=95)